Now that Bitcoin (BTC/USD) has finally broken above the $100,000 mark again, it’s time to zoom out and examine the bigger picture. While it’s easy to get caught up in the daily volatility or short-term market structure, understanding the long-term macro trend is essential, especially at such a significant milestone.

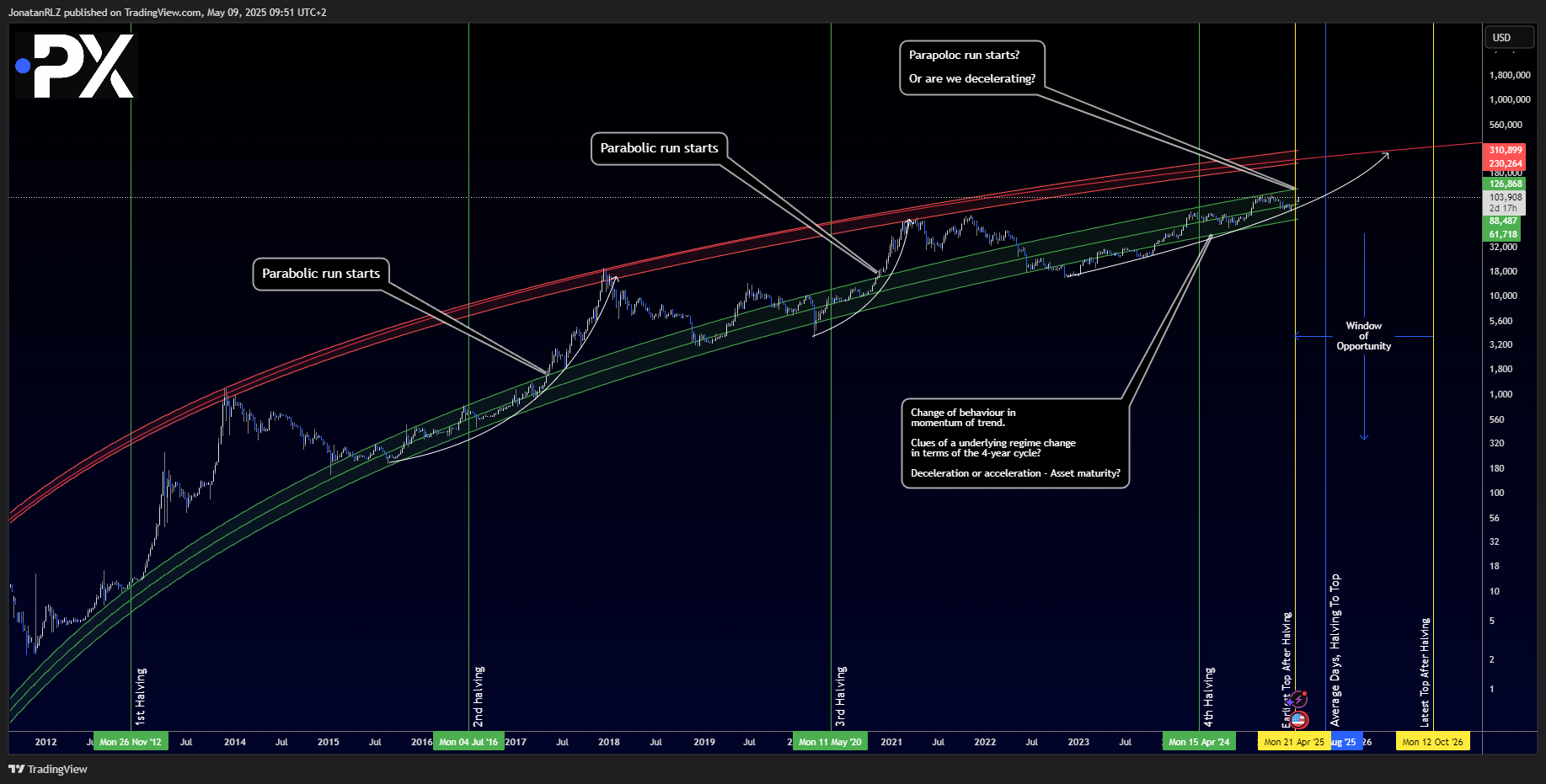

The chart we’re working with includes Bitcoin’s long-term logarithmic regression band, a tool that has historically outlined the market’s high time frame behavior. Also plotted on the chart are several key vertical lines: the green lines represent each of the four Bitcoin halvings, the blue line marks the average number of days from a halving to the following cycle top, and the two yellow lines show the earliest and latest days recorded for cycle tops in previous bull markets. Together, these form what we refer to as the “window of opportunity.”

Looking at the past three cycles, the earliest top occurred 370 days after the halving, the latest at 540 days, and the average landed at 481 days. Based on the most recent halving on 19 April 2024, this average would place a potential cycle top around 20 August 2025.

Of course, these are speculative projections based purely on historical patterns. We can’t predict the future, but we can observe that previous tops in 2017 and 2021 occurred just after Bitcoin exited the green regression zone. This kind of behavior may be repeating again now.

However, things are different this time. Bitcoin is no longer a fringe asset—it’s increasingly being embraced by institutions and traditional finance. With ETFs, broader corporate interest, and ongoing global uncertainty, we’re witnessing a shift in how Bitcoin is perceived and traded. This shift could be why the trend appears to be moving at a slower, more controlled pace compared to the explosive parabolic moves of 2017 or even 2021.

The key question now is: are we witnessing the beginning of a new type of market cycle? Has the four-year halving rhythm been altered by mainstream adoption, or is Bitcoin simply taking a steadier path toward a potential parabolic breakout?

While time will ultimately provide the answer, one thing remains clear: the macro structure is intact and looking strong. Reclaiming the $100,000 level is not just a psychological milestone, it reinforces the health of Bitcoin’s broader trend and puts us squarely back in bullish territory.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.