The German stock index DAX, also known as GER40,GER30, has posted impressive gains recently, outperforming other major European benchmarks like the Euro Stoxx 50 and the UK FTSE 100. With the DAX now trading at all-time highs, the key question is whether there is more fuel in the tank, or if we are due for a pullback after this strong rally.

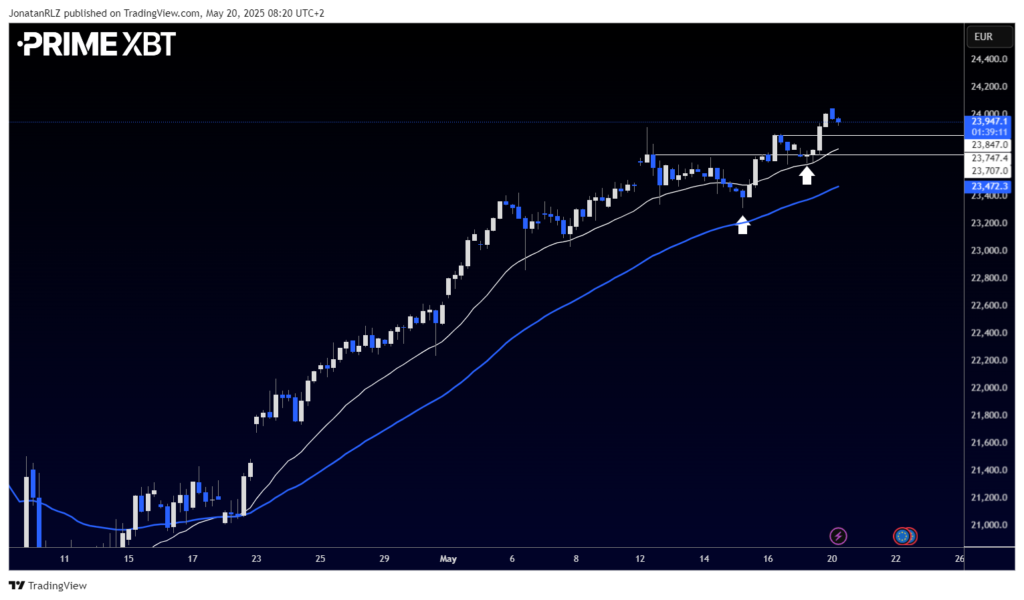

Looking at the daily time frame, we see a clean and strong bullish trend. The high timeframe support area around 23,300 now acts as the key level to watch. If this zone holds, it would reinforce the current trend and signal that buyers remain firmly in control. Notably, the daily 20 EMA also sits within this support zone, adding further confluence to this level.

Dropping down to the 4-hour chart, the structure continues to look healthy, with the 20 EMA above the 50 EMA and price maintaining a steady sequence of higher highs and higher lows. Two levels stand out here. The first is the untested support at 23,847 just below current price, and the second is the already-tested support at 23,700. These levels will be closely monitored by trend-following traders.

To anticipate potential structural changes, traders will be watching for a break of the most recent higher low. The chart highlights this with two white arrows showing the key swing points. A break below these swing lows would be the first sign of a possible trend shift and an early signal for short sellers.

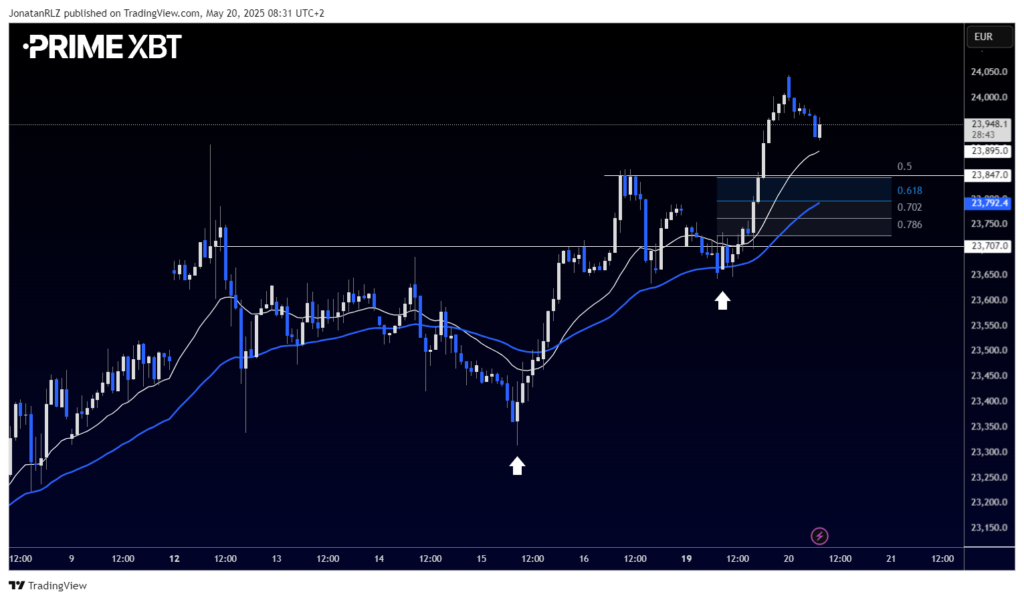

Zooming into the 1-hour time frame, the 23,847 support level aligns perfectly with the 50% Fibonacci retracement of the most recent intraday up move. This area also sits between the 20 and 50 EMAs on the 1-hour chart, creating a solid confluence zone. If momentum remains intact, this area could act as a solid base for continuation higher.

However, a break below the intraday reload zone, between the 0.618 and 0.786 Fibonacci levels, would be a sign of weakness. For short sellers, the ultimate confirmation would come with a break below the latest swing low.

So far, the DAX continues to show strength. For now, the trend is intact, but the coming sessions will reveal whether buyers can defend these key zones or if the first cracks begin to show.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.