In today’s update on USD/JPY, we are revisiting the cyclical theme that has been in focus over recent weeks. On the weekly chart, USD/JPY continues to trade within a broad range structure, with the 140.00 level acting as a major support since it was reclaimed in June 2023.

So far, the range lows around 140.00 have produced three distinct reactions. The first test, marked as number 1, delivered a sharp V-shaped recovery with a strong bullish weekly candle. The second test, marked as number 2, resulted in a similar reaction. The current test, marked as number 3, has so far produced a double bottom formation, which is generally a bullish pattern when it appears at support.

However, in this context, the nature of this third reaction looks slightly weaker. Unlike the previous V-shaped bounces, this time we are seeing a flatter, slower recovery. Adding to this concern, the weekly 20 EMA has now crossed below the 50 EMA, marked inside the white circle as number 4. This is a key difference compared to the earlier reactions.

This developing pattern suggests relative weakness in the current cycle, particularly when viewed alongside broader macro pressure on the US dollar. If USD/JPY fails to hold the 140.00 level on a high time frame basis, the entire range structure may break down. In such a scenario, the next major downside target would be around the 130.00 region.

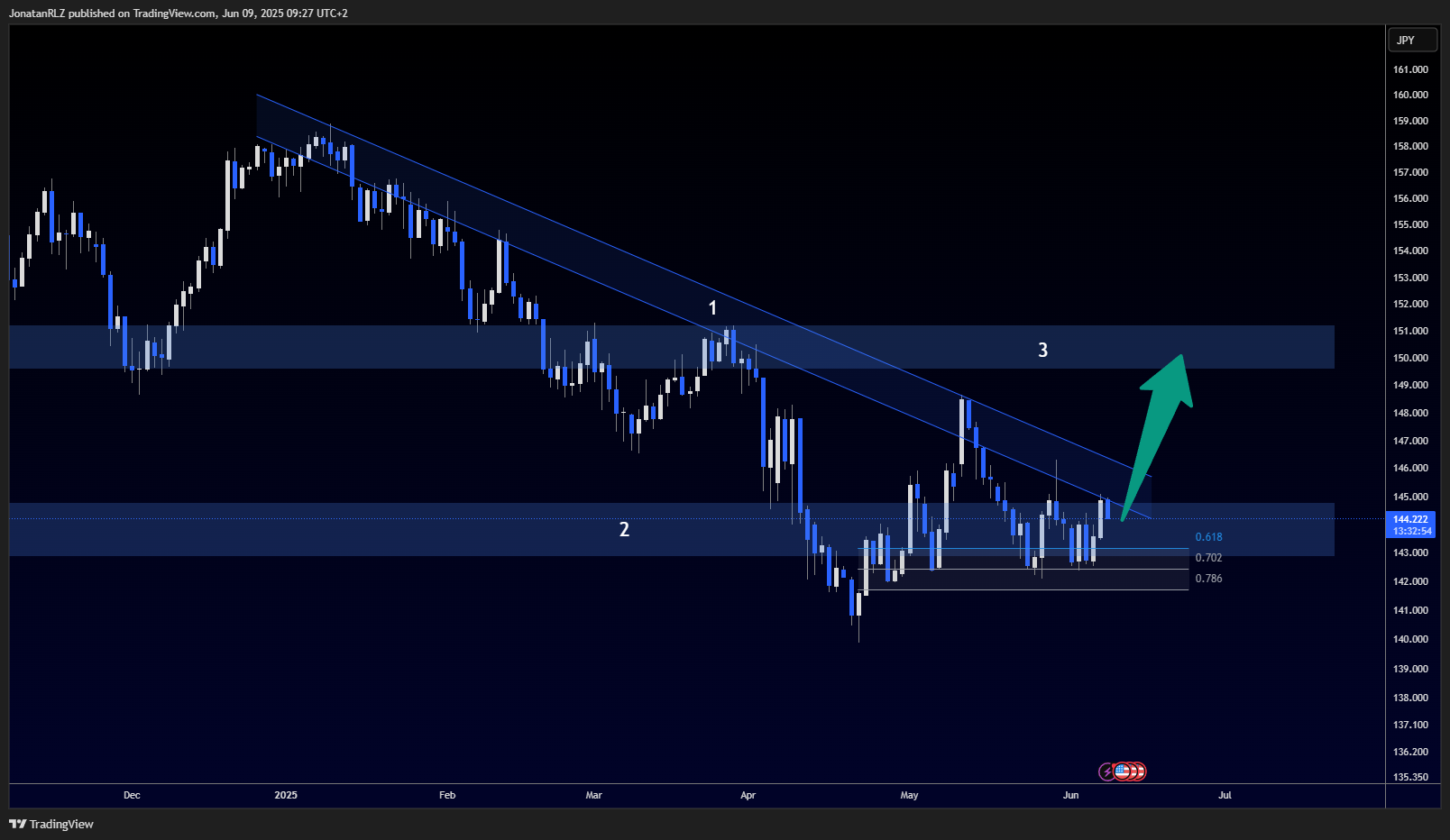

Switching to the daily timeframe, we can see that a new double bottom is also visible here, with both lows falling inside the local reload zone of the most recent uptrend. Price continues to test the descending trendline marked as number 1, and we are converging toward the high time frame range low marked as number 2.

If we break above the descending trendline, the first major resistance to watch would be the 150.00 level, marked as number 3. This area also aligns with the weekly range midpoint.

What adds further context here is the broader yen landscape. When comparing USD/JPY to other JPY pairs using a correlation chart, all other major yen pairs are showing bullish structures, while USD/JPY stands out as neutral to bearish. This divergence signals relative weakness in USD/JPY compared to the rest of the yen complex.

Combining the fact that USD/JPY is holding long-term support and showing relative weakness, the higher probability over the coming weeks may be for USD/JPY to trade higher and start catching up to its peer group. However, this outlook hinges on support at 140.00 continuing to hold.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.