Slippage is a term used in finance that describes the difference between the expected price of a trade and the actual price of a trade. Slippage is possible in any market and at any time. However, slippage is often seen during extreme volatility and when you use market orders.

Large-volume orders can also cause slippage, as there may not be enough buyers or sellers at the current price to fill them. Professional traders tend to “scale into positions” when they have millions of dollars worth of an order to fill.

Cryptocurrency is especially vulnerable to slippage because the markets are extraordinarily volatile. This becomes increasingly true with smaller markets because you are also concerned with the lack of volume. If there are no buyers or sellers to match the orders, the market will automatically go to the next price that can match orders and execute.

How does Positive and Negative Slippage Differ?

Slippage can happen in both a positive and negative manner. While most people discuss slippage through the prism of losing money, there is such a thing as positive slippage, where you are a beneficiary.

- Positive Slippage – Positive slippage occurs when the price of a market falls as you enter an order. For example, if you decide to buy 1000 coins of your favorite crypto at $1, slippage could have your order filled at $0.98, making a better price for your entry.

- Negative Slippage – Negative slippage is also possible. This occurs when the price of your crypto market increases during the order process, reducing the number of coins you can buy at that price. In this example, you decide to buy 1000 coins at $1, but slippage has your order filled at $1.02, resulting in a higher entry price.

Slippage generally occurs when extreme amounts of volatility or huge orders are entering the market. It’s also important to understand that slippage is typically in small increments, such as 0.05% or 0.10%. When things become much more volatile, you can see as much as tenfold in slippage, but these situations aren’t that common.

If you are trading a larger order, slippage becomes much more critical. Slippage on a $100,000 order of just 0.10% could mean as much as a loss of $100. However, on a $100 order, it is a loss of just $0.10.

Why Does Slippage happen in Crypto?

Slippage is a function of the size of the market you are dealing with. Slippage can also be a function of extreme volatility, which crypto has plenty of. Keep in mind that slippage will be minor under most circumstances, but there are times when it can be extreme. Understand the market conditions that you are entering or exiting. Furthermore, you must understand your tolerance to slippage and its effect on your portfolio.

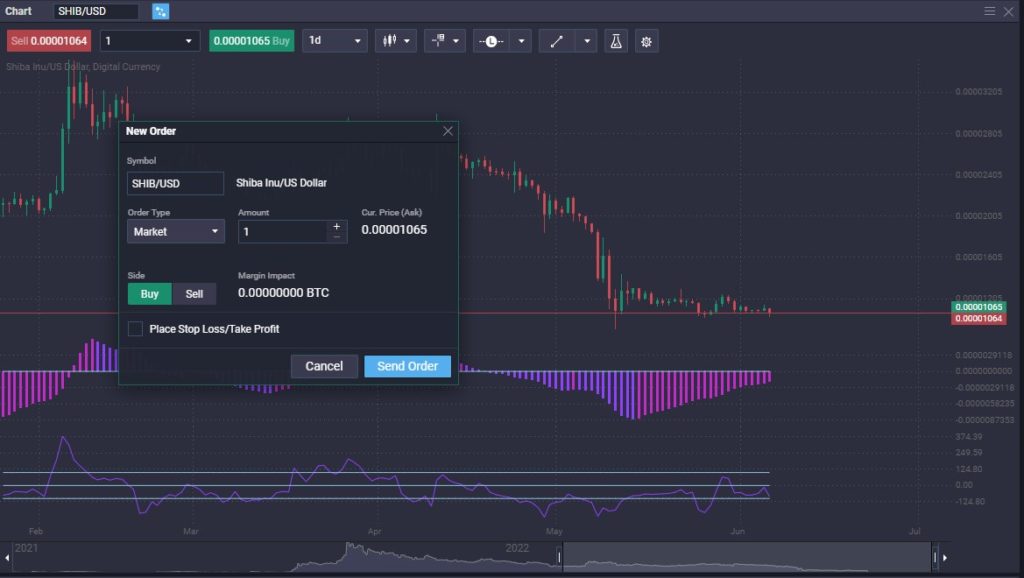

With altcoins, especially the smallest ones, slippage can cause quite a bit of variation in your returns. This is because there are not as many people trading the market back and forth. When you compare crypto markets, you can see that some of the larger markets, such as Bitcoin and Ethereum, have much less slippage than smaller ones, such as Shiba Inu.

Crypto markets behave like futures markets for commodities because there is no reference price. It’s not like trading the Euro against the US dollar because the quoted currency won’t necessarily be as stable. This is especially true when you are trading one coin against another. Remember, crypto markets are about demand and not necessarily the necessity of a transaction. (Currency markets feature speculation and hedging and some transactions necessary for cross-border payments.)

It’s also necessary to understand that as institutional money has gone into these markets, it has offered to stabilize them under normal conditions. Still, as all of the institutional money jumps out simultaneously, it exacerbates normal slippage.

Institutions leaving the market simultaneously can be especially prevalent when there is some news or a shutdown with a network. Solana has recently seen institutions dump it due to a couple of outages. In those situations, spreads can widen quite drastically, and you will see massive slippage in any transactions you try to make.

Examples of Slippage

To better understand slippage, you need to understand the various types of slippage and perhaps some of the examples you will most likely encounter in the crypto markets. Crypto is a young market, so slippage is much more common in it than in other places like stocks, but there are things that you can do to counter this issue.

High Volume Slippage

High volume slippage occurs when a massive order comes into the marketplace, looking to get filled. For example, you could see a multimillion-dollar order for Cardano go into the market. In this scenario, the trader is looking to get involved rather quickly and is willing to take whatever the market offers.

The exchange will do whatever it takes to match that order, regardless of the number of orders. This means they may have to jump to fill bits and pieces of that massive order. Not all orders will be filled at the same price when it is big enough.

In this example, you may see 20% of the order filled at $1.10, 5% of the order finding liquidity at the $1.11 level, 12% of the order finding willing sellers at the $1.12 level, and so on. This type of slippage can be avoided by “legging into the order,” and most large institutions will do this unless they are simply looking to buy and hold or exit the market at any price. You may not get the price you expect in these scenarios because a large order is triggered somewhere else.

Low Liquidity Slippage

Perhaps the most common form of slippage happens in a low liquidity environment. This is especially prevalent in small markets, as you may not be able to get filled at the price you request. Keep in mind that low liquidity slippage becomes especially vicious when you combine both a high-volume order and a small market.

Depending on the time of day, liquidity can fluctuate, so keep that in mind. With larger crypto markets, liquidity is not much of an issue, and as crypto gains popularity, liquidity should increase.

In a market with little volume, you have to use limit orders or accept that you may get a relatively large amount. It may not matter as much if it is a longer-term holding, but it can be pretty expensive if you are trading short-term.

How Do You Calculate Slippage in Crypto?

Calculating slippage at exchanges in the crypto markets requires a few equations. You need to look at the order book for all bids and ask orders within 10% of the median price. Slippage is calculated for all of these orders within this range, with the following steps used to determine the value. In this example, you would use a calculation for placing a $100,000 market buy order to give you a matter for the Ask Slippage. You can also use the same steps to find out the Bid Slippage. This may be a great way to understand your tolerance for slippage in your portfolio and which exchange to use.

First Step

Go through the assorted Asks by price level until the exchange can fill a $100,000 buy order starting from the Best Ask. If you are trying to find out Bid Slippage, you go through the assorted Bids by price level until the exchange can fill a $100,000 cell order starting from the Best Bid. You can also use different order sizes to determine how liquid the exchange is.

Second Step

Figure the Average Buy Price using all Asks that were needed to fulfill the $100,000 order. As an example, the order book could show that there are Asks at $20,000 for 2 Bitcoin and Asks at $20,100 for 3 Bitcoin so that the Average Buy Price would be calculated in the following manner:

($40,000 + $ 60,300)/6 = ~ $20,060.

Third and Final Step

You then calculate the percentage of variation between the Best Ask and the Average Buy Price as follows:

|Average Buy Price – Best Ask| / Best Ask.

|$20,060 – $20,000| / $20,000 = 0.03

How to Avoid Slippage? Things to Consider When Trading Crypto

Slippage cannot be eliminated, but there are some things that you can do to minimize the damage. Remember that crypto is a relatively young area of trading, so slippage should become much less an issue as time goes on. In the meantime, there are a few things to consider.

Entering and Exiting the Markets

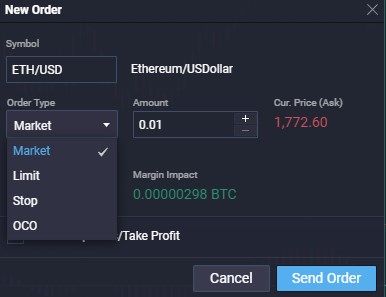

There are a few things you can do to reduce the amount of slippage that you deal with, and that is to use a limit order. A limit order tells the broker at which price the trader will enter the market.

You decide to buy Ethereum and wish to buy it at $1727. You can place a limit order to buy Ethereum at that price, and it will only get filled if the broker can facilitate the exact amount of units at the same price you set.

Unfortunately, with a limit order, you also have the possibility of an order not being filled. However, this is the only way to avoid slippage altogether. That being said, you can get filled most of the time for smaller retail accounts. Unfortunately, limits with orders do potentially have the ability to cause less opportunity, especially in fast-moving markets.

Limit Orders

There are orders you can use that can minimize or even eliminate slippage. However, each has its use, and you should understand these orders before attempting to use them in your account.

- Limit Orders – Limit orders specify a price you are willing to buy an asset. For example, if you choose to buy Bitcoin with a limit order of $22,000, you either get the price, or you don’t. If the order cannot be filled at that price, it will not trigger.

- Stop-limit Orders – Stop-limit orders specify a price your broker will trigger a buy or a sell order to either get you in or out of the market. This guarantees a specific price, but it does not ensure that the order will be filled. Using a stop-limit order to protect your account against positions against you is very dangerous. If you get slipped when your protection order is run up against, you may incur more losses as the broker will not exit the position.

- Stop-loss Orders – Stop loss orders are orders that will tell the broker to get you out of the market as soon as possible and are typically used to either exit the trade that has gone against you or perhaps collects profits on a pullback in a trade that has already been successful. However, this is the same as a “market order,” which means slippage can occur.

Don’t Fret a Little Slippage

The most important thing to understand is that slippage will happen regardless of what you do. Unfortunately, far too many retail traders focus on things they cannot manage, and slippage is one. Granted, if your broker consistently slips every order you take, that might be something to look into. However, it would help if you did not let a little slippage ruin your trading plan, nor should it be the cause of great concern.

An analogy would be that in the Forex world, the average spread between the British pound and the US dollar is quite consistently two pips. Twenty years ago, that spread was closer to 100. As retail traders piled into the markets, it created enough liquidity to drive the spreads and slippage to much lower levels. Crypto will do the same. Understand that your tolerance for slippage must be relatively high in crypto, but it should be expected, given the nature of the volatility.

Accept that Slippage Happens

Slippage happens. There are no two ways about it, and you need to understand that it is part of the cost of doing business in a volatile market. Cryptocurrency markets are relatively young, so they have more of an issue with slippage than the New York Stock Exchange. However, even on the NYSE, there is slippage at times.

Understand that this is part of the cost of doing business, and any reputable broker will acknowledge that you cannot always get filled at an exact price. However, through diligent technical analysis and money management, you should be able to overcome this issue.

Conclusion

There are some steps you can take to avoid slippage. For example, you, of course, will be looking to please limit orders wherever you can. However, it would help if you also kept in mind that a stop-loss order is used to protect your account, and therefore a stop-limit order, although preferable in its function, is not the best way to go. Your price could get skipped over, and the broker will not execute because the price is not the exact one you asked for.

By using limit orders to enter the market, you can at least eliminate slippage on the way into the market. You need to understand that volatility is both a benefit and a burden when trading crypto. Slippage is part of that necessary burden. It is not until crypto markets become more mainstream that slippage decreases. Ironically, it will also kill volatility and therefore work against many benefits.

In conclusion, never use market orders when you don’t have to, but understand that some slippage will be the “cost of doing business.”

How do you stop slippage in crypto?

One of the most important ways to stop slippage is never to use a market order. A market order tells your broker that you want into the market regardless of price. It would also help keep in mind that stop-loss orders may get triggered but be filled as a market order. Limit orders are the only way to guarantee the price you are buying or selling crypto, as the broker will either find that price for you or skip your order.

What is the slippage percentage in crypto?

Slippage of 0.05% to 0.10% is relatively common. When market conditions are extraordinarily volatile, you may see these percentages tenfold. As a general rule, the smaller the market is for the coin, the more likely you are to have significant slippage.

Is slippage good or bad?

Although occasionally slippage can work out in your favor, it is generally considered bad. Slippage can distort your results over the long term if you have backtested your system. While most slippage is minor, it can add up to a big difference over the long run.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.