Bitcoin rose just 0.9% last week in a choppy week of trading. During that week, the price fell to 100k before swiftly recovering to end the week at 105.6k. The price has pushed higher at the start of the new week, briefly rising above 110k on Tuesday as investors look towards the 112k ATH.

The past week has been broadly positive for altcoins, as they tracked Bitcoin higher. ETH remained unchanged, while SOL underperformed Bitcoin, rising just 1.7%. XRP rose 5.6%, outperforming, while HYPE jumped 14%.

The crypto market capitalisation has risen to $3.44 trillion, up from a low of $3.26 trillion a week earlier. Meanwhile, the Fear and Greed index is at 66, which is Greed, up from Neutral last week and a level which could support a sustained move higher.

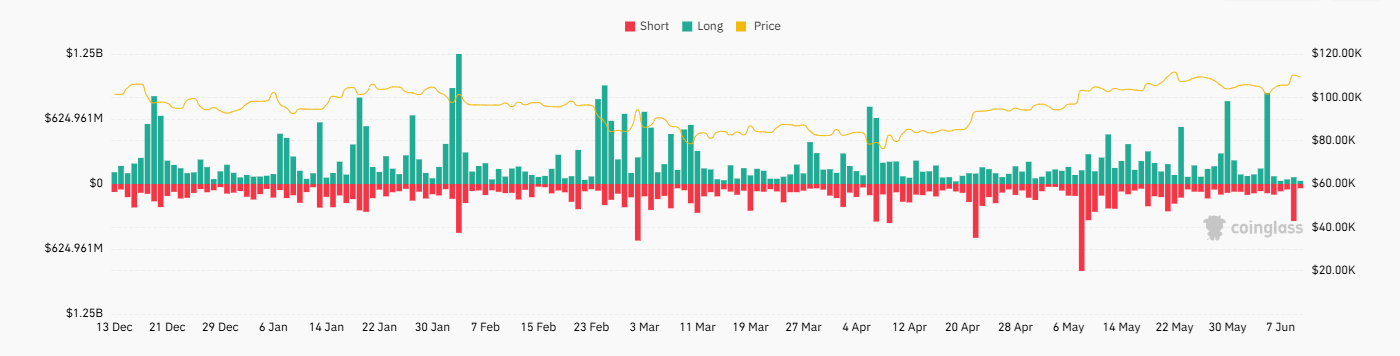

Bitcoin’s rally to 110k sparked a liquidation event, with the crypto market experiencing $450 million in liquidations over the past 24 hours. The vast majority were short positions liquidated at $391.2 million, whilst just $59.6 million were longs.

Ethereum outperforms Bitcoin ETFs

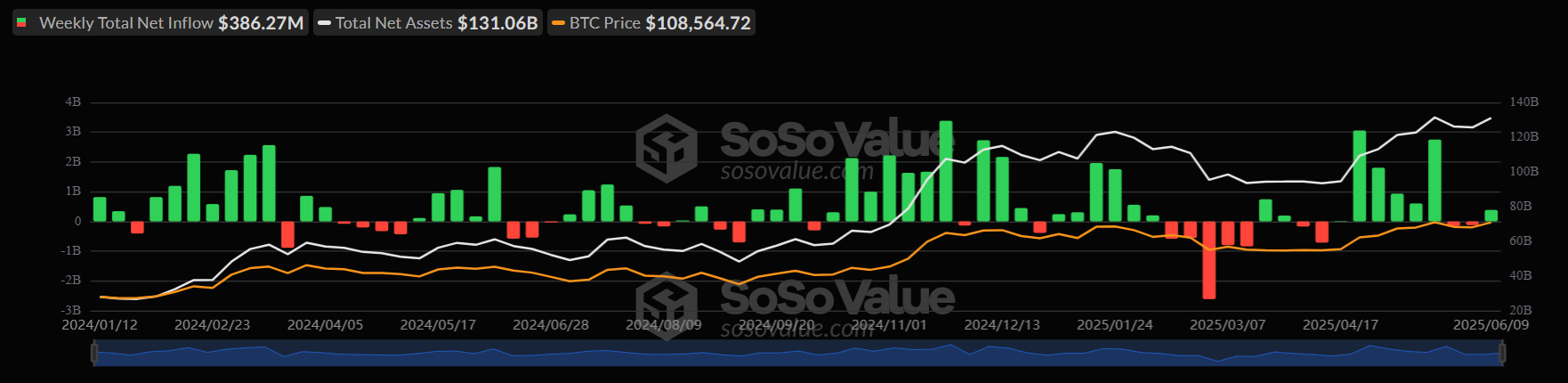

Bitcoin institutional demand slowed last week. The BTC ETF saw a second straight week of net outflows, reaching $128 million, following $157 million in net outflows the previous week. However, that weakness appears to have been short-lived, and BTC ETF demand has recovered this week, with institutional demand showing net inflows. Persistent inflows into BTC ETFs could help the Bitcoin price rise to fresh record highs.

Despite the slight weakness in the broader BTC ETF market this month, BlackRock’s Bitcoin ETF made history again on Monday. The IBIT fund surpassed $70 billion in assets in just 341 days of trading, making it the fastest ETF to reach that milestone. This was five times faster than the old record held by GLD of 1691 days. BlackRock’s Bitcoin ETF is by far the most popular among similar funds, and institutional investors are rushing to gain exposure to the relatively new asset class. GLD is an exchange-traded fund that allows investors to bet on the price of gold without physically purchasing it.

ETH ETF demand shows no signs of slowing

Meanwhile, Ethereum ETFs have seen 15 straight days of net inflows, indicating that institutional investors are shifting their focus from Bitcoin to Ethereum infrastructure. Since May 16, Ethereum ETFs have seen inflows totalling 837.5 million, with the funds looking to cross the $1 billion AUM milestone soon.

Institutional interest in Ethereum is growing as it sheds its speculative reputation, with investors instead viewing it as an infrastructure for next-generation financial systems. Although Ethereum underperformed Bitcoin over the past seven days, over the past thirty days, Ethereum is up over 6% compared to Bitcoin’s 4%. Last month’s Pectra upgrade has helped boost optimism surrounding the road map for upgrades.

Corporate purchases

Corporate demand for crypto continues to rise. (Micro) Strategy has required a further $110.2 million worth of Bitcoin even as the price trades close to its all-time high. According to a U.S. Securities and Exchange filing, Strategy acquired 1045 Bitcoin at an average price of $105,426 per coin. This takes the firm’s holdings to 582,000 Bitcoin acquired at an average price of 70,860 per BTC. This marks the ninth straight week that strategy has acquired Bitcoin, even though the price is just below its all-time high of 112k.

There has been increased interest in crypto treasury purchases. Firms such as Japanese Meta Planet, French-based The Block Chain Group, and Norwegian crypto exchange Block Exchange have added to their holdings or announced plans to purchase in recent weeks, highlighting increased corporate interest, which underpins the price.

Macro Backdrop

Bitcoin has risen firmly at the start of a new week amid optimism surrounding US-China trade talks to discuss tariffs and future trade deals. And negotiations are taking place in London between U.S. Treasury Secretary Scott Bessent, two other Washington officials, and China’s vice premier He Lifeng.

The talks came about after President Trump and Xi Jinping spoke on the phone last week after trade talks between the two countries had stalled. Optimism surrounding the revival of negotiations is lifting demand for crypto and US equities. The S&P 500 is less than 2% from its record high, and the tech-heavy Nasdaq is less than 3% away from its 22,245 record level.

The market has moved on from last week’s very public spat between Trump and Elon Musk. The falling out on social media resulted in Bitcoin falling to 100k, while Tesla dropped 15%. The effects have been shot live. Despite Trump saying that his relationship with Musk is over, Bitcoin has moved past the narrative already.

Could US CPI pull BTC lower in the near term?

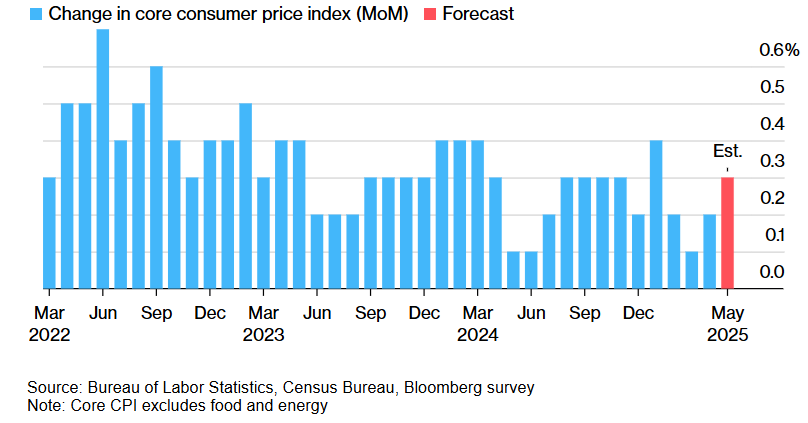

This week, attention will be on US CPI data, which is expected to show that US inflation ticked higher in May to 2.5% YoY, up from 2.3%. Meanwhile, core CPI is expected to rise to 2.9% YoY, up from 2.8% in April. Rising inflation, notably hotter than forecast inflation, could raise concerns, especially as Trump’s tariffs are expected to increase inflation further. Hotter inflation figures could send Bitcoin lower in the near term.

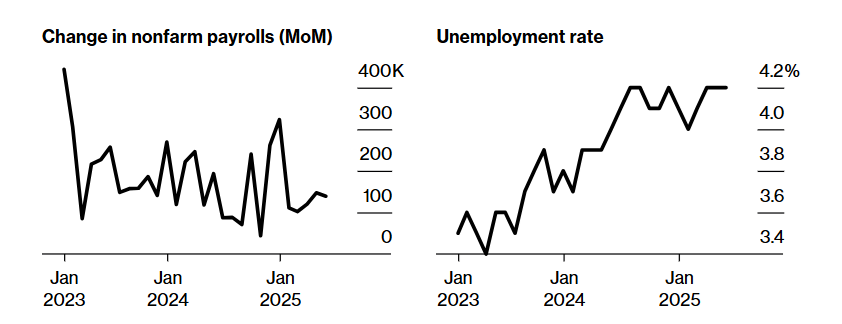

The CPI figures come after data last week showed the labour market is cooling. 139K jobs were added in May, down from 147K the previous month. A cooling labour market and sticky inflation could put the Fed in a difficult position when cutting rates further. For this reason, the Fed is opting to remain patient about further cuts.

On-chain activity points to holding. Could a rally be ahead?

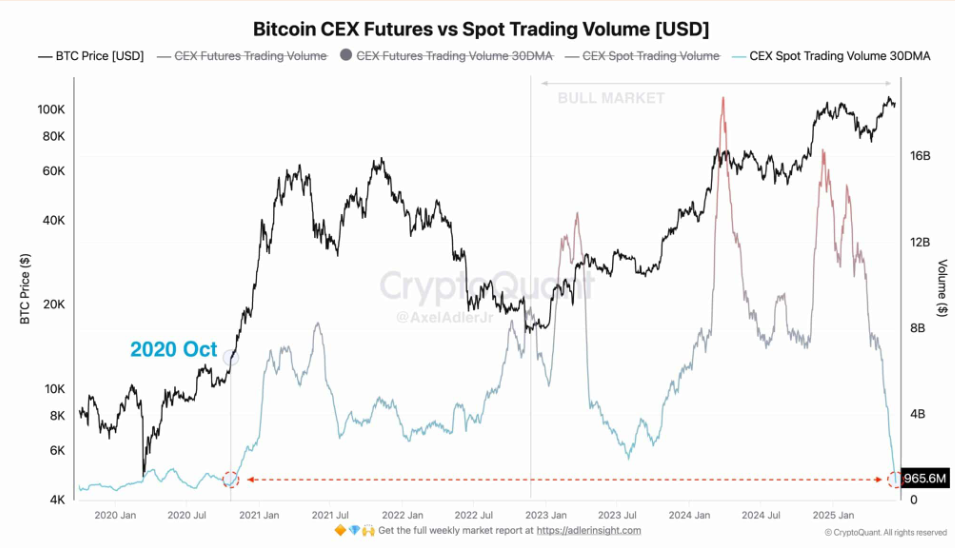

Bitcoin on-chain activity has declined. According to CryptoQuant data, the average Spot Trading Volume on centralised exchanges has fallen to levels last seen in October 20202.

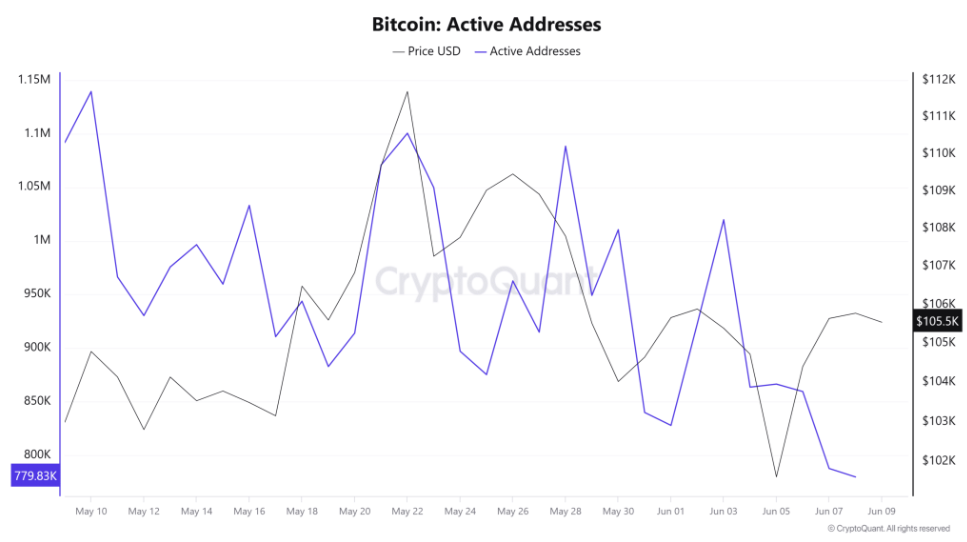

This fall points to reduced trading activity and declining speculation. As a result, Active Addresses plummeted sharply. Over the past 30 days, the number of active addresses has fallen to a low of 779.8k, supporting the view that demand is weak and interest was fading.

These market conditions have historically preceded either a strong breakout or an extended consolidation. This suggests a strong conviction among investors as they resist short-term fluctuations.

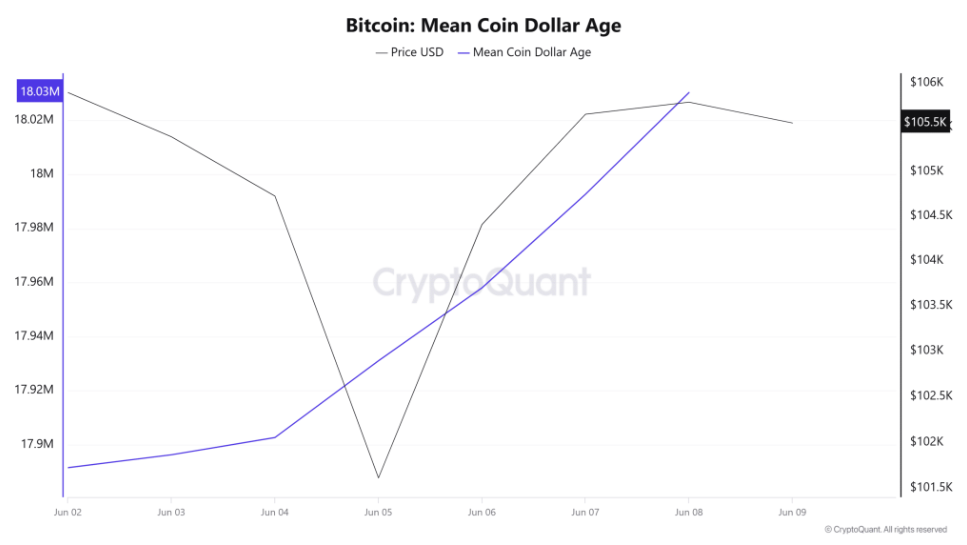

The Mean Coin Dollar Age has soared to 18.03 million. This sustained rise points to coins ageing without being spent and strong holding behaviour. As a result, trading volume is declining, and investors are keeping assets off exchanges.

This could suggest that the market is in a quiet phase, as it was in 2020, when exchange volumes dropped to similar levels before the market rallied in 2021.

Could Bitcoin’s recovery have further to run?

According to Alphractal, the 1000-day RSI has broken out of the descending triangle pattern. When this has happened in previous bull runs, the ascending trendline support formed from the lows of the bear market was retested. This retest occurred in April when BTC fell to 74.5k. A breakdown below the RSI 1000 could bring a selling opportunity. However, for now, the chart suggests that the bull market has steam to go further.

The MVRV pricing bands use multiples of the MVRV ratio to provide clues as to when the market has reached extreme levels. Bitcoin spent much of the first six months of 2021 near the 3.2 times multiple of the realised price.

However, in this cycle, the 3.2 line has not been breached. This could indicate that the best of the bull run has yet to come. However, it’s also worth remembering that not every cycle is alike.

Trading involves risk.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.