Bitcoin jumped 5% last week and is building on those gains heading into the new week. The largest cryptocurrency started last week at 98k before recovering sharply to a high of 108.5k over the weekend. BTC continues to hover around 108.5k as the new week begins.

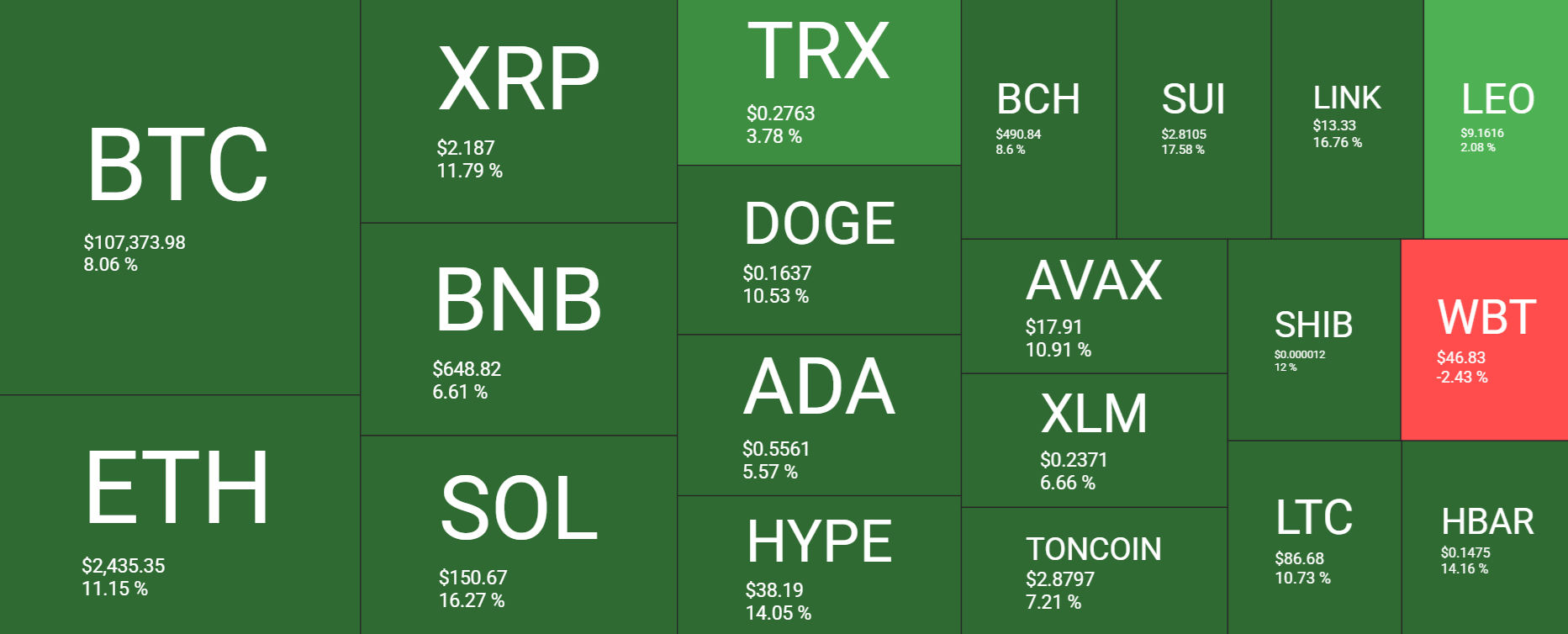

Strong gains were seen across the cryptocurrency market. Ethereum and Ripple jumped over 11% Solana gained an impressive 16% as the larger altcoins outperformed smaller altcoins. DOGE was 10% higher across the week, and ADA gained 5%.

The cryptocurrency market capitalisation has risen to $3.3 trillion, up from $3.03 trillion a week ago. Meanwhile, the Fear and Greed Index is at 50, Neutral, recovering from 37, which was in Fear territory last week, but down from 60, which was in Greed territory a month ago.

Bitcoin’s 4% jump last Monday, which saw the price recover from $98,000 to $106,000, sparked a liquidation event that resulted in $379.45 million of short positions being liquidated and $114 million of long positions. However, across the remainder of last week, there were no major liquidation events.

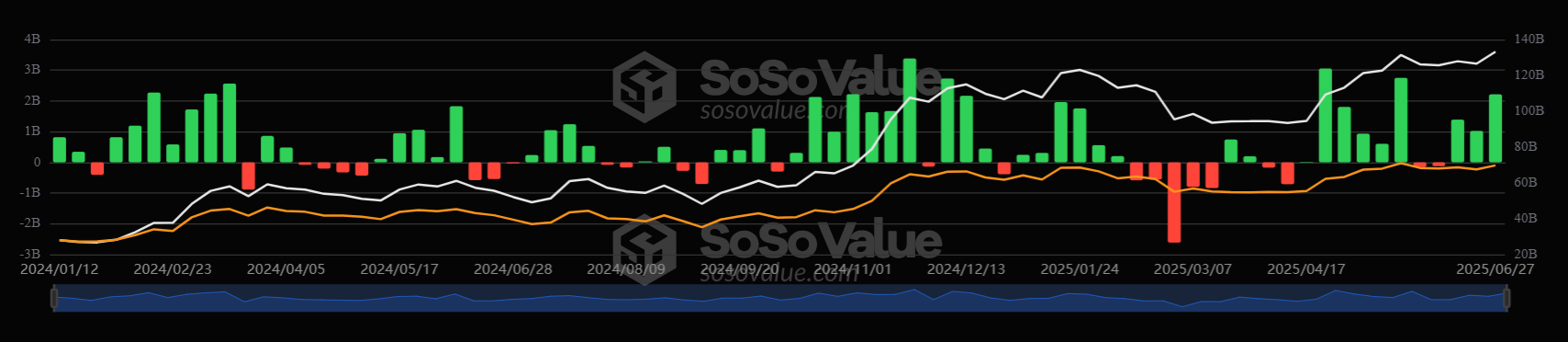

BTC ETFs see $2.2 billion in inflows

US Bitcoin ETFs recorded their 14th straight day of net inflows. On Friday alone, BTC ETFs registered net inflows of $501.27 million, bringing the total deposits from the previous week to $2.2 billion, marking a three-week streak of positive momentum. Across the past three weeks, Bitcoin ETFs have seen $4.63 billion in inflows. This week’s inflows were the highest weekly flow since the end of May, when Bitcoin reached its all-time high at $11,900.

The month of June saw $4.50 billion in inflows, marking the third consecutive month of inflows as institutional demand remains strong. Persistent institutional demand could help Bitcoin reach fresh record levels, and JP Morgan highlighted strong institutional demand as a factor that could see BTC outperform Gold in the second half of 2022.

Macro backdrop

The ceasefire between Israel and Iran, agreed upon on June 23rd, continues to hold, stabilizing the markets and allowing cryptocurrencies to recover alongside U.S. stock indices. US stock indices reached record highs.

The market will continue to monitor the ceasefire, which has considerably lowered the likelihood of a closure of the Strait of Hormuz, accounting for a fifth of the world’s oil supply by consumption, and has pulled oil prices 12% lower across the week.

The sharp drop in oil prices eases concerns over the inflationary impact while allowing attention to return to macroeconomic data and Trump’s trade tariffs.

Trump’s tariffs

The July 9 deadline for pausing reciprocal trade is drawing nearer, and significant progress on trade deals remains elusive. Whilst the US signed a framework agreement with China on rare earth shipments, other deals are yet to be announced. However, Trump said over the weekend that this doesn’t matter as the US will send letters to hundreds of countries assigning tariff rates. He didn’t think he would need to extend the pause. On Friday, Treasury Secretary Scott Besson said trade deals could be wrapped up in the coming days.

Crypto markets have disregarded the potential economic risks stemming from trade tariffs as these haven’t been reflected in the economic data so far. Federal Reserve Chair Jerome Powell testified before the Senate twice last week, stating that inflation could still be impacted by tariffs later this summer. That said, core PCE, the Federal Reserve’s preferred gauge for inflation, only saw a very slight increase in June, rising 0.2% month on month, up from 0.1% in May and 2.7% YoY from 2.6%.

It remains unclear whether businesses will fully pass on the cost of tariffs to consumers; moreover, service prices have been falling since mid-last year. Federal Reserve Chair Jerome Powell hinted at two rate cuts this year, in a slightly more dovish tone than in the Fed meeting. The market is almost fully pricing in a September rate cut at 93%, up from 70% expectations just a week earlier.

Q3 outlook & seasonality

Q3 is typically the weakest quarter for Bitcoin performance. According to data from Coinglass, the average quarterly return for the July to September period is just 6% compared to 85% in Q4, 51% in Q1, and 27% in Q2. Therefore, Bitcoin could be expected to continue consolidating above $100,000.

However, it’s also worth noting that Q3 in post-halving years has consistently demonstrated strength, outperforming the Q3 period in other years. In the most recent cycle in 2021, the BTC price rallied by 25%. Meanwhile, the 2017 post-halving year saw gains of 80% in Q3. This would reinforce the case for a bullish breakout in the coming quarter.

Given the increasing institutional and corporate demand, the more optimistic outlook for the US economy, expectations for Fed rate cuts, and the improving regulatory backdrop, the fundamental outlook for BTC remains positive.

On-chain data is also showing encouraging signals.

Bitcoin long-term holders increase exposure

Bitcoin long-term holders, those who hold coins for at least six months without selling, have doubled down on their commitment even as Bitcoin price hit record highs in 2025. According to CryptoQuant, on a rolling 30-day basis, the long-term supply change has increased by a net 800,000 BTC, marking a new record.

Historically, the 30-day LTH supply increases have only passed the 750,000 BTC mark 6 times. The most recent of those was in July 2021 and September 2024, which preceded a BTC price spike. Therefore, this could be a powerful signal that should be taken into account.

Meanwhile, short-term holders, those holding for less than 6 months, have an aggregate cost basis just below $100,000. This level often acts as a support during bull market corrections. This was evident in last week’s correction to 98k. According to Glassnode data, the 98-93k area is a critical level of support. As long as the price holds above here, then the bull market structure remains intact.

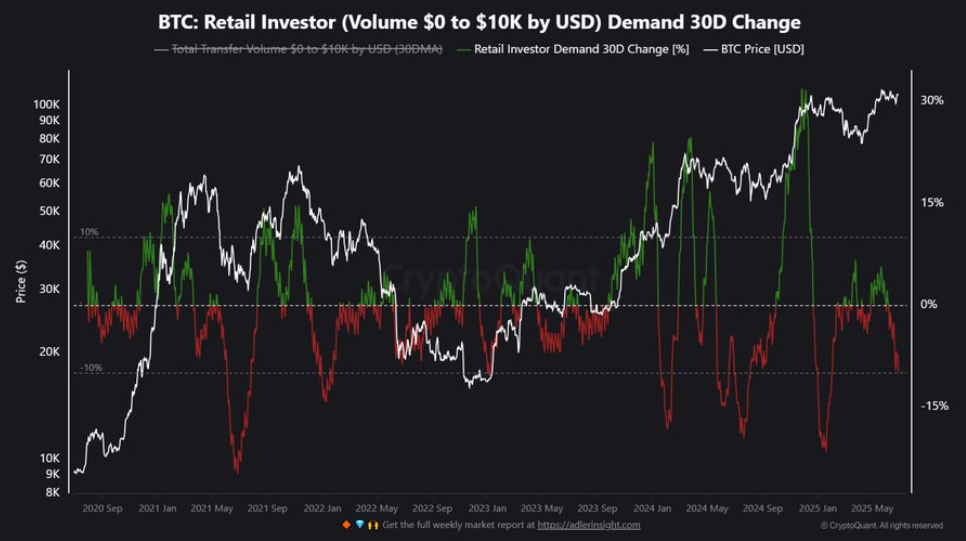

Retail demand fades, but whales lead the way

Retail participation in Bitcoin has continued to fade. According to the 30-day demand change chart, BTC transfers between zero and 10 K fell by over 10% the most in six months. This drawdown, seen in red on the chart below, reflects a lack of trading conviction from smaller market participants. Historically, this decline will lead to either consolidation or more volatility, depending on the action of whales. This is because the withdrawal of smaller investors points to a growing reliance on institutional activity for market direction.

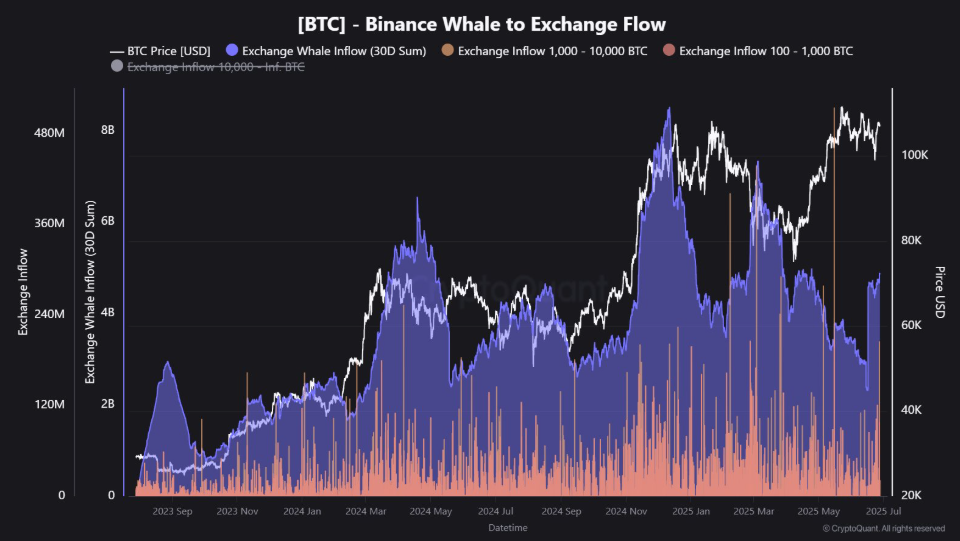

Interestingly, over the last 30 days, more than 45,420 BTC, valued at $4.88 billion, have flowed into Binance. Exchange whale inflows represent a sharp pivot towards active positioning, which can be seen before large price swings. This could mean the whales are preparing to distribute or react to market catalysts.

Could a break above 111k trigger a short squeeze?

According to the data, there’s a thick liquidity band between 108K and 111K, where most over-leverage short positions are likely to be wiped out if Bitcoin pushes higher.

Liquidity zones can act as magnets, drawing price action into the volatile territory. A rise above 108K could spark a wave of short liquidations, rapidly pushing the price towards the 115-118K range.

However, failure to breach this zone could see further sideways consolidation.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.