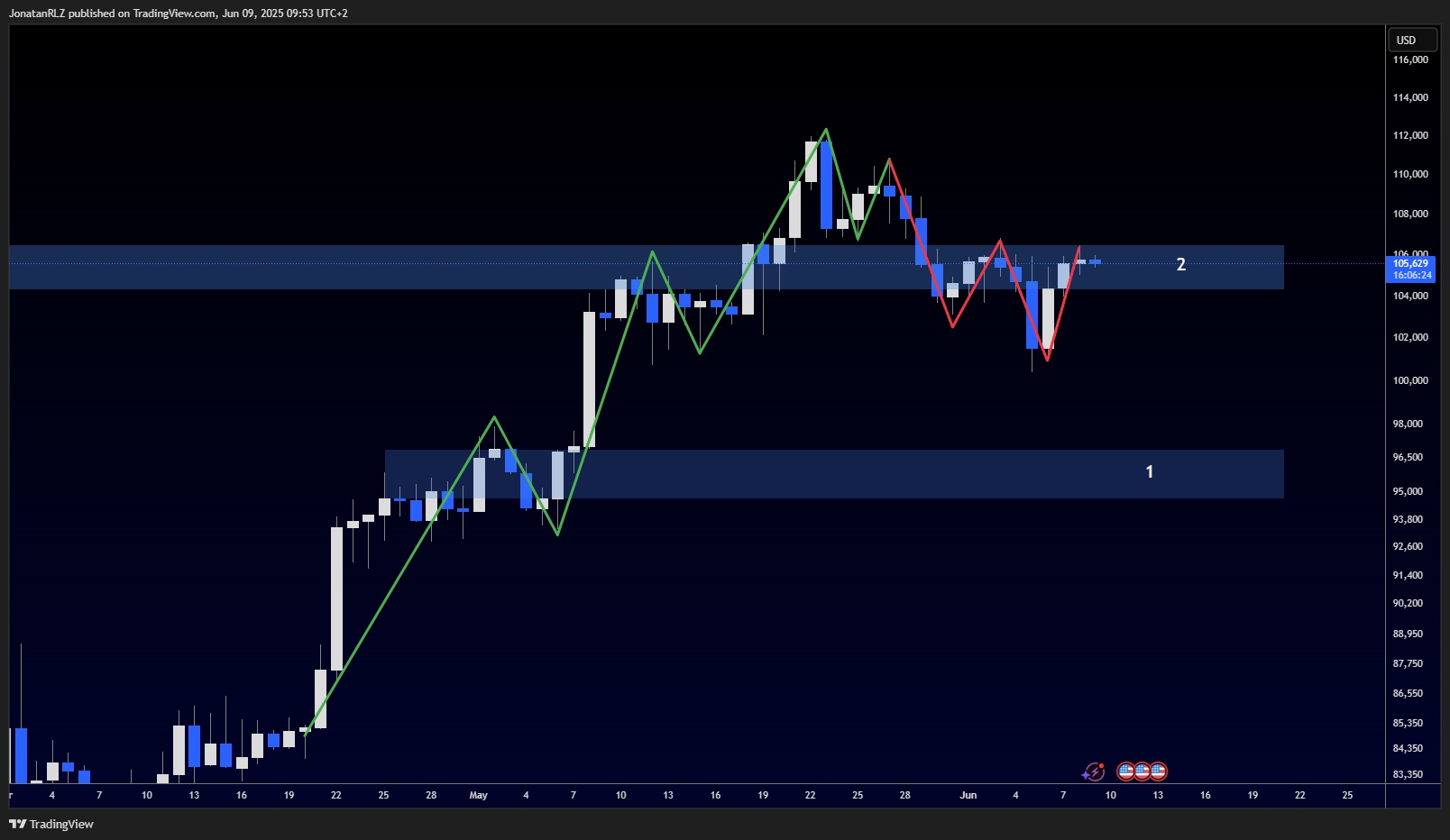

Today’s update on Bitcoin starts with the daily chart, where we are focusing on two major levels and the current state of the local trend. The first key level is support at 96,000, marked as number 1. The second is the resistance zone around 106,000, marked as number 2, which is where price is currently trading.

Looking at the broader trend, Bitcoin showed strong momentum into its all-time highs last month, but since then, the daily chart has shifted into a structure of lower highs and lower lows. That means the uptrend has stalled, and the 106,000 level becomes especially important.

Reclaiming this level would shift Bitcoin back into bullish territory on the daily timeframe. If price can close above this resistance convincingly, it would suggest that bulls are regaining control and that we may be entering another phase of upside continuation. In that case, a move toward higher levels later this week becomes a realistic scenario.

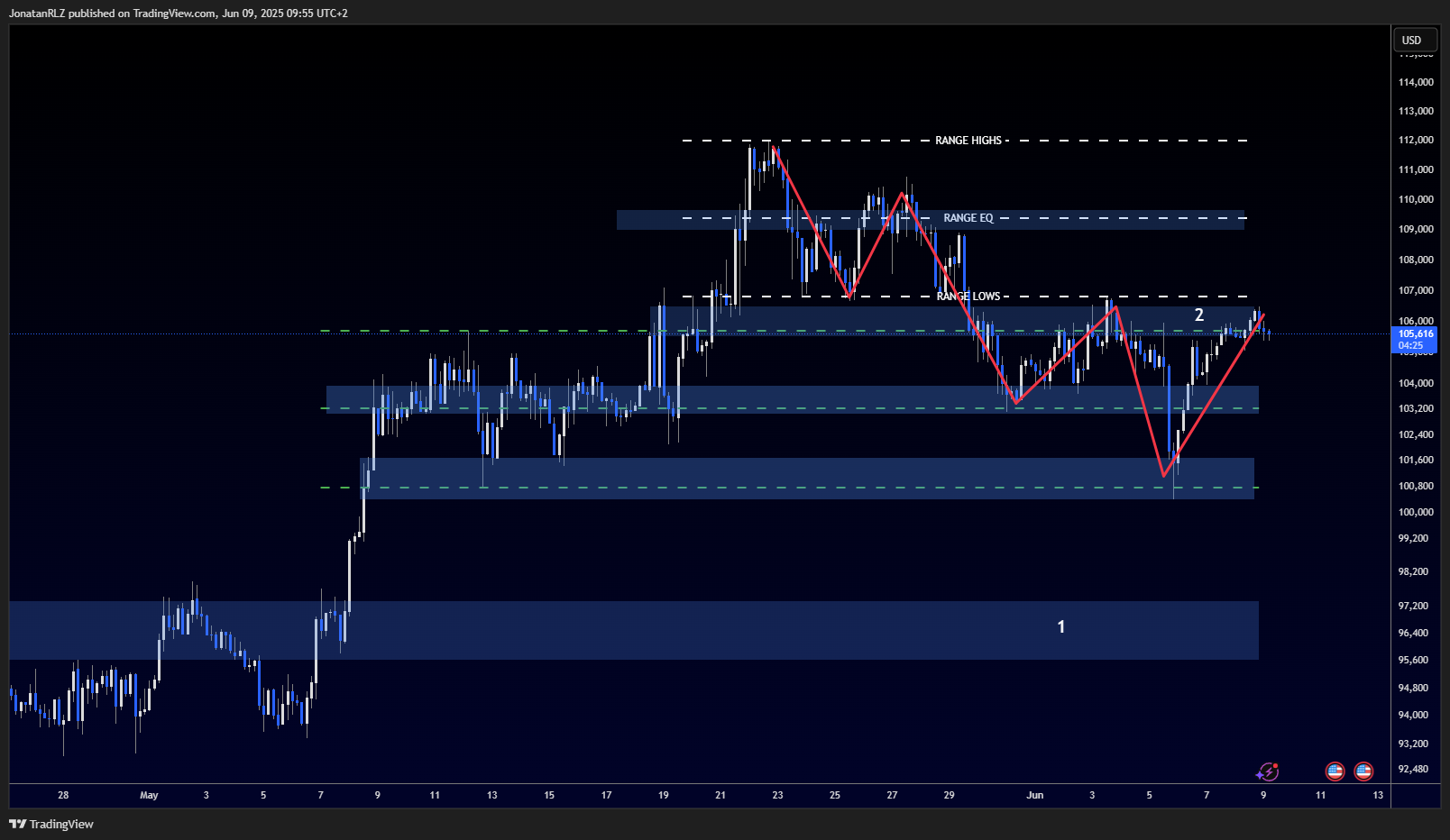

On the 4-hour chart, structure is even clearer. Two defined ranges are in play, the same ones we highlighted last week. Friday’s price action confirmed that the range low served as solid support, and since then, Bitcoin has pushed higher to test the upper boundary of the green range. This level, aligned with 106,000, is marked as number 2 and matches the daily resistance.

This puts Bitcoin at a critical inflection point.

A breakout above this level would signal more than just intraday strength. It would also break the current bearish structure on the daily and establish a new bullish phase on the 4-hour. From there, the next immediate target would be the range equilibrium around 109,000, with potential for a continuation up toward the range highs at the all-time highs.

Until then, 106,000 remains the line in the sand for both bulls and bears.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.