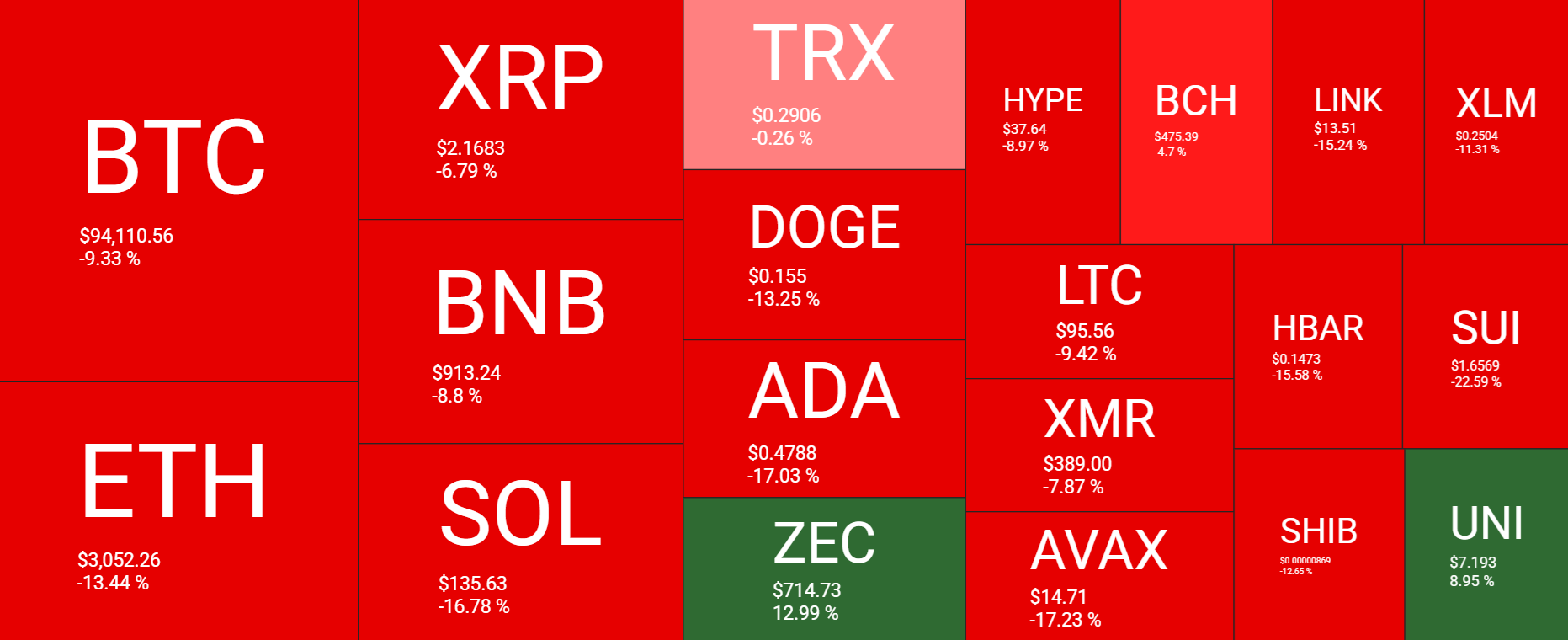

Bitcoin fell a further 6.5% last week, after 7% losses the week before, putting losses so far in November at 14%. The largest cryptocurrency started last week on a positive note, rising to 107k, before running into rejection at this key resistance level and then rebounding lower, falling to a low of 93.8K over the weekend. The price has edged higher to 95k at the start of the new week, but the 50 SMA crosses below the 200 SMA, signaling a death cross.

Bitcoin wasn’t alone in the selloff. Altcoins were also bleeding out, with Ethereum down 13.4% across the past 7 days. Solana fell 16% over the past 7 days, while XRP dropped 6.5%. There were some pockets of positivity with ZEC rising 13% and UNI rising 9% across the past 7 days.

The total cryptocurrency market capitalisation has fallen to a low of $3.18 trillion, a level last seen in June. This is a decline of almost 11% from the start of last week.

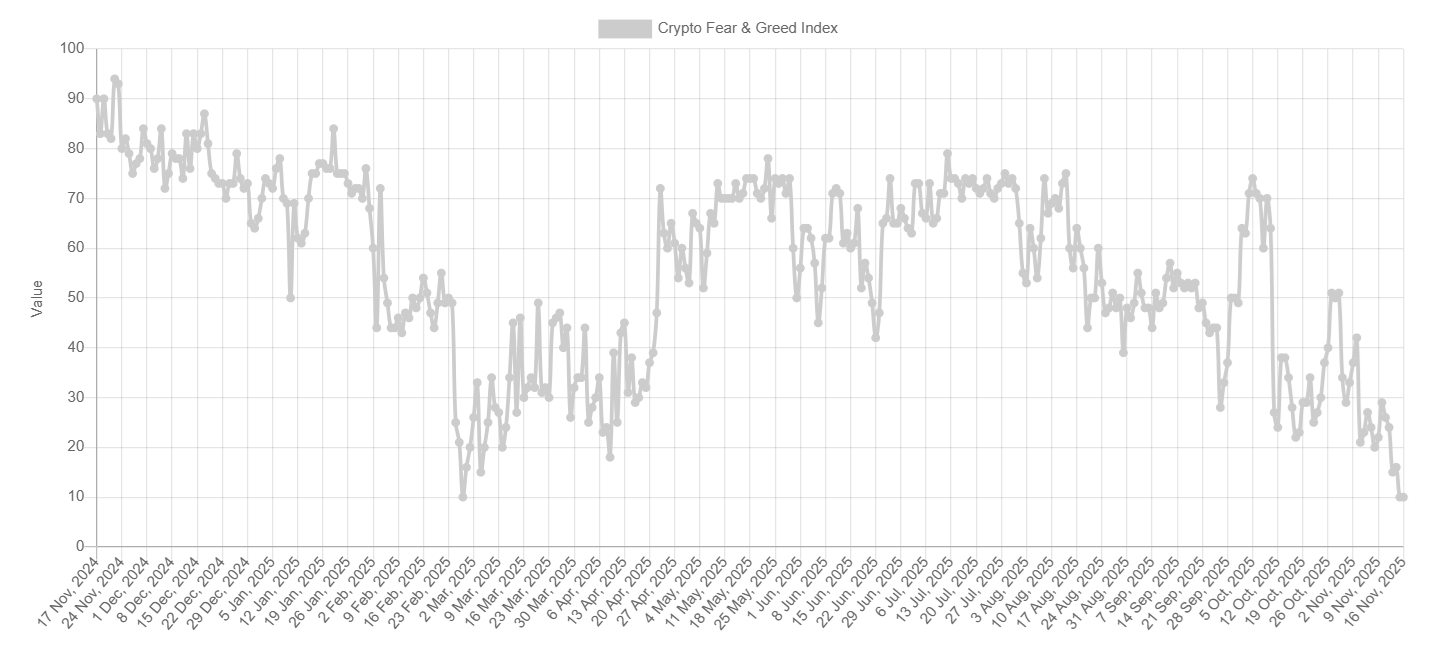

Sentiment analysis indicates the crypto market is in Extreme Fear. The Alternative Fear and Greed index has dropped to 14, down from 22 last week but up slightly from 10 yesterday, the lowest level since February, as sentiment collapses. The shift alone is enough to make even long-term traders pause.

Historically, extreme fear has tended to act as a contrarian signal, often showing up near accumulation zones, prompting investors and traders to ask whether this is the bottom. However, prolonged periods of extreme fear can fuel a deeper selloff.

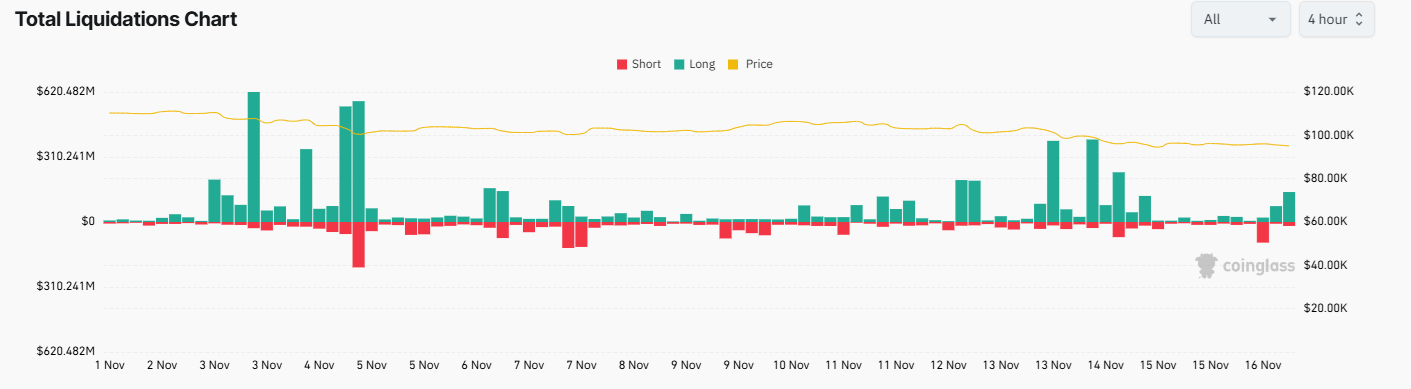

Liquidations surge

Crypto liquidations hit the market last week. As BTC crashed below 100k, the move triggered a massive liquidation event, marking the largest intraday shakeout this week. In total $1.1 billion in crypto positions were wiped out, of which $907.2 million were long positions and $168.9 million were shorts. Over the past week, $2.8 billion in long positions were liquidated.

Macro backdrop – Fed December rate bets fall, Nvidia to report

The deleveraging event on 10 October continues to reverberate in crisp crypto markets, which have remained fragile since. From a broader macro perspective, the crypto sector was directly affected by AI bubble fears in the US equity markets.

US technology stocks, particularly AI-related equities, have fallen sharply in recent sessions, with the Nasdaq 100 underperforming the Dow Jones Industrial Average. Worries over stretched valuations and elevated AI spending have dragged on sentiment. Bitcoin has maintained a strong correlation with the Nasdaq 100 index; however, the correlation is strongest when the index is falling and significantly weaker when it is rising, suggesting a preference for tech stocks over BTC when the market is bullish. Nvidia’s earnings this week could reignite the AI trade or send it on another leg lower, which could influence BTC.

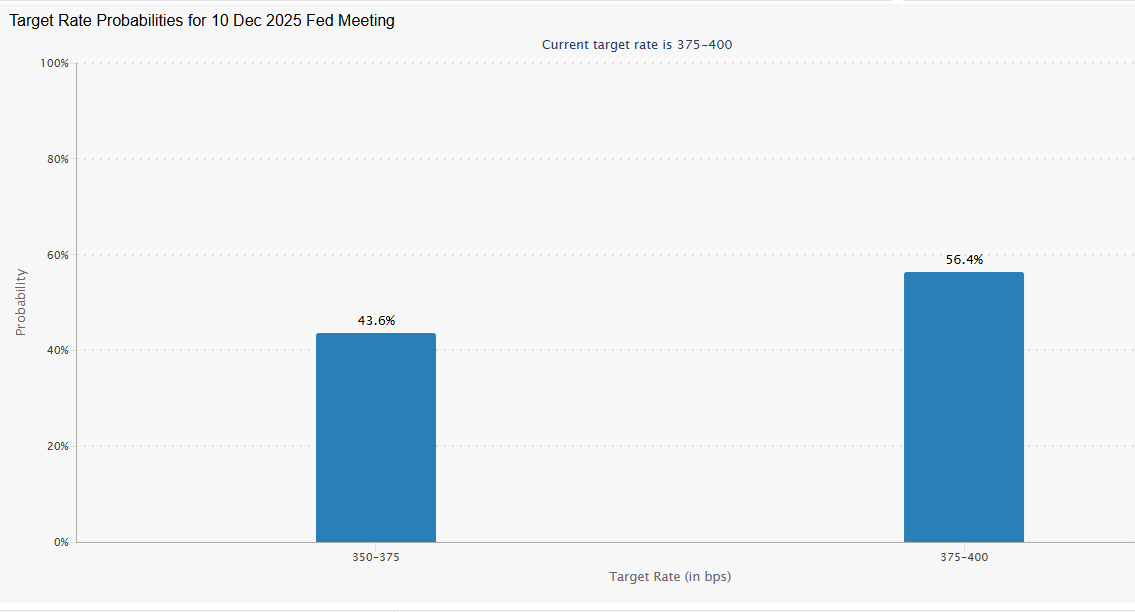

In addition to the tech sell-off and likely related, the market has reined in Federal Reserve rate cut expectations. While the US government reopened after the longest shutdown in recent history, it didn’t bring much joy to markets, as concerns over data releases remain. The White House warned that the October inflation or non-farm payroll data may never be released. This means that the FOMC may still be short on recent data at the 10-11 December meeting, making a hold more likely. Hawkish comments from Fed speakers have also pulled down expectations for a December rate cut.

The market is now pricing in a probability of a December rate cut below 50%, down from 67% a week ago and over 90% a month ago.

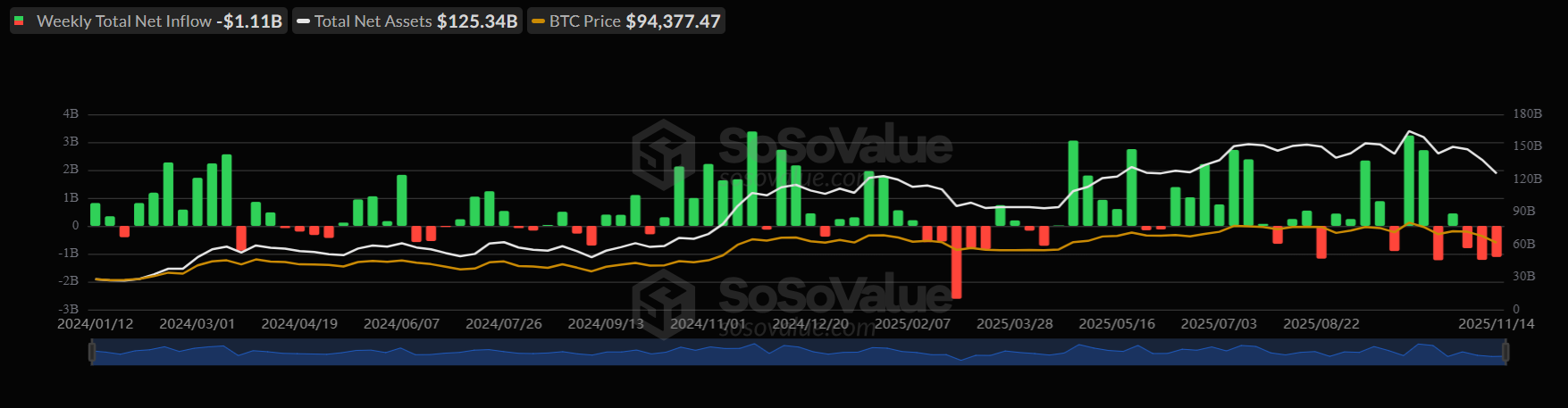

Fading institutional demand

Institutional pressure intensified the selloff last week, with Bitcoin ETFs recording net outflows of $1.1 billion, marking the third straight week of net outflows and the second straight week of net outflows exceeding $1 billion.

On a monthly basis, net outflows in November have reached $2.33 billion, putting November on track to be the second-worst month; the performance for BTC ETFs is only after $3.56 billion in outflows in February this year.

The data show that institutions are pulling back amid macro noise and a broad de-risking of high-beta assets amid uncertainty around the Fed’s path forward. These figures suggest that big money isn’t treating this dip as an opportunity yet. Should institutional demand continue to fade, Bitcoin could face a deeper price correction. However, news that Harvard University has tripled its stake in BlackRock’s ETF could bring some optimism to an otherwise depressing picture, given the strong validation the Harvard name carries.

On-chain metrics are bearish

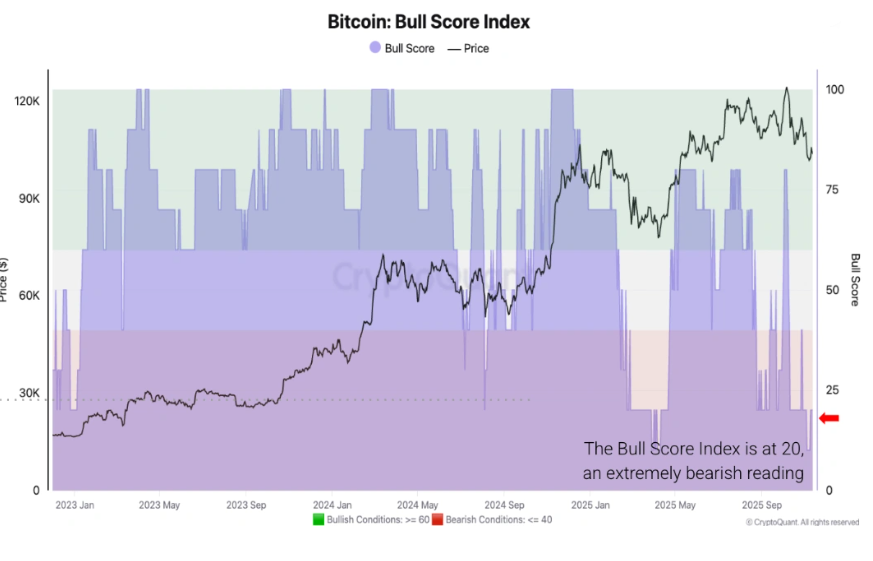

CryptoQuant’s weekly report highlighted that Bitcoin remains in a bearish phase as the price remains below the 100K level. The CryptoQuant bull score index has fallen from 80 on 6 October, when Bitcoin was at a record high of 126K, to just 20 last week, as Bitcoin dropped below 100K.

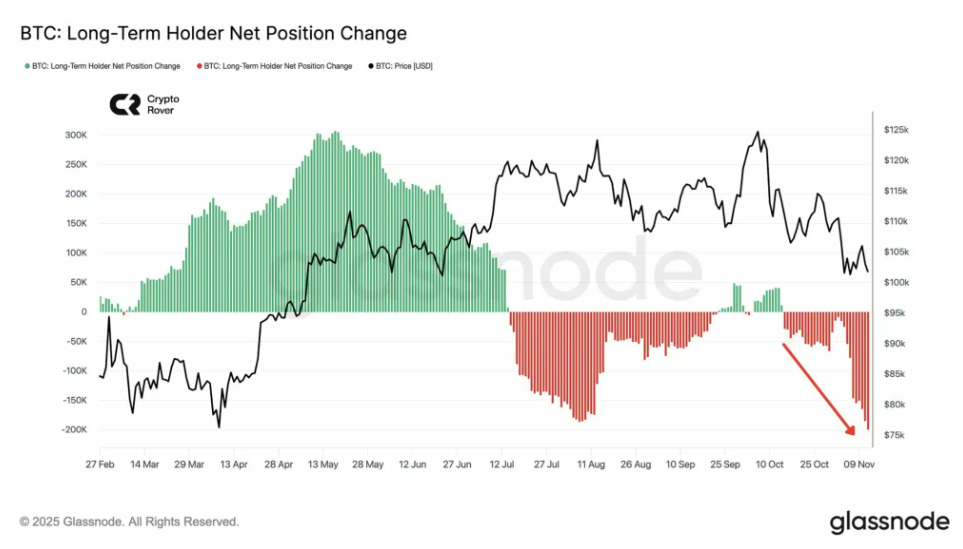

Furthermore, long-term holders continue to sell. The cohort has sold 815,000 BTC over the last 30 days, marking the highest levels since January 2024, adding downward pressure to the price. LTHs are rotating supply at the fastest pace this year.

The Net Position Change flipped from steady accumulation in Q2-Q3 to distribution in October and November. This came just as global search interest for “crypto” has fallen to deep-bear-market levels. In short, supply is moving aggressively, while attention has nearly disappeared.

Adding to the bearish setup, the price closed the week well below its 50-week SMA, a critical dynamic support which is often considered the final barrier before a bear market. This was an aggressive break below key technical support, pointing to growing downside risk and marking the first time since the previous cycle bottom that BTC has not bounced from the long-term support.

Fishing for a bottom

Halfway through Q4, BTC is experiencing its weakest fourth quarter since 2018, with a net loss of over 15%. Furthermore, 74% of that drawdown came in November, making it the second-worst month of 2025 after February.

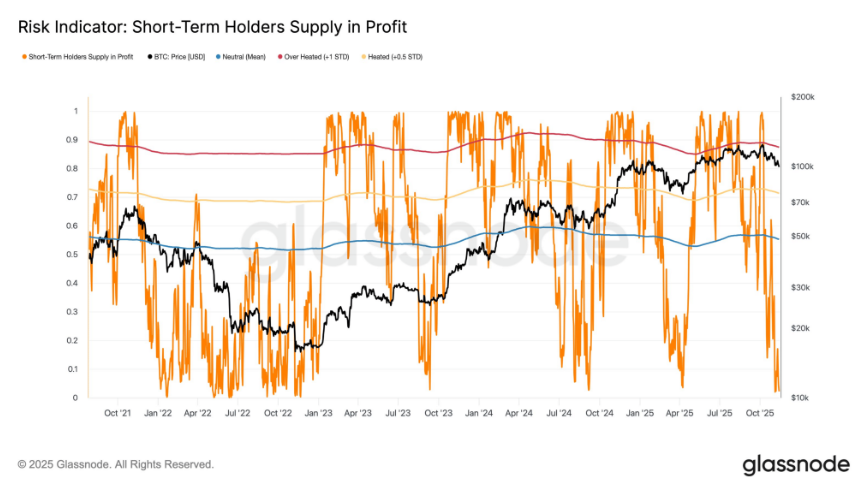

This latest breakdown comes as Bitcoin fell below the 98,000 floor, back to early May levels, leaving 99% of short-term holders sitting on unrealized losses. The price is also well below the short-term cost basis of 112k. This typically points to a reduced willingness to add and an increased likelihood to sell rallies.

If the price can return above both the 50-week SMA and the STH band, this could attract fresh demand; however, repeated rejections of these lines may lead to additional selling pressure.

What can history tell us?

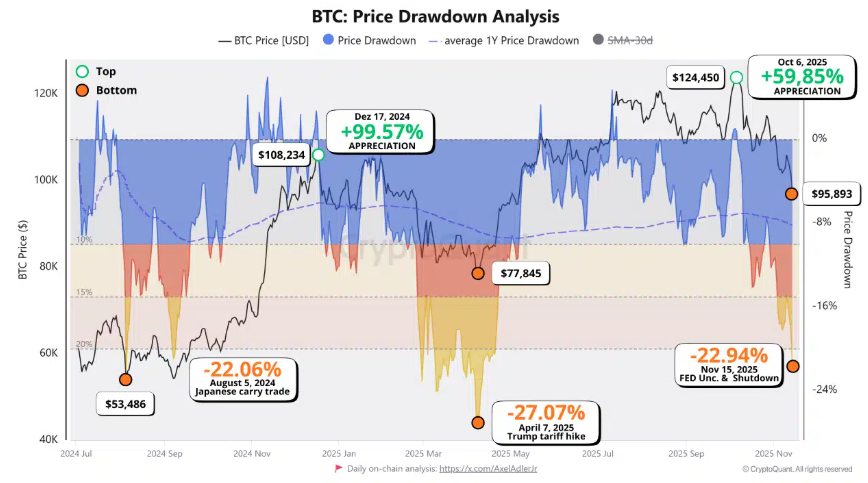

According to CryptoQuant Insights, an analysis of Price Drawdown over the past year may help determine whether the current drawdown is nearing its end. Earlier in the year, the market had retraced by 22%-27% from its highs, marking a bottom before rallying 60%-100%. The market is currently down 23% from its record high.

The low stablecoin supply ratio could also give bulls hope, as it shows stablecoins’ high purchasing power and indicates upside potential. However, high volatility could still catch trades investors on the wrong side of a move.

The short-term holder MVRV ratio is at 0.86. A reading of 0.833 in August 2024 and 0.85 in April of this year signaled the market bottom, followed by rallies to new all-time highs. Could a similar scenario play out again?

However, bearish indicators cannot be ignored, and the price action, institutional demand, and on-chain data over the coming days could indicate whether BTC falls meaningfully below 95k towards 85k or stabilises and heads back above 100k towards 107k.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.