After booking gains across the previous week, Bitcoin rallied to a record high of 108k on Tuesday before slumping 14% to a low of 92k on Wednesday. The price briefly recovered above 100k but failed to hold above the key level and traded lower, around 95k, towards the start of the new week, testing 50 SMA support.

Whilst Bitcoin fell almost 5% across the week, altcoins were a sea of red. Ethereum tumbled 12%, Solana 14%, and XRP 6%. AVAX was a notable underperformer, falling 22%, while DOT fell 17% and XLM tumbled by 14%.

The market turbulence last week and, especially, Thursday’s volatility triggered $1 billion in leveraged liquidations, $844 million of which were long positions. This was followed by a further $634 million in long liquidations on Friday. Bitcoin and Ethereum were hardest hit, but altcoins were also slammed.

Bitcoin ETFs see record outflows

After 15 straight days of net inflows, Bitcoin ETFs saw their largest daily net outflow on record on Thursday. BTC ETFs saw $680 million in net outflows, eclipsing the previous record of $563 million in outflows set on May 1 after Bitcoin dropped 10% to $60k over the week. BTC ETFs also saw net outflows on Friday.

Despite recording the highest outflows on record, BTC ETFs still managed to record net inflows of $449 million across the week.

The Fed signaled fewer rate cuts in 2025

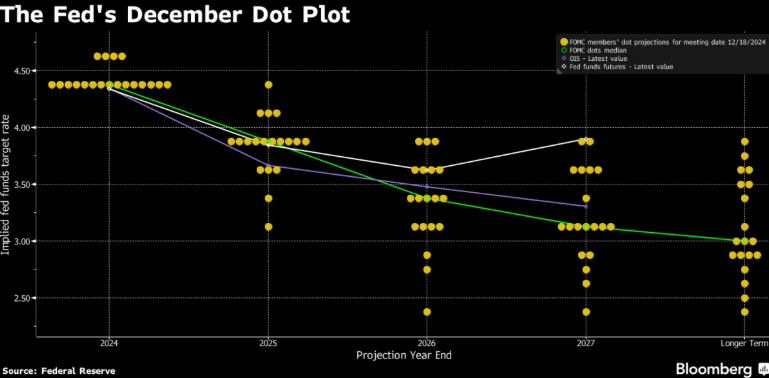

Within a day of reaching an all-time high of 108K, Bitcoin plunged following the Federal Reserve interest rate decision. The Fed cut rates by 25 basis points, which is in line with expectations, but signaled fewer rate cuts in 2025.

As laid out in its dot plot, the Fed’s latest projections pointed to just two 25 basis point rate reductions in 2025, fewer than the three previously expected. Federal Reserve chair Jerome Powell’s comments underscored this less accommodative stance, emphasising the central bank’s intention to remain cautious and measured.

The market reaction was swift and pronounced. After the Feds’ announcement, Bitcoin, viewed as a risk asset, quickly slid below the psychologically significant 100K level. Other cryptocurrencies followed suit, with many altcoins recording double-digit percentage declines and meme coins seeing some losses.

The Fed’s hawkish posture rippled beyond digital assets, pulling US equities sharply lower. The S&P 500 fell 3%.

Apart from the hawkish projection from the Federal Reserve chair, Jerome Powell, also dampened expectations surrounding a Bitcoin Strategic Reserve. Optimism surrounding the Bitcoin Strategic Reserve had surged at the start of last week, following comments from Trump, which helped the cryptocurrencies reach a record high.

The crypto market recovered from Friday’s lows after US core PCE came in slightly cooler than expected. The Fed’s preferred gauge for inflation eased to 0.1% MoM in November, down from 0.3% in October, marking its coolest level since May. On an annual basis, core PCE remained at 2.8%, defying expectations of a rise to 2.9%.

The data helped to calm fears after several months of rising inflation. Given the higher levels of liquidity, risk assets perform better in lower interest-rate environments.

MicroStrategy buys & short-term holders fuel drop & whales wait

Corporate demand for Bitcoin has remained strong despite the price declines this week. At the start of the week, Michael Saylor’s MicroStrategy announced that the company had purchased an additional 15,350 Bitcoin for around $1.5 million. This takes MicroStrategy’s current holdings to 439,000, acquired for an average price of 61,725 per Bitcoin.

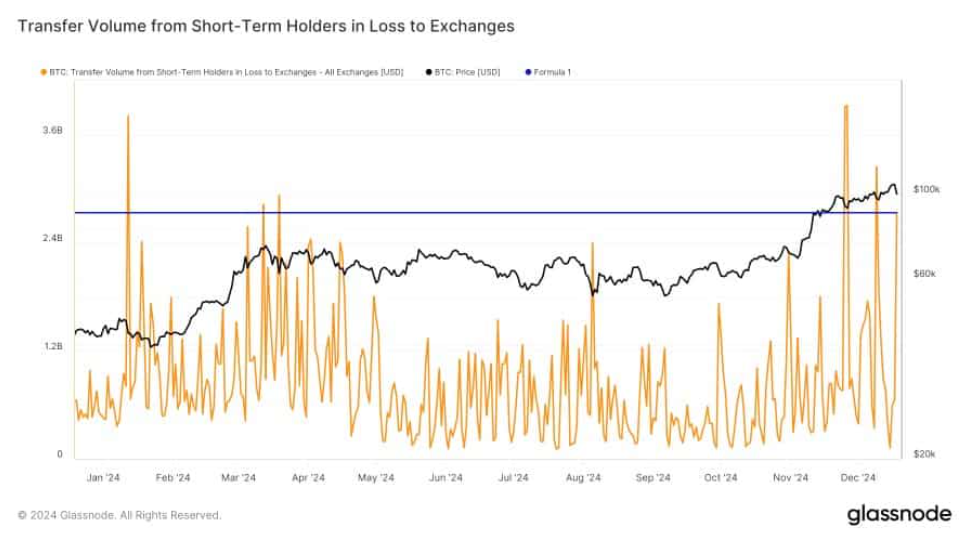

Instead, Bitcoin’s downturn could be attributed to short-term holders. The data shows this group collectively offloaded 26,000 bitcoins valued at $2.7 billion. The selloff included trades that made profits and losses, highlighting the volatility of trading activity. Meanwhile, whales are remaining primarily on the sidelines for now. Whales re-entering the market could help drive Bitcoin prices higher.

Comparison to the 2021 bull run

The recent Bitcoin price correction has been particularly painful, especially for those who invested in Bitcoin’s rally close to its all-time high. For those who invested in the past one to four weeks, a realized price of 98K means they are currently at a loss. However, those who entered between one and three months ago have a realized price of 71K.

In the 2021 bull market, Bitcoin frequently moved to new all-time highs, followed by sharp corrections before the cycle concluded. Even in the bull run, Bitcoin’s price occasionally fell below the realised price for investors holding for one to four weeks but consistently rebounded afterward, suggesting that such a correction did not signal the end of the cycle. Could this be repeated in the current bull run?

Is a supply shock coming?

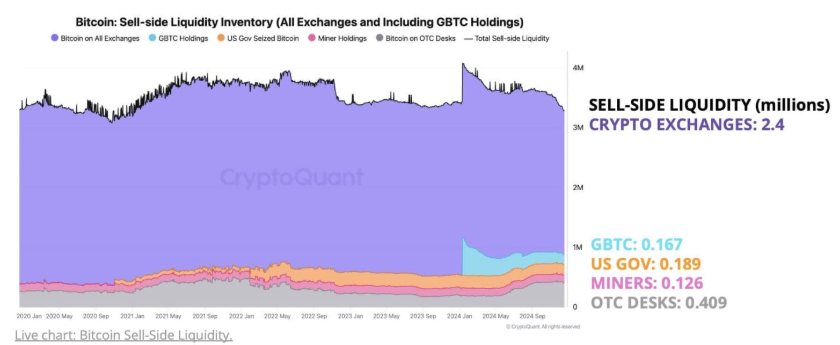

According to data from CryptoQuant, the Bitcoin market has seen a massive drop in sell-side liquidity, which could indicate a supply shock is coming. On-chain analysis shows that the amount of Bitcoin readily available for sale (sell-side liquidity) has fallen to its lowest level in four years.

The data shows that only 3.397 million Bitcoins are available for sale across exchanges, miners, OTC desks, and GBTC. This marks a huge drop of 678,000 BTC this year alone. Shrinking supply reduces potential selling pressure and creates a tighter market, particularly as demand continues to be strong.

Bitcoin demand has been steadily growing over the past few months at a monthly rate of 228,000 Bitcoin. Meanwhile, accumulator addresses that consistently buy Bitcoin and never sell any increase their holdings at a record level of 495,000 Bitcoin a month. These accumulations are becoming a significant force in the market, contributing to a liquidity crunch as more tokens are locked away from circulation. These trends point to investor confidence and bullish market sentiment.

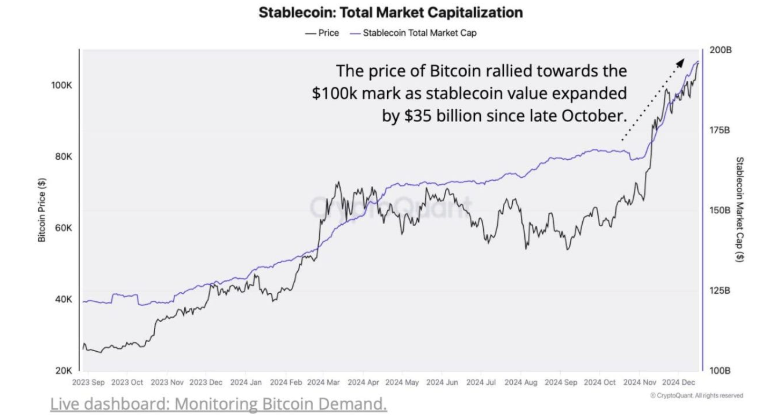

Meanwhile, according to CryotoQuant, the total market capitalization of USD stablecoins (a proxy for liquidity in the cryptocurrency market) increased to $200 billion, up 20% since late October. This indicates increased capital inflows into the crypto market, potentially fueling price increases.

Underperforming on a historical basis, but social volumes surge

Despite expectations of a supply shock, Bitcoin is underperforming in this fourth quarter compared to its previous performance. Historically, Q4 has been the most bullish for Bitcoin, with average price increases of 85% since 2013. However, this year, it’s less than 50%. Typically, Bitcoin adds around 2.8% in the penultimate week of the year, and this week, it saw a massive slide.

While Bitcoin’s Sanat rally has failed to materialize, Santiment reports show that discussions surrounding buying the recent Bitcoin dip have reached record-high levels, a sentiment last seen in April 2024. Since April this year, the price has rallied around 80%. Should history repeat itself, BTC could push significantly higher.

Week ahead

The week ahead could be quieter owing to Christmas. Volumes could be lower, and liquidity thinner, which could result in choppy trade.

The US economic calendar is relatively quiet, with only US consumer confidence, durable goods orders, and jobless claims to watch out for.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.