Digital assets have garnered significant attention in recent years, with Stellar (XLM) and Ripple (XRP) emerging as two prominent players in the field. While both digital assets aim to revolutionize international payments and financial services, there are key differences between the two. In this article, we will provide a comprehensive comparison of Stellar and Ripple, exploring their histories, technologies, use cases, token utility, regulatory considerations, communities, and future prospects.

Overview of Stellar (XLM)

XLM’s current price is $0.26876. XLM is 1.5% in the last 24 hours, with a circulating supply of 30844533313 XLM

Stellar is a blockchain platform that focuses on facilitating fast, low-cost cross-border transactions. Founded in 2014, Stellar aims to address the inefficiencies and high costs associated with traditional remittances and payments. The platform employs a distributed ledger and a consensus algorithm known as Stellar Consensus Protocol (SCP). In fact, it is that very Stellar Consensus Protocol that makes it so quick. Stellar’s native cryptocurrency, XLM, serves as a bridge currency, facilitating seamless conversions between different fiat currencies.

Stellar has gained traction in the industry due to its notable partnerships and use cases. For instance, it has collaborated with IBM to enable faster, more transparent cross-border payments for financial institutions. Additionally, Stellar’s technology has found application in areas such as micropayments, token issuance, and decentralized exchanges, further bolstering its relevance in the cryptocurrency space.

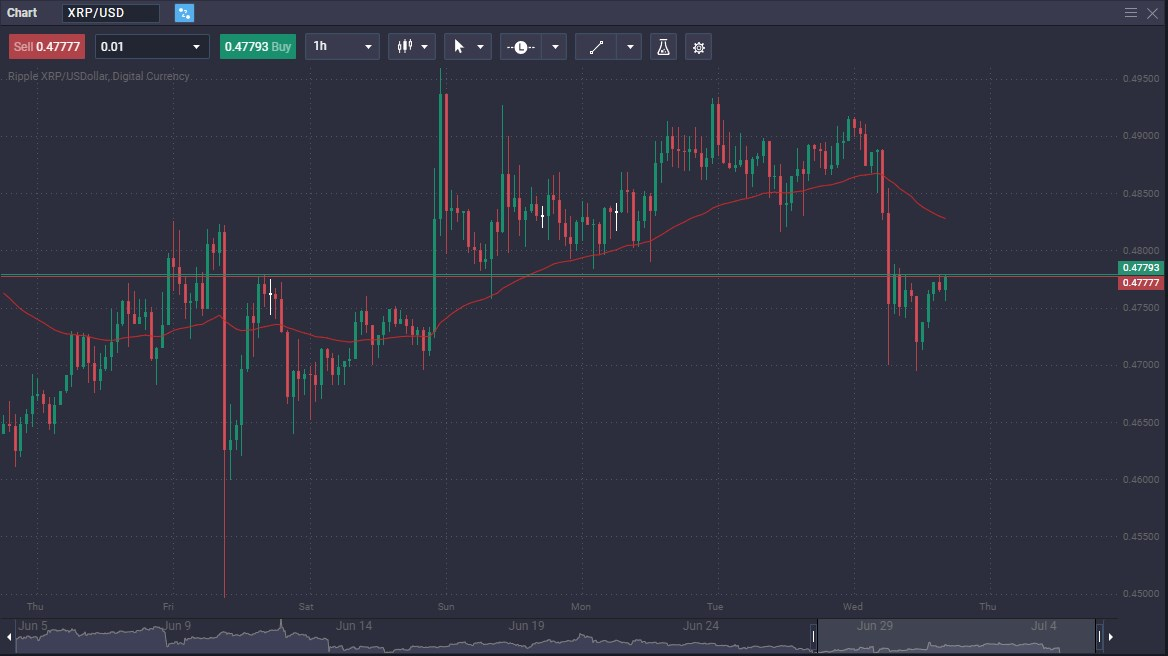

Overview of Ripple (XRP)

XRP’s current price is $2.2492. XRP is 1.6% in the last 24 hours, with a circulating supply of 58394167593 XRP

Ripple, established in 2012, aims to enable efficient global payments and remittances. It offers a suite of solutions, including the XRP Ledger and the digital asset XRP, to facilitate fast and secure transactions. Ripple’s consensus protocol, known as Ripple Protocol Consensus Algorithm (RPCA), ensures agreement among network participants.

Ripple has made significant strides in the financial industry, partnering with major banks and payment processors to enhance their cross-border payment capabilities. Its solutions provide real-time settlement, liquidity management, and reduced transaction costs, positioning Ripple as a leading player in the space.

Comparison of Key Features

To understand the differences between Stellar and Ripple, it’s crucial to examine key features such as transaction speed, scalability, security, decentralization, and consensus mechanisms.

Transaction Speed and Scalability

The Stellar platform boasts impressive transaction processing capabilities, with low confirmation times and high throughput. Its architecture enables the handling of a substantial number of transactions per second, contributing to its efficiency as a cross-border payment solution. Ripple, too, offers fast transaction speeds and has demonstrated the ability to handle high transaction volumes effectively.

Both platforms address scalability through different approaches. Stellar’s SCP allows for parallel processing, enhancing scalability, while Ripple leverages a unique feature called “federated consensus” to enable faster transaction settlement. Both Stellar users and Ripple users find the ability move tokens easier than to transfer fiat currencies over the system to be a major benefit. Both xrp and xlm can be used as digital currency, but more often than not are converted to a fiat currency such as the US dollar, and then deposited into the general financial institutions you are familiar with. Both shine quite brightly when doing international transfers.

Decentralization and Consensus Mechanisms

Stellar and Ripple differ in their levels of decentralization. Stellar aims for a more decentralized network by allowing anyone to participate as a validator. The Ripple network, on the other hand, operates with a smaller set of trusted validators. However, both platforms have taken measures to ensure the security and integrity of their networks.

SCP and RPCA

Stellar utilizes SCP, a consensus mechanism that enables network participants to reach agreement on the order of transactions. Ripple employs RPCA, which relies on a network of trusted validators to confirm transactions and ensure consensus.

Use Cases and Industry Adoption

Stellar and Ripple target similar use cases, including international payments, remittances, and financial services. Stellar’s partnerships with IBM and other financial institutions have contributed to its adoption in the banking sector. Ripple, on the other hand, has formed collaborations with numerous banks and payment processors worldwide, with a particular focus on enhancing international remittances.

Both platforms have garnered industry recognition and adoption, showcasing their potential to revolutionize traditional financial services. Both the Stellar Development Foundation and Ripple Labs are working on the adoption of payment systems to facilitate cross border payments, and business transactions in a rapid and reliable manner.

XLM vs. XRP: Token Utility and Distribution

XLM and XRP serve distinct purposes within their respective ecosystems. XLM is primarily used as a bridge currency on the Stellar network, facilitating the conversion of different fiat currencies during cross-border transactions. It also serves as an anti-spam measure, as a small amount of XLM is required for each transaction on the network.

XRP, on the other hand, plays a crucial role in Ripple’s ecosystem. It serves as a digital asset that provides liquidity for cross-border transactions. Financial institutions and payment processors can utilize XRP to facilitate instant settlements and reduce the need for pre-funded nostro accounts.

Differing Paths

In terms of token distribution, both XLM and XRP have followed different paths. XLM’s initial distribution occurred through a combination of an airdrop program and partnerships with other organizations. On the other hand, Ripple Labs holds the majority of XRP tokens, with a portion released periodically to the market. This distribution model has raised some discussions regarding market dynamics and price stability. It is worth noting that both ripple and stellar consensus protocol algorithm offer extremely low transaction fees.

Regulatory Considerations and Partnerships

The regulatory landscape surrounding XLM and XRP varies, with each project facing its own challenges and compliance efforts. Both Stellar and Ripple have taken steps to ensure compliance with relevant regulations and collaborate with regulatory authorities to promote their adoption.

SEC Lawsuit

It is worth noting that the Securities and Exchange Commission in the United States has been suing Ripple Labs, suggesting that Ripple is a security, so the regulatory concerns are still high when it comes to this coin.

Nonetheless, it should be said that the SEC lawsuit seems to be struggling to find sympathy in the US court system, and a potential settlement could be reached soon. Meanwhile, the banks and financial institutions around the world continue to look at the Ripple network as one of the most promising solutions to financial transactions. By offering blockchain technology, security, and of course speed, Ripple and Stellar lumens both are in the eye of financial institutions going forward.

Partnerships

Strategic partnerships have played a significant role in the adoption of both platforms. Stellar’s partnership with IBM has opened doors for its technology to be utilized by major financial institutions. Ripple Labs has collaborations with various banks and payment processors have facilitated the integration of its solutions into existing financial infrastructure. The ability to validate transactions rapidly continues to be a major benefit of the network as well.

Community and Developer Ecosystem

The size and engagement of the Stellar and Ripple communities have grown steadily over the years. Both projects have attracted developers, enthusiasts, and industry experts who actively contribute to the development and promotion of their respective ecosystems. Stellar and Ripple provide developers with tools, resources, and support to build applications on their networks, fostering innovation and growth.

Future Outlook and Potential Challenges

While both Stellar and Ripple have achieved significant milestones, they face challenges in a rapidly evolving landscape. Competition from other blockchain projects and emerging technologies poses a potential hurdle. Additionally, the evolving regulatory frameworks across different jurisdictions require continuous adaptation to ensure compliance.

Both projects have outlined roadmaps and plans for future innovation and growth. Stellar aims to expand its partnerships and increase adoption in various industries. Ripple continues to collaborate with financial institutions and explore new use cases for its solutions.

Conclusion: Choosing Between Stellar and Ripple

Choosing between Stellar and Ripple ultimately depends on individual needs, preferences, and goals. Stellar’s focus on decentralization and partnerships with major players in the banking industry may attract those seeking a more open and inclusive network. Ripple’s established collaborations and solutions tailored for financial institutions may be appealing to users looking for seamless integration into existing infrastructure.

It is important to acknowledge the transformative potential of both Stellar and Ripple in revolutionizing global payments and financial services. As the industry continues to evolve, further advancements and innovations from both projects can be expected, contributing to the overall growth and adoption of digital assets.

However, it is also important to realize that the world of digital assets is still a new one, and the market capitalization can rapidly change as it is still early as far as adoption of crypto is concerned. Blockchain technology continues to be a “buzz word” type of investment, and therefore investment advice should be taken with a grain of salt, and you should be careful of the potential risks in this field.

The adoption of these digital assets remains to be seen, but there is momentum. It is slower than many of the “true believers” of the decentralized network expected, but at the end of the day, the progress continues. As long as that is the case, a case for both coins in a well-diversified portfolio makes sense.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.