Bitcoin is hovering above 116k, after rising to a fresh 6-week high of 117.3k early in the day as investors await cautiously for the Federal Reserve interest rate decision at 18:00 GMT.

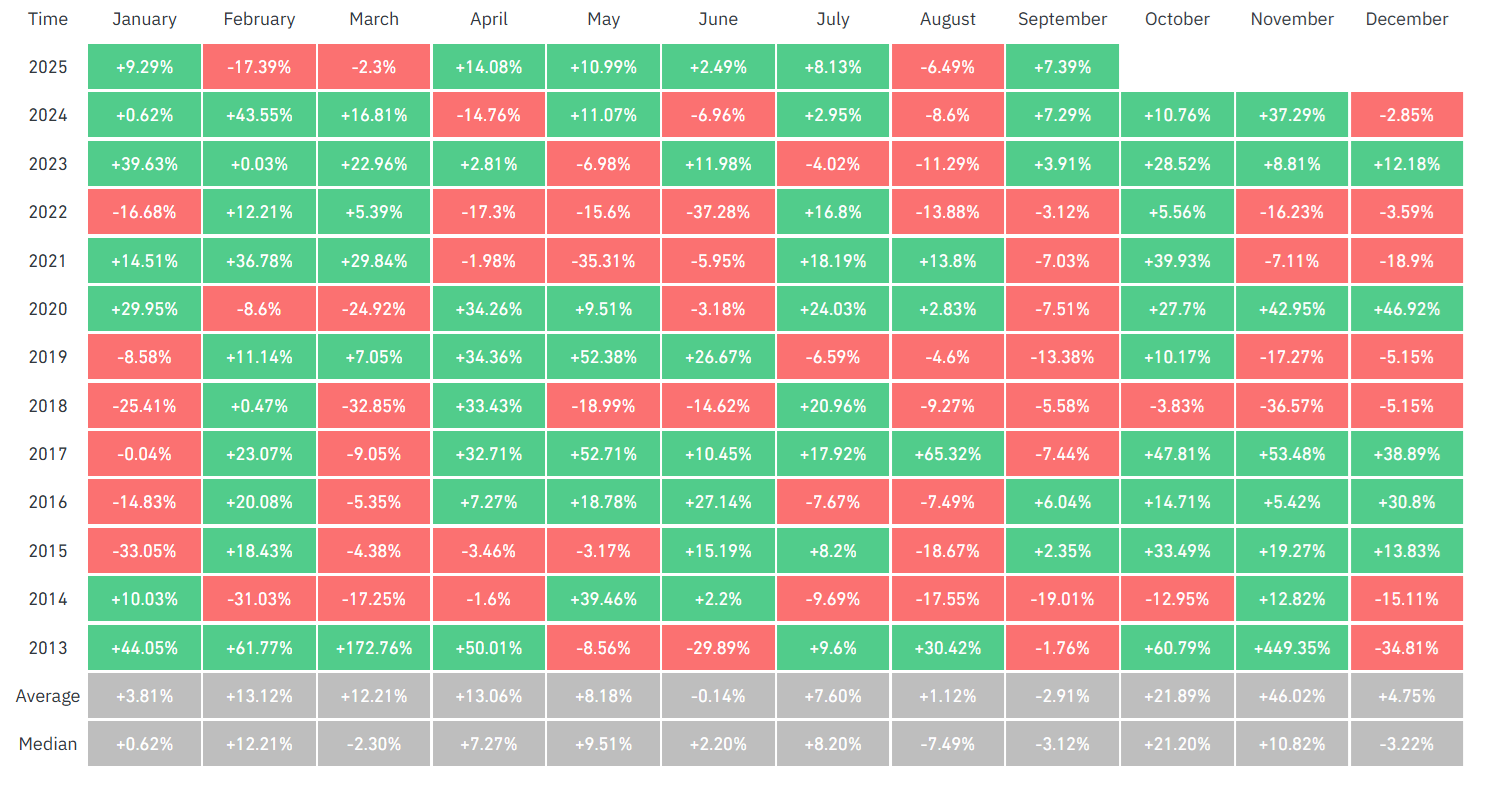

Bitcoin has gained 8% so far in September, defying seasonality trends and marking the best September since 2012. September is traditionally Bitcoin’s weakest month with average losses of around 8%. Yet this September is on track to be its second-best ever, with September 2012 being more profitable with gains of 19.8% and last year September saw gains of 7.3%.

This September is interesting owing to the clash between BTC price seasonality and historical cycle patterns, which point to the next bull market high. Meanwhile, other risk assets are also defying seasonality at record highs. The S&P 500 trades over 2.2% higher this month, while the tech-heavy Nasdaq has rallied 4% signaling a strong month for equities in September, a typically weak month for stocks.

Risk assets, along with Gold, have rallied across September on growing expectations that the Federal Reserve will resume its rate-cutting cycle. The market is fully pricing in a rate cut from the Fed today, with potentially a further two 25-basis-point rate cuts before the end of the year to support the weakening US job markets.

BTC volatility fades

Interestingly, as prices have pushed higher, volatility has faded across the year against the expectations of longtime market participants based on prior performance.

According to CoinGlass data, volatility has dropped to levels not seen in over a decade. This also coincides with the lack of severity in Bitcoin price drawdowns from the all-time high in this bull market. In previous bull markets, drawdowns have reached 80% but so far in 2025, the largest bull market drawdown has been 30%.

The relative lack of volatility could be a sign of a maturing market, particularly given rising institutional and corporate demand.

BTC institutional demand is the strongest since July

On this note, BTC ETFs have booked net inflows for the last six straight days, recording the strongest inflows since July. The recent momentum lifted US spot Bitcoin ETFs’ combined holdings to 1.32 million BTC, surpassing the previous record set on July 30. Furthermore, over the past week, inflows into Bitcoin ETFs have surpassed new supply growth by a factor of 8.93 times, marking a key tailwind for Bitcoin’s performance.

How the Fed rate decision could impact BTC?

BTC ETF demand has risen significantly ahead of the Fed rate decision. While the cut is priced in, attention will be on forward projections, Powell’s presser, and the dot plot. The Fed’s dotplot in June signaled 50 basis points of cuts. The market is pricing in 70 basis points worth of cuts by the end of the year. Investors will be looking for the Fed to guide towards more rate cuts to propel risk assets higher. However, recent capital allocations into equities and altcoins could mean that BTC gains are limited.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.