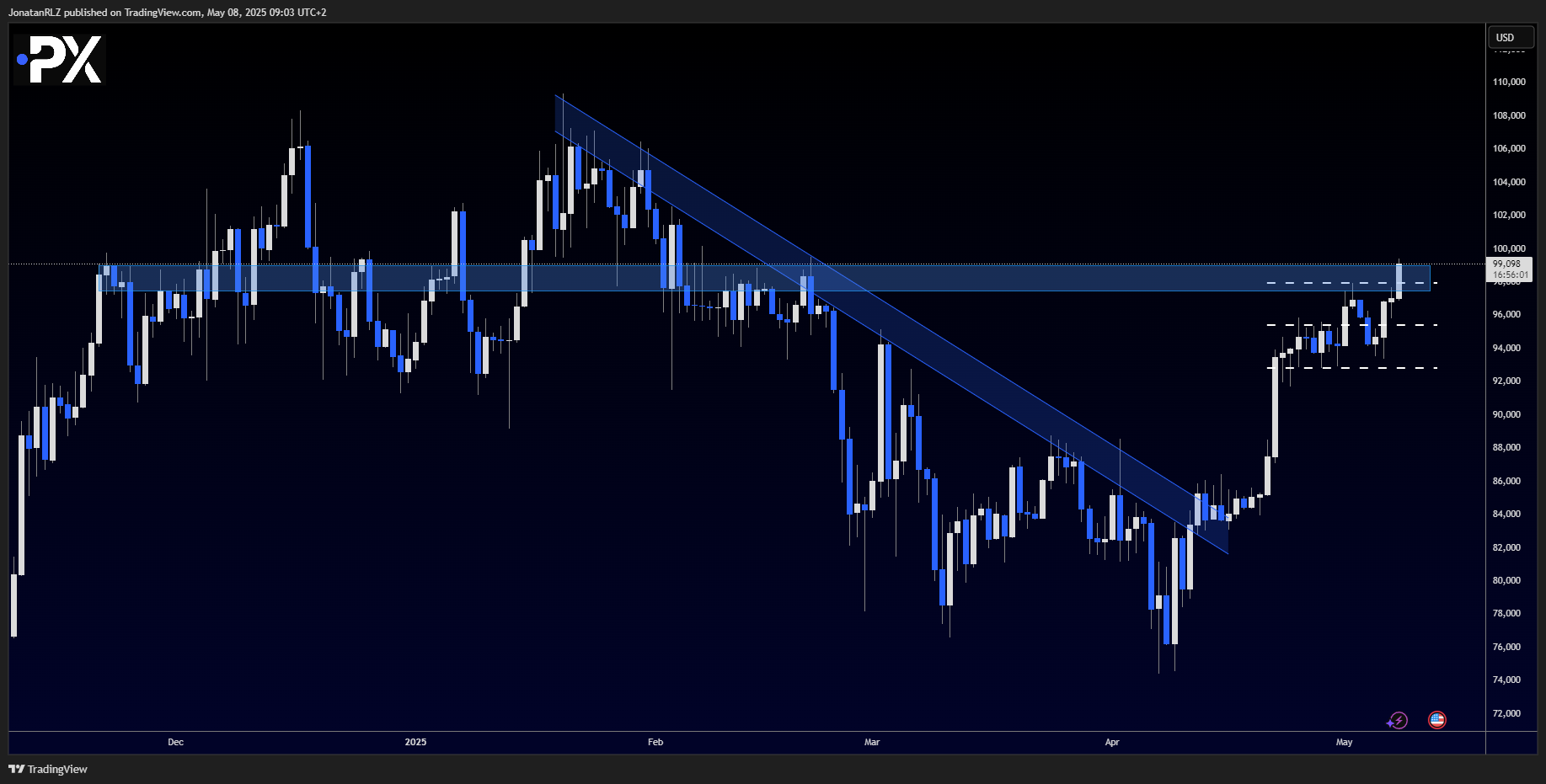

Following the FOMC decision yesterday, Bitcoin surged and successfully broke above its recent local range, where the range highs had been marked just below 98,000. This move appears to be a convincing breakout, with bullish momentum carrying price toward critical resistance.

On the daily time frame, Bitcoin is now testing a major resistance zone between 97,500 and 99,000. This is the final significant resistance area before the highly anticipated 100,000 psychological level comes into view. Traders will be watching this zone closely, as a confirmed break above could potentially trigger a strong continuation move.

Even though this looks like a convincing breakout on the lower time frames, it is important to note that the daily candle has not closed yet and price remains within a high time frame resistance area. A daily close above this zone would provide a stronger confirmation of bullish continuation.

On the 4-hour time frame, we can see a very clear breakout area just below 98,000. If price retraces to this level, bullish traders will be watching for a confirmed bounce as a potential signal for continuation to the upside and a possible breakout above the high time frame resistance.

Overall, Bitcoin is showing a healthy structure and has now recovered much of the downside move that occurred during the first part of this year.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.