Leveraged trading allows traders to control a larger position than would typically be possible by borrowing funds from their broker. Leverage refers to the proportional relationship between the nominal size of a trading position and the required deposit, also known as margin. The broker provides a short-term loan to enable traders to benefit from larger position sizes. While this can lead to significantly greater profits, it can also result in equally substantial losses if the trader lacks experience or a proper risk management strategy.

Leveraged trading enables traders to control larger positions by borrowing funds from their broker, amplifying both potential profits and losses while requiring only a fraction of the total position as a deposit

What is leverage in trading?

Leverage in finance refers to the practice of using borrowed capital or debt to take a position in a financial instrument. Borrowing funds to trade can offer significant upside potential, but it also carries risks. By leveraging capital, traders amplify both potential benefits and risks, making leverage a double-edged sword.

Leverage is most commonly used in trading markets such as:

- Forex,

- Crypto,

- Commodities,

- and other financial instruments.

The borrowed funds come from the broker and function like any other loan, typically with interest applied. At PrimeXBT, all leverage-related calculations are handled seamlessly in the background, allowing traders to focus entirely on their strategies.

Common Trading Markets: Forex, Crypto, Indices, Commodities

Understanding the Cost of Leverage: Interest and Fees

The financing for leverage typically comes with an annual interest rate calculated daily. For most traders, this results in minimal costs, especially for short-term positions. However, traders planning to hold positions long-term need to consider how interest fees might impact their overall profitability.

At PrimeXBT, these costs are streamlined, making it easy for traders to manage their positions effectively without being bogged down by complex calculations.

Leverage Trading in Action: A Real-Life Example

A prominent example of leverage trading occurred during the GameStop frenzy, where retail traders using leverage forced hedge funds with high short interest to cover their positions. The rapid increase in demand and leveraged buying caused significant losses for some hedge funds, estimated at around $20 billion.

This extreme case highlights both the opportunities and risks of leverage trading. While some retail traders achieved substantial profits, others faced losses due to the volatile nature of such trades.

How does leverage trading work?

Leverage utilizes the margin available in a trader’s account to increase the size of their positions. The leverage ratio and margin requirements vary based on the trading platform and the instrument being traded.

By depositing only a fraction of the total trade value as margin, traders gain access to significantly larger positions. However, both gains and losses are amplified, making it essential for traders to carefully calculate their risk-to-reward ratio and adhere to a disciplined money management plan.

Example: How Leverage Impacts Trading

Consider buying 10 BTC at $10,000 each:

- On a spot trading platform, the total cost would be $100,000. If Bitcoin’s price rises 10%, you’d earn $10,000.

- On a margin trading platform with a leverage ratio of 1:100, the same position would require only $1,000 in margin. The profit remains $10,000, but your initial capital exposure is significantly lower.

While the amplified gains are attractive, remember that losses are equally magnified. Using leverage responsibly and adhering to a solid risk management plan is critical for success.

Margin Trading: How Borrowed Funds Work

Margin trading allows traders to borrow funds from their broker, using their account balance or securities as collateral. For example:

- Without margin, $10,000 allows you to buy 400 shares of a stock priced at $25.

- With a 50% margin, the same $10,000 enables you to control $20,000 worth of shares, or 800 shares.

If the stock rises to $30, your profit doubles with margin. However, if the price drops, your losses also double. This emphasizes the importance of a strict money management strategy when trading on margin.

Leveraged ETFs: A Different Way to Trade with Leverage

Leveraged ETFs are exchange-traded funds that use leverage to magnify daily returns. For instance, the Direxion Daily S&P 500 Bull ETF aims to deliver three times the daily return of the S&P 500.

While leveraged ETFs offer opportunities for short-term gains, they carry high fees and are best suited for experienced traders. CFDs, like those offered by PrimeXBT, provide an alternative with 24/7 trading flexibility and customizable position sizes.

Trading derivatives

Trading Derivatives with Leverage

Derivatives such as options, futures, and CFDs allow traders to utilize leverage while gaining exposure to market movements:

- Options: Offer price action exposure for 100 shares at a fraction of the cost.

- Futures: Provide standardized contracts in liquid markets but come with risks like “limit up” or “limit down” scenarios.

- CFDs: Available at PrimeXBT, CFDs combine leverage flexibility with around-the-clock trading opportunities.

What is a leverage ratio?

What is a Leverage Ratio?

The leverage ratio defines the relationship between a trader’s margin and the total trade value. For example:

A $1,000 margin at a 10:1 ratio provides $10,000 in market exposure.

The leverage ratio varies based on market conditions, instrument volatility, and broker policies. Highly liquid markets, such as Forex, often offer higher leverage options.

| Leverage | 1:1 | 20:1 | 50:1 | 100:1 | 200:1 |

| Investment | $1000 | $1000 | $1000 | $1000 | $1000 |

| Exposure | $1000 | $20,000 | $50,000 | $100,000 | $200,000 |

What are the advantages of leverage trading?

Advantages of Leverage Trading

Leverage offers several benefits, including:

- Amplified Profits: Small price movements can result in significant returns.

- Capital Efficiency: Less trading capital is tied up in individual trades.

- Diversified Positions: Allows traders to manage multiple trades simultaneously, reducing overall risk.

When used professionally and responsibly, leverage can be a powerful tool for traders across all experience levels.

What are the risks of leverage trading?

While leverage can accelerate account growth, it also amplifies risks, including:

- Excessive Losses: The potential to lose more than the initial margin deposit.

- Emotional Trading: Inexperienced traders may over-leverage, leading to poor decision-making.

- Margin Calls: Positions may be liquidated if account values drop below required levels.

How to manage leverage trading risks

To trade safely with leverage:

- Use a leverage ratio suitable for your experience level (e.g., 1:10 for beginners).

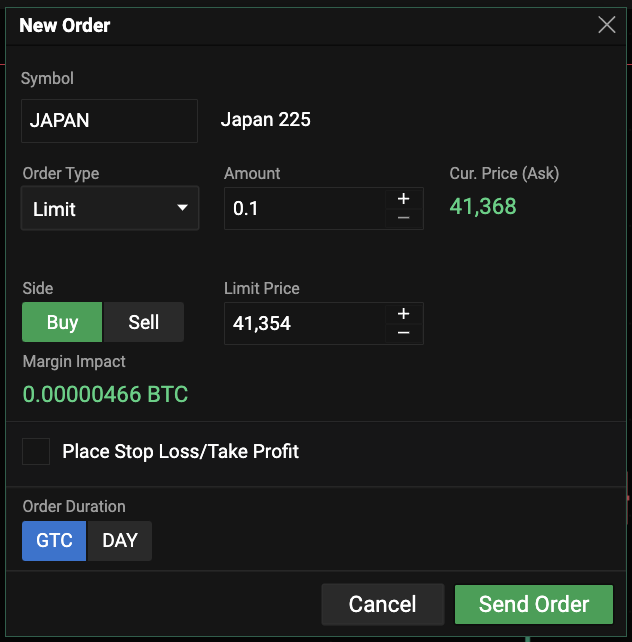

- Always set stop-loss and take-profit orders to manage your risk.

- Follow the 1% rule, risking only a small portion of your account on each trade.

Discipline, proper planning, and emotional control are essential for success in leveraged trading.

Tips for leverage trading

Before you start using leverage in your trading, there are a few tips that you may want to take to heart before risking any of your hard-earned capital.

- Make sure you have a trading plan – Having a trading plan is paramount when using leverage. You need to know when to get in, when to get out, and how much you are willing to risk before pressing any buttons.

- Define your risk – It is crucial to understand how much you are willing to risk per trade, from both a statistical standpoint and an emotional comfort standpoint.

- Know the fees and costs – before we start trading, you should understand any fees or costs involved in doing so. Keep in mind that it is part of the “cost of doing business” and does eat into your profit margins.

- Discipline – Discipline is the first thing you should think of, as without it you will surely blow up an account. You must be willing to be very rigid in your approach, understanding that emotional trading can do massive damage.

- Watch announcements – Make sure that you are aware of any announcements that could cause volatility in the market you are trading. The last thing you want is to have a sudden spike take you out of a position, only to see that it was a “knee-jerk reaction” to a headline.

Leverage Trading Simplified

Leverage trading can be very rewarding, as it allows the trader to take on a larger position than usual. By doing so, they can rapidly increase the size of their account, but it should be noted that losses can be amplified as well. This is where leverage trading gets some newer traders into trouble because it is so easy to see massive moves in profit and loss statements.

By adhering to strict money management, leverage can become one of your most powerful tools. It is imperative that you understand the risks involved and understand that there is a reward for those who use it properly. Leverage can vary quite drastically from market to market, so you should also understand how much leverage you will be using before putting on any particular position. A bit of restraint and common sense goes a long way when trading using leverage.

What is leverage trading?

Leverage trading allows traders to borrow funds from a broker to increase their trading position size. It amplifies both potential profits and risks. For example, using 10x leverage means you can trade $1,000 with just $100 of your own money.

What leverage is good for $100?

For a $100 account, conservative leverage between 1:5 and 1:10 is recommended for beginners. This limits risks while still providing opportunities for profit. Higher leverage, such as 1:50 or 1:100, can lead to quick losses if trades go against you.

What does 20x leverage mean?

A 20x leverage means you can trade with 20 times the amount of your initial investment. For example, if you have $100, a 20x leverage lets you control a $2,000 position. However, small market movements can significantly impact your account due to the higher exposure

What does 1 to 500 leverage mean?

1 to 500 leverage means you can trade $500 for every $1 in your account. With a $100 deposit, you can control a $50,000 trade. While this allows for large profits, it also increases the risk of losing your entire account balance with minor market changes.amounts of money.

What does 100% leverage mean?

100% leverage, often referred to as 1:1 leverage, means you are trading with your own money without borrowing. While it minimizes risk, it also limits your profit potential compared to higher leverage ratios

What leverage should a beginner use?

Beginners should use low leverage, such as 1:5 or 1:10, to reduce risk while learning. This approach ensures you don’t lose significant funds due to inexperience or volatile market movements.

Is leverage trading a good idea?

Leverage trading can be beneficial for experienced traders who understand market risks and have a solid strategy. However, it’s risky for beginners and those who cannot afford potential losses. Always trade responsibly and use stop-loss orders

What happens if you lose a trade with leverage?

If you lose a trade with leverage, the loss is calculated on the full position size, not your initial investment. For example, with 10x leverage, a 5% market drop could result in a 50% loss of your account balance.

Is leverage good for the long term?

Leverage can be risky for long-term trading due to overnight fees and market volatility. Traders using leverage for long-term strategies should consider costs like interest rates and focus on proper risk management

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.