Bitcoin is holding steady on Friday, staying above the 90K level as attention turns to two key events -the US Supreme Court ruling on Trump’s tariffs and the US non-farm payrolls data for more clues on the path of interest rates.

Bitcoin’s recovery at the start of the year was short-lived and quickly gave way to a selloff, which has pulled BTC over 3% lower across the past 4 sessions. Caution amid heightened geopolitical uncertainty worldwide weighed on crypto prices, along with mixed US data.

How the non-farm payroll could impact BTC

Attention is now firmly on the US non-farm payroll report, which is expected to show headline job creation was 66k in December, similar to November. Unemployment is expected to tick lower to 4.5% from 4.6%, and average hourly earnings are set to rise 0.3% MoM.

The data come after this week’s figures were mixed. ISM services were stronger than forecast, the employment subcomponent ticked higher, and jobless claims were better than forecast. However, ADP payrolls and JOLTS job openings were weaker than forecast.

Overall lead indicators suggest a potentially higher-than-expected NFP reading. This could scuttle any chances of a January Fed rate cut and call a March rate cut into question.

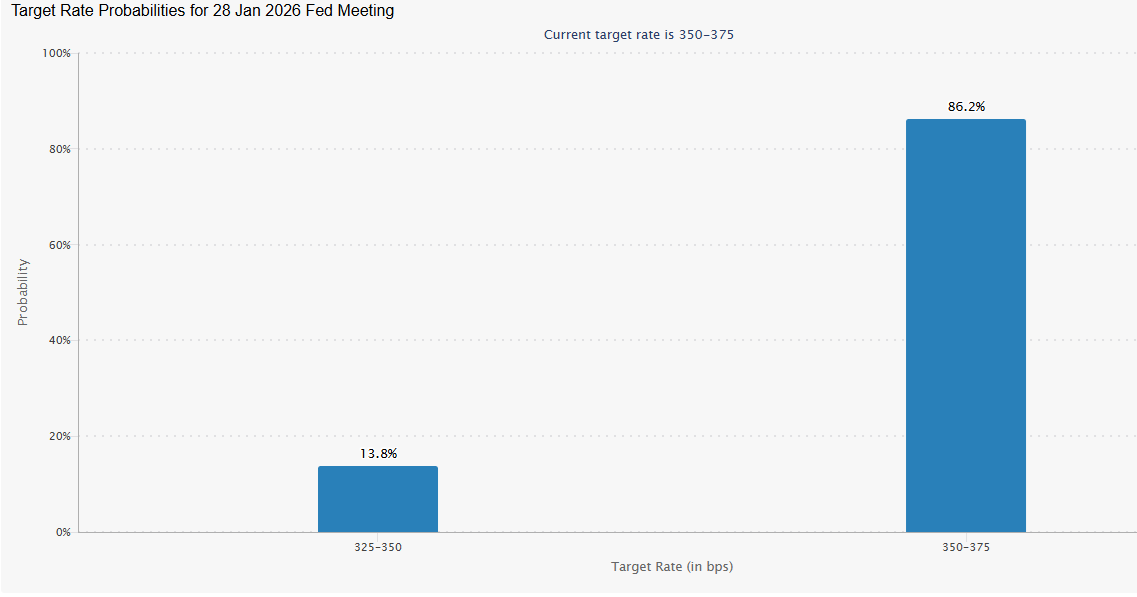

Markets currently price in just a 14% chance that the Fed will reduce rates by 25 basis points later this month, down from 21% a month ago, according to CME’s FedWatch tool. The odds of a 25-basis-point rate reduction by March are 37%.

Given that Bitcoin and other risk assets perform better in low-interest-rate environments due to higher liquidity, a stronger-than-expected NFP report could be bearish for Bitcoin. A weaker jobs report is needed for BTC to sustain upside momentum.

BTC & ETH institutional demand falters

The US spot Bitcoin ETFs had another day of net outflows on Thursday, extending their negative run to three days. According to SoSo Value, the US Bitcoin ETF recorded $398.9 million in outflows yesterday. Over the past three days, roughly $1.12 billion has left Bitcoin ETFs, nearly wiping out the net inflows generated across the first two trading days of 2026.

Spot Ethereum ETFs have mirrored their Bitcoin counterpart, reporting $159.1 million in net outflows on Thursday. Recent ETF outflows continued to reflect portfolio rebalancing and profit-taking after an initial rally at the start of the year.

US Supreme Court Ruling

The other key event investors will be watching is the US Supreme Court ruling, expected at 10 AM Eastern Time. Last April, President Trump imposed tariffs ranging from 10% to 50% on imports from countries worldwide, calling it “Liberation Day.” Today, the court will decide whether those tariffs are illegal.

According to Polymarket estimates, there is a 76% chance the court will rule tariffs illegal. If this happens, the U.S. government may have to return part of the $ 600 billion already collected from these tariffs.

Such a decision could quickly impact market sentiment, as tariffs are currently seen as helping growth while also raising inflation. A rule against them could make investors cautious, bringing volatility to both the crypto and stock markets.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.