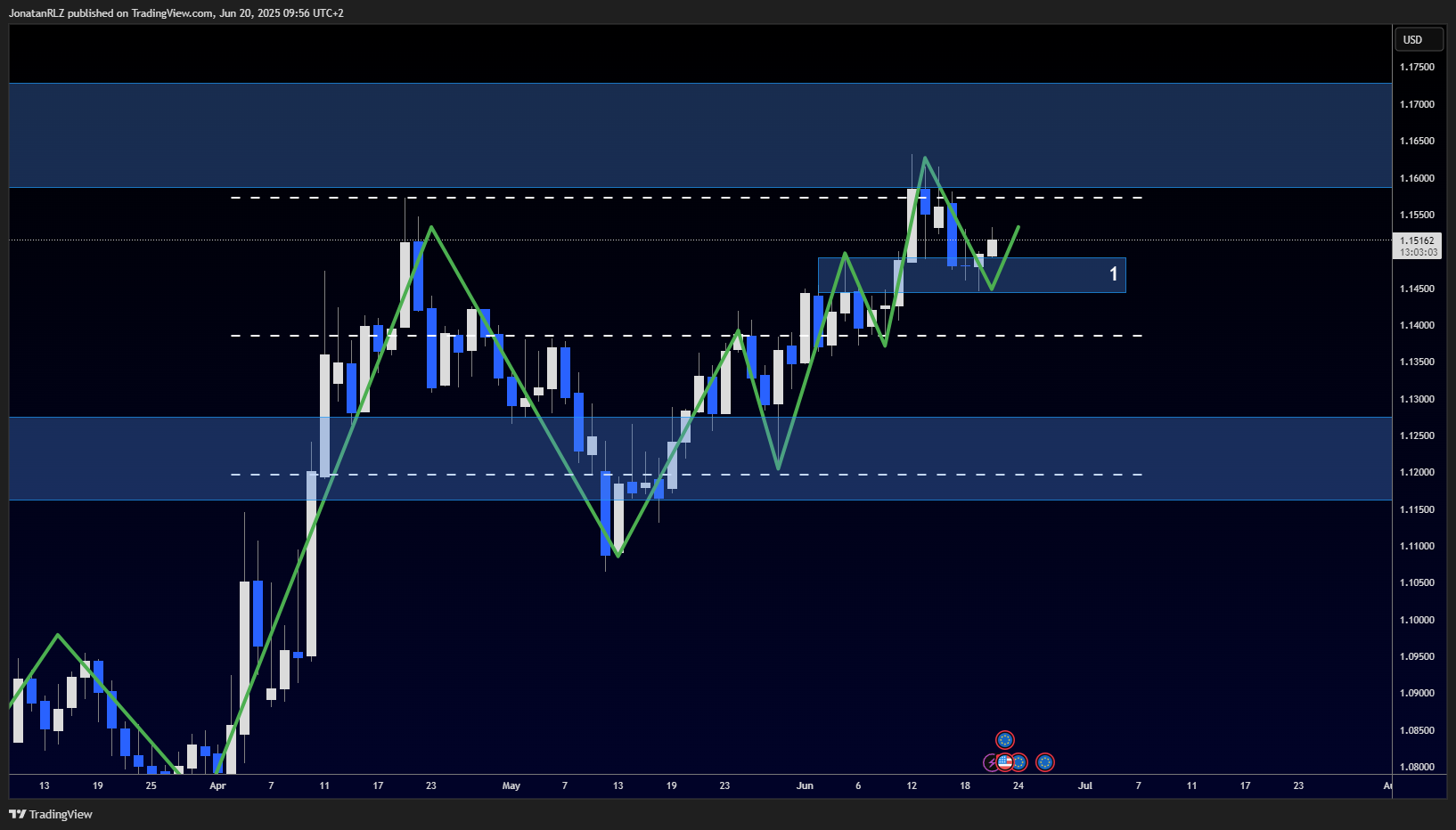

On the higher timeframes, EUR/USD continues to trade below the key 1.1600 resistance level, and we still see the broader high time frame range structure in play, with support anchored at 1.1200. Price remains inside this range, trading between the 1.1200 support and 1.1600 resistance, potentially building the foundation for a new long-term cycle.

The current daily structure looks constructive. We are seeing a series of higher highs and higher lows, marked with the green trendline on the chart. Price is also holding above a recent breakout zone, marked as number 1, which shows a clean break and retest. This setup supports a continued bullish bias, at least while this current local trend remains intact.

Moving into the 4-hour chart, price has retested the breakout zone around 1.14500, which also aligns with the midpoint of the local long reload zone. This area acted as support and was followed by a strong bullish engulfing candle, marked with a green arrow on the chart. As long as EUR/USD holds above the 0.702 retracement zone, the local structure remains constructive.

This support zone around 1.14500 now becomes a key area for bulls to defend. If price holds here, it confirms the potential for this level to act as a valid swing low, supporting a continuation of the broader bullish trend.

Zooming into the 1-hour chart, we can see a double bottom structure, with the neckline of that pattern aligning perfectly with the breakout zone and the reload zone. If we see a short-term retrace, bulls are likely to watch the 1.14800 area closely for another potential defence.

A bounce from this level would further validate the local trend, while a breakdown below it could invalidate the recent bullish structure and shift short-term sentiment to neutral or bearish.

Overall, EUR/USD continues to trade within range boundaries on the higher time frames, but the shorter-term structure remains bullish, supported by breakout retests and clean technical confluence zones.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.