Rising geopolitical tensions in the Middle East have sent risk assets sharply lower, and safe-haven Gold has jumped northwards.

Israel launched a major strike on Iran’s military and nuclear sites as tensions in the region reached new heights. Israel warned that further action will follow, while Iran vowed retaliation, raising the risk of a wider war in the region, which could have global ramifications.

The escalation of geopolitical tensions has hit the market mood, pulling risk assets lower and triggering a $1.15 billion liquidation event in the cryptocurrency market. Asian markets are lower, and US and European futures are also in the red.

Bitcoin has fallen to a low of 103k but has since recovered to 105k. Ethereum has dropped 4% to 2500, and Solana has tumbled 6% to 143.00. Meme coins are being hit the hardest with Fart coin and Ethena down almost 20%. However, safe havens such as Gold, the Japanese yen, and the Swiss Franc benefit from the risk flows. XAU/USD surged to a high of $3444, its highest level since the April 22 all-time high. Elsewhere, Oil rallied 11% at one point, marking its largest daily surge in 5 years.

Bitcoin historically has shown sensitivity to geopolitical unrest, often falling as investors and traders reduce their exposure to volatile assets. While the Crypto market is considered to be a long-term hedge, in the short term, it often mirrors broader market sentiment.

The geopolitical shock triggered a wave of liquidations in the cryptocurrency market. According to data from Coinglass, $1.14 billion was liquidated over the past 24 hours. Of those, $1.04 billion were long positions, compared to $100 million in short positions.

The ramping up of geopolitical tensions comes to a market that was already jittery owing to Trump’s erratic trade tariff policies. Earlier in the week, Trump warned that his administration would be sending out “take it or leave it letters” to swathes of its trading partners outlining the unilateral tariffs ahead of the July 9 deadline.

Headline risk remains a key driver for the markets, and investors will continue to monitor developments in the Middle East and Trump’s trade policy. If tensions de-escalate, BTC could recover. Attention will also turn towards the Federal Reserve interest rate decision next week.

Fed rate decision

Next Wednesday, June 18th, the FOMC will release its latest policy decision. The FOMC is expected to leave interest rates unchanged this time round, but will release a summary of economic projections, all right, don’t plant, which will show where it expects the path for interest rates to be.

Data this week shows that inflation remains high, but some weakness is seeping into the labour market. The updated projections, dot plot, FOMC statement, and Federal Reserve Chair Jerome’s press conference should clarify how the central bank sees Trump’s policies impacting the economy and the outlook for interest rates.

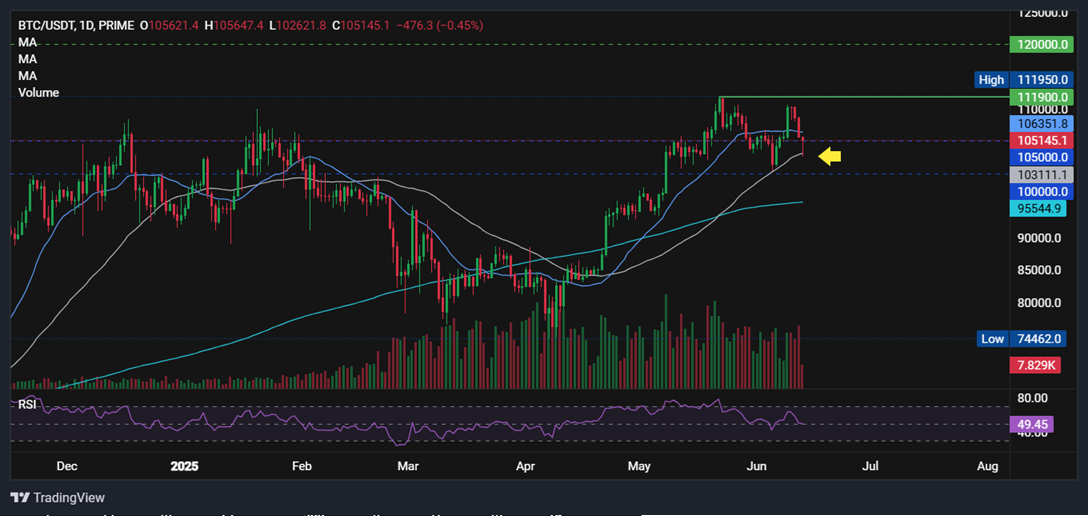

Bitcoin finds support on the 50 SMA

Bitcoin has fallen away from 110k, last week’s high, before finding support on the 50 SMA. The long lower wick on the candle suggests that selling demand was weak at the lower prices, and an element of buy-the-dip has helped the price recover. The RSI is neutral.

Buyers will look to rise above 110k to create a higher high and bring 111.9k and fresh record highs into focus. Sellers will need to break below the 50 SMA at 103k to extend the selloff towards the key 100k level.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.