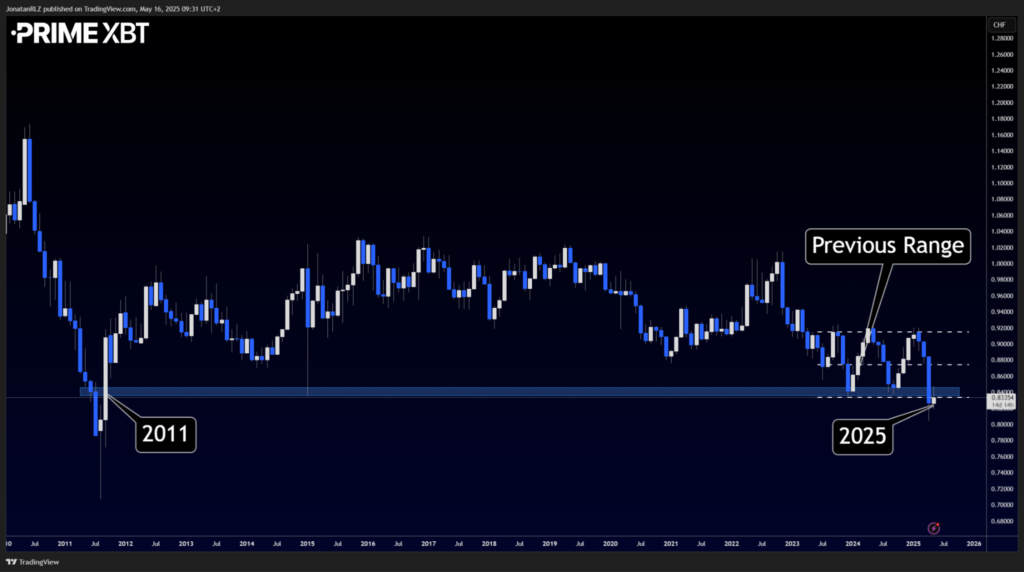

USD/CHF is currently trading at levels not seen since 2011. The recent breakdown below long-term high timeframe support came in the wake of escalating U.S. tariffs, which temporarily weakened the U.S. dollar versus the Swiss franc. However, with trade tensions now appearing to cool, especially between the U.S. and China, the question becomes: can USD/CHF reclaim this critical support? A move back above would place the pair back within a previously well-defined range, offering clear structure for traders and investors.

Looking at the daily chart, USD/CHF is now retesting the previous range low area between 0.8420 and 0.8450. A successful reclaim of this zone would place price action back within the former range, opening the door to a move toward the next high timeframe resistance around the range EQ level at 0.8750.

Dropping down to the 4-hour chart, we can see a developing bullish structure, with price breaking out of a short-term range marked by blue dotted lines. USD/CHF is currently testing this previous range from above, and this level must hold to validate any further upside potential. Notably, this is the second test of the zone, and as is often the case, repeated tests weaken a level from the direction of pressure, while strengthening it from the opposite side. Should buyers defend this area and break the descending trendline marked on the chart, it could mark the beginning of a short to medium-term reversal. This would align with a stabilising macro environment and risk-on sentiment.

Trade USD/CHF

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.