Bitcoin booked another weekly loss, falling 1.7% over the past week and extending losses of 10% from the previous week. BTC experienced high levels of volatility, starting last week at around 86k, briefly spiking to 95k, before ending the week at -5 % on Sunday at 80k as traders continued to sell out of the risk asset. BTC/USD remains depressed at 82k at the start of the week.

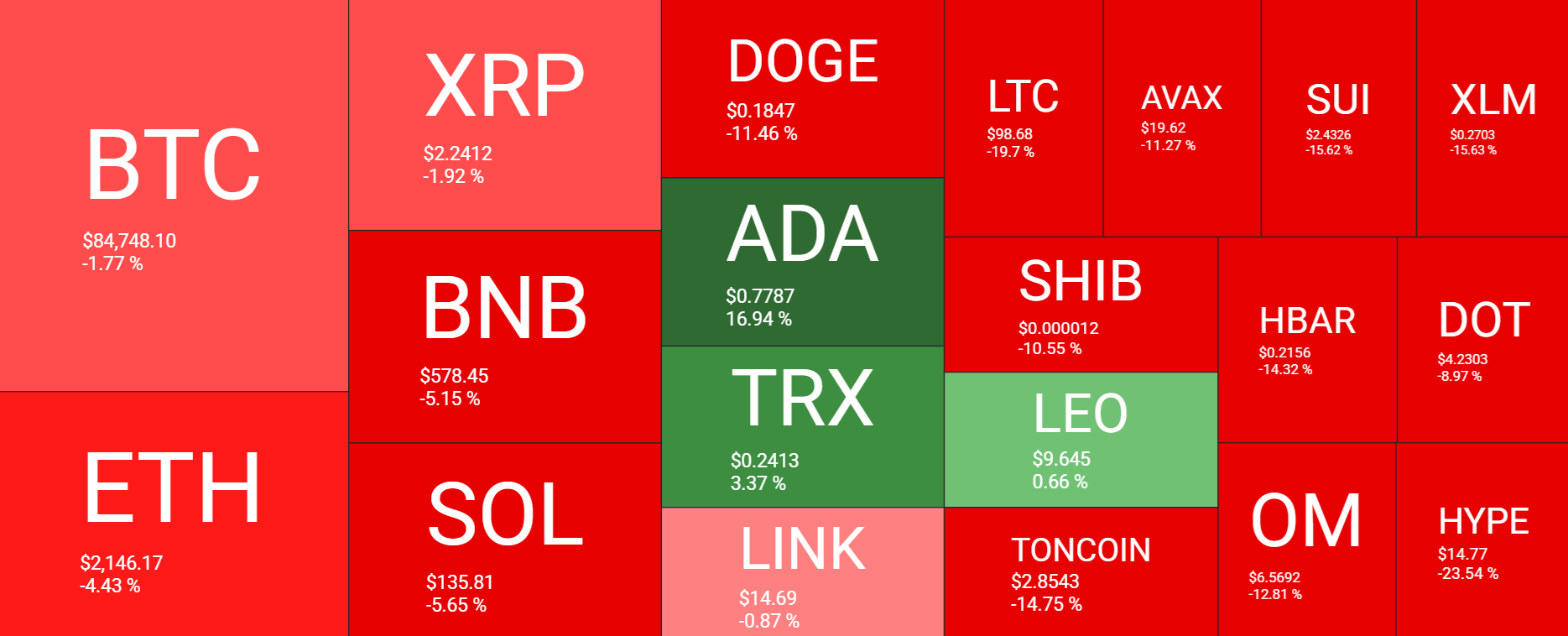

In addition to Bitcoin falling across the week, major altcoins were also under pressure. Ethereum fell over 4%, Solana dropped 5.5%, and XRP booked losses of 1.7%. There were a few spots of positivity, with Cardano gaining 16% and TRX gaining 3.3%.

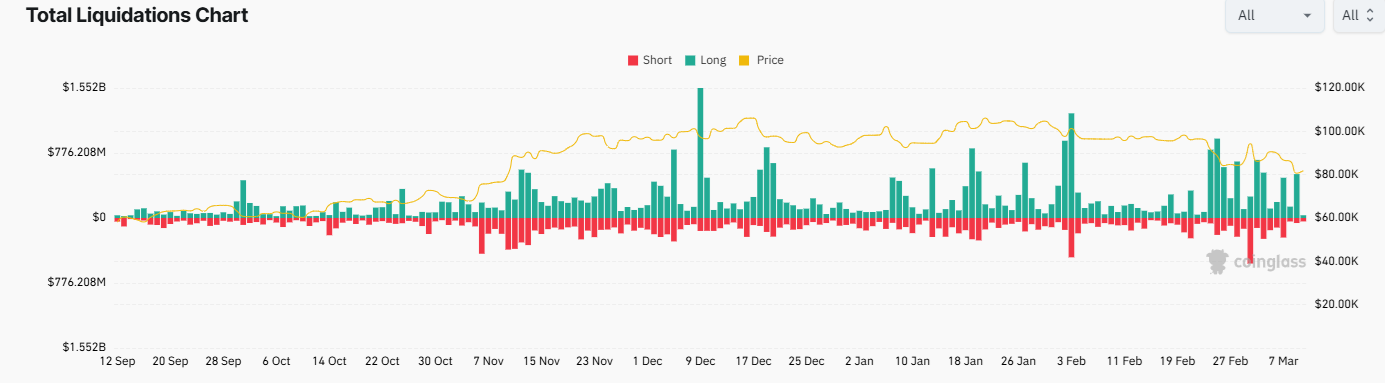

Bitcoin liquidations

While Bitcoin price held at 86k across the start of the week, heading into Monday, the price tumbled lower as bears took control, pulling the price to a low of 80k. The latest downtrend negatively affected 220,000 over-leveraged traders. According to Coinglass data, total liquidations in the last 24 hours reached $620 million. BTC made up $240 million, and ETH accounted for $108 million.

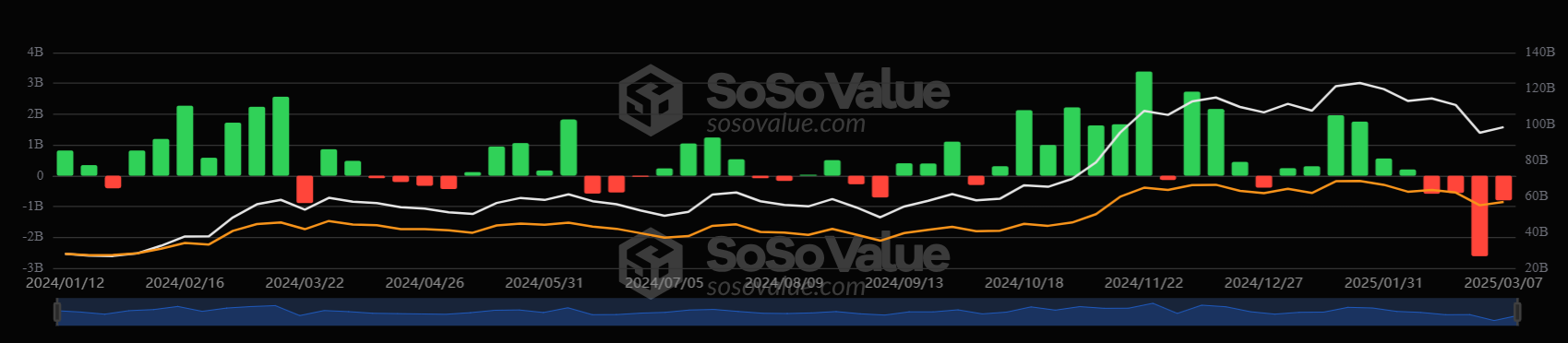

The chart highlights the elevated levels of long liquidations since late February, underscoring the high levels of volatility that the crypto market has experienced over the past few weeks.

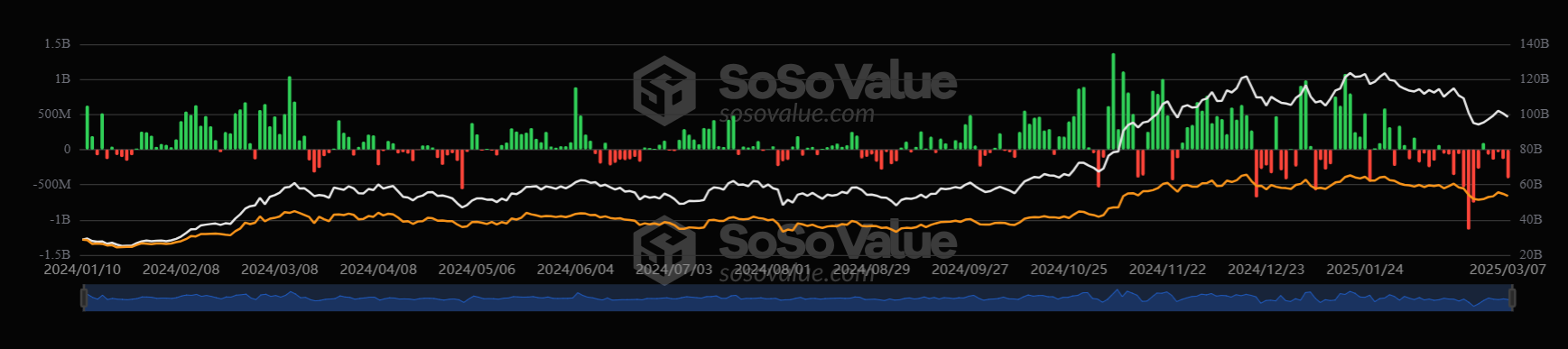

ETF sees a fourth week of outflows

Institutional demand fell again last week as investors pulled money from Bitcoin ETF’s. Friday was the worst day, and according to so-so valued data spot Bitcoin ETF, saw $409 million worth of outflows, which brought the weekly loss to $740 million.

Still, this wasn’t as bad as the prior week, when Bitcoin ETFS had its worst day on record. That said, it was still the fourth straight week of outflows, suggesting that institutional sentiment remains cautious. Over $4.5 billion in net assets have left the market in the past four weeks.

Macro backdrop

President Trump rocked the crypto market last week with his flip-flopping on his trade tariff policy, which overshadowed the formal announcement of the creation of the Bitcoin Strategic Reserve and the accompanying crypto stockpile.

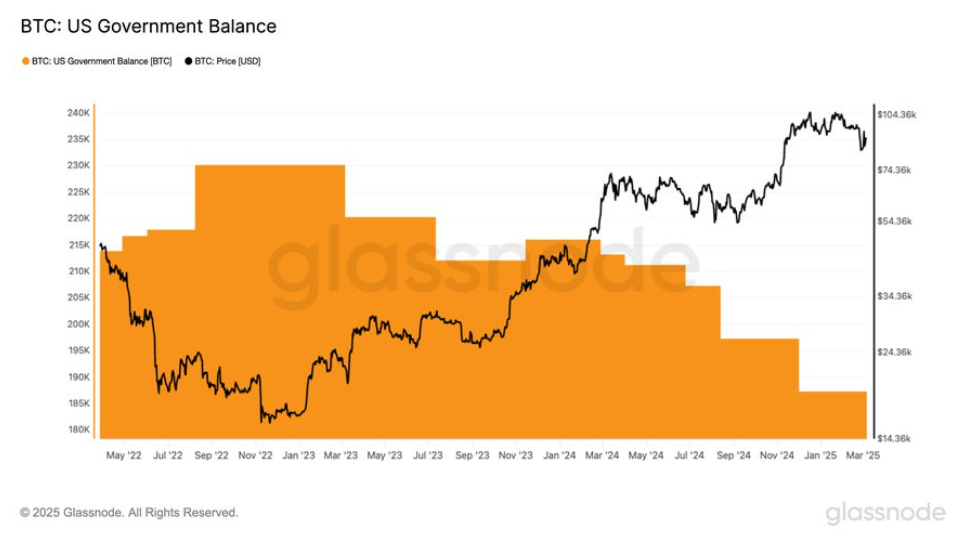

Last week, President Trump finally fulfilled his campaign promise and signed an executive order to establish a strategic Bitcoin reserve. This reserve will hold almost 200,000 Bitcoin, which the US already has in its possession from seizures.

Interestingly, Bitcoin sold off following the announcement amid widespread disappointment that the reserve would utilise tokens seized in government criminal cases rather than fresh purchases directly from the market. This means that demand will not be picking up due to the Bitcoin strategic reserve. While the current plan doesn’t involve government Bitcoin purchases, it doesn’t feel rule them out in the future.

Still, the news disappointed, sending Bitcoin lower and highlighting what a tough crowd this is to please. While the market was disappointed, given its high expectations, let’s not forget that the US prioritisation of Bitcoin reserve legitimizes its status as digital gold and could drive further institutional adoption worldwide.

White House Crypto Summit fails to drive demand

In addition to formally announcing the historic Bitcoin strategic reserve, the White House also hosted its first crypto summit, which received mixed reactions from the community. While the summit was heavy on praise, it was light on substance. A framework for stable coin legislation before August and assurances of a lighter regulatory touch failed to ignite the market. This was a nothing burger, failing to live up to high expectations.

Furthermore, geopolitical tensions, tariffs, and concerns over the US economy have overshadowed any positive idiosyncratic developments for the industry this week.

Trade tariff concerns & recession fears

Beyond the announcement of crypto-related legislation, Bitcoin’s price continues to be pressured by macroeconomic developments and global trade concerns. In a week when President Trump applied 25% trade tariffs to Mexico and Canada and an additional 10% trade tariff on China before announcing a slew of delays and exemptions, trade tariff uncertainty has hit market sentiment hard.

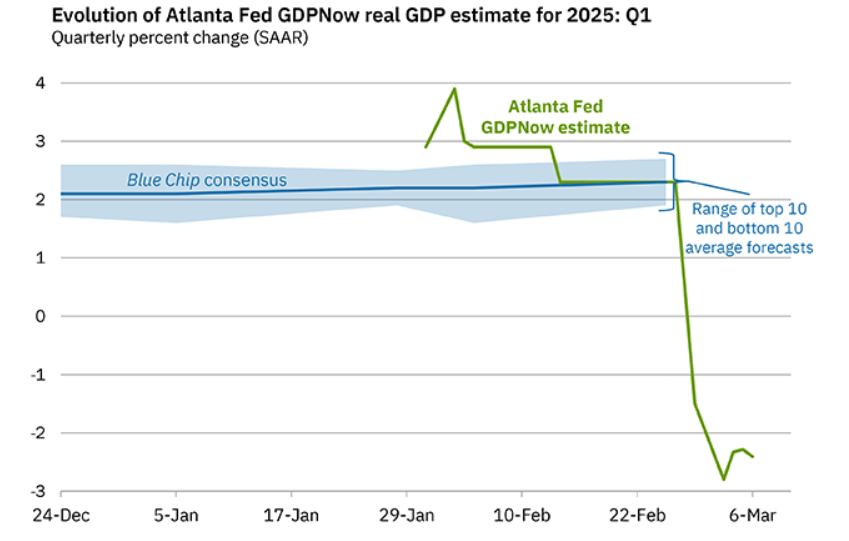

Whilst U.S. economic data across the week wasn’t as bad as feared, worries over a recession in the US are building. According to the Atlanta Fed GDP projection, Q1 GDP is forecasted at -2.4 %.

Recession fears have weighed on demand for riskier assets, with US stocks falling sharply. The tech-heavy Nasdaq 100 fell 3% last week, marking its worst weekly performance since September, while the USD fell to a four-month low.

USD and BTC decouple

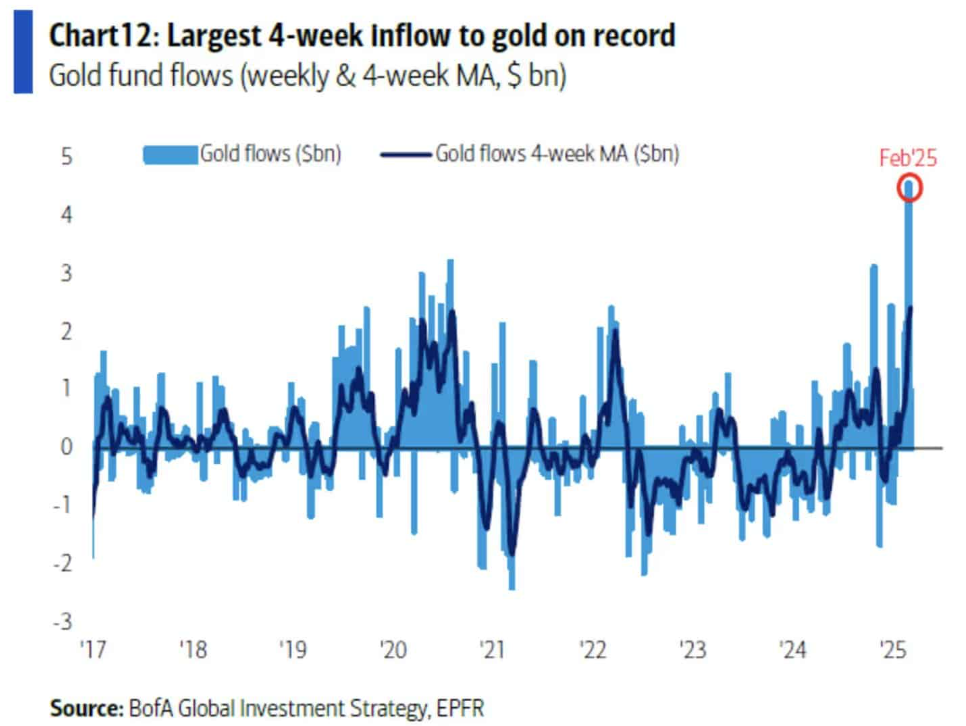

Despite the US dollar index plunging to a 4-month low, Bitcoin has also fallen, breaking its historically strong inverse correlation with the greenback. At the same time, US gold imports are surging, suggesting investors favor the traditional safe haven.

Historically, a sharp fall in the US dollar index has preceded major Bitcoin rallies. In 2017, BTC sold 87x after the XY broke below 90. In the 2021 cycle, BTC 10x’d into the peak. However, this time, dollar weakness comes as Bitcoin continues to fall, trading over 20% below its all-time high.

In previous cycles, BTC rallied on monetary easing as DXY weakened. This time, the fiscal forces are different owing to trade tariffs, sticky inflation, and fears of stagflation.

Market sentiment turns defensive

Despite the crypto summit optimism, Bitcoin strategic reserve, and bets of Fed rate cuts, investors’ uncertainty and risk aversion are mounting. With liquidity tightening and momentum fading, the odds of a BTC break below 80k are rising.

Meanwhile, Gold is shining as the preferred hedge, seeing a record $4.9 billion in inflows in just four weeks. As old correlations weaken, BTC faces increased uncertainty and volatility.

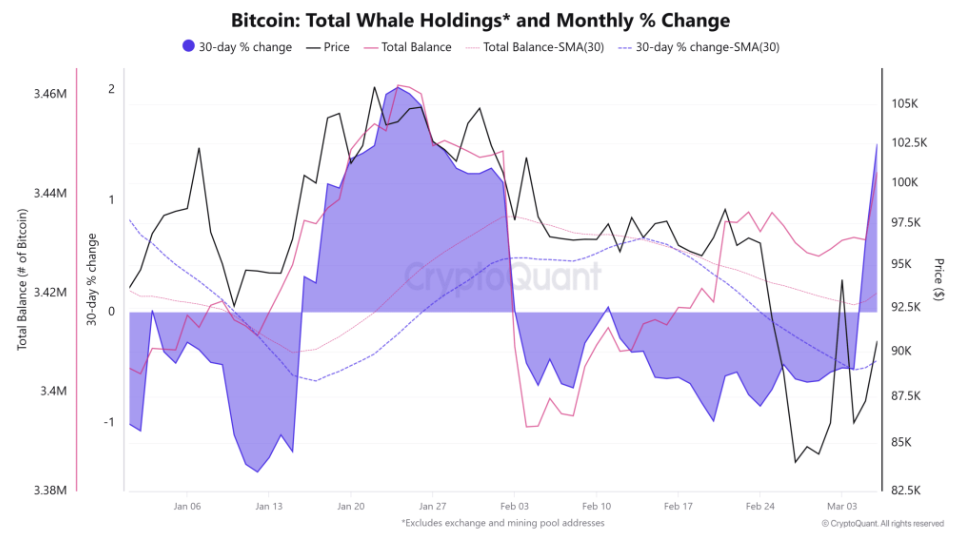

Bitcoin whales resume accumulation

Bitcoin whales have been steadily reducing their holdings for over a month, marking the longest period of net decline in the past year. However, there are signs that this trend has shifted, as whales are starting to accumulate again. This shift has pushed the monthly percentage change in whale holdings back into positive territory, indicating possible changes in market sentiment. Nevertheless, it remains to be seen whether this will fuel Bitcoin’s next rally or if it’s just a temporary adjustment.

On-chain data indicate that whales are in accumulation mode, with a 30-day percentage change of 0.7%. Historically, similar shifts in whale behavior have preceded significant price movements. When whales have shifted from selling to accumulating, Bitcoin has experienced periods of heightened volatility and, in many instances, recovery.

Should whales continue to buy aggressively for Bitcoin to attempt to break back above the 90k level.

Looking Ahead

Markers will continue to be driven by sentiment and Trump’s comments. Meanwhile, US inflation data on Wednesday could be a key driver. A hotter-than-expected CPI when growth is seen slowing considerably could fuel worries about stagflation, pulling BTC and other risk assets lower.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.