The 3 Bar Play Pattern is a short-term price formation and three candle pattern used by traders to identify potential trade entries and exits. First utilised by day traders for scalping small gains repeatedly during market hours, its simplicity and effectiveness has led to wide adoption by swing and positional traders as well.

As its name denotes, the pattern consists of just three candlesticks forming specific sequences that can signal possible market moves to come. For traders overwhelmed by complex indicators, the straightforward nature of recognizing these three candle formations makes this pattern very appealing.

In particular, day traders and scalpers favor the Three Bar Play Pattern for its ability to identify quick hits in the market on intraday time frames. The compact three candle chart pattern means the entire pattern unfolds rapidly allowing these traders to enter and exit trades swiftly within the same day trading session.

Understanding the 3 Bar Play Pattern

The 3 Bar Play Pattern consists of three candlesticks forming very specific sequences hinting at potential continuation or reversals from the previous trend.

The bullish variation first candlestick starts with a strong bullish move with an unusually long candle body surging upward before consolidating in the second candle and then resuming the uptrend in the third long green bullish candle, called the trigger bar, making a new high.

Conversely, the bearish version begins with a long red candle plummeting downward, consolidating slightly in the second candle, before sellers return convincingly in the third bar breaking the low of the first candle.

Bullish vs. bearish 3 Bar Play Patterns

The 3 Bar Play Pattern comes in two variants – bullish and bearish.

In the bullish 3-bar formation, the first bullish candle shows strong buying pressure closing near its peak. The second middle candlestick then gaps up above closing price of the first candle but sells off to close around the midpoint of the first candle’s body. Finally, the third long green candle shows buyers regaining control, surging past the first candle’s high. Together, these three bars drifting higher signals a potential uptrend forthcoming.

The bearish 3-bar formation is essentially the inverse. It starts with a long red bearish down candlestick showing substantial selling pressure. The second candle gaps down below closing price of the first candle but then recovers slightly to close the midpoint area. Sellers then return with force in the third candlestick, dropping prices below the first candle’s low to signal a potential bearish trend ahead.

Advantages and limitations of the 3 Bar Play Pattern

The key advantages of using the 3 Bar Play pattern include its simplicity, effectiveness for short-term trading, and potency as an early signal for momentum. However, traders should remember it does not guarantee outcomes. Prudent risk management through stops and position sizing remains essential. Markets also evolve so traders should assess if the pattern’s edge degrades over time as conditions change.

The Three Bar Play Pattern is a continuation pattern, not to be confused with the Three Bar Reversal Pattern. Traders should anticipate a move in the direction of the first bar, not a trend reversal. The second part should be thought of as a rest bar or pullback bar, where the price action pauses to consolidate. The third candlestick is the momentum bar, which marks the resumption of the prevailing market trend from the initial bar.

How to trade the 3 Bar Play Pattern

When a clear 3 Bar Play pattern emerges on the charts, skilled traders can employ several effective tactics to profit from the expected price movements signaled by the formation. Consider this information carefully in comparison to your day trading setup before entering a long or short position.

Trade in the direction of the trend

The key takeaway from identifying a valid 3 Bar Play is anticipating the potential start of a new trend in motion. As the old trading maxim dictates, “the trend is your friend.” Therefore, the most reliable strategy is capitalising on the expected direction of the trend rather than trying to prematurely pick a top or bottom by fading or reversing it.

For bullish plays, this means executing long buys to ride the expected upswing. For bearish plays, retail traders should initiate short sells to capture the anticipated descent. By aligning trades with the emergent trend, the probability of success rises substantially.

Wait for breakouts past key levels before entering

However, rather than hastily jumping into a position at the close of the third candle, savvy traders exercise a little patience in their day trading strategies to allow the pattern to fully activate. This means waiting for a clear breakout past important resistance or support levels that validate the pattern’s projected path, or waiting for confirmation depending on the candle’s closing price.

These key levels are usually previous swing points the prices broke through initially to set up the trading range preceding the formation. By reclaiming those levels, traders get the confirmation needed to pull the trigger with greater confidence.

Use protective stop losses on trades

Once in a position after the breakout, smart traders always use stop loss orders to protect capital in case the anticipated move fails to materialise. Rather than merely hoping a pattern works out as expected, stops enforce disciplined risk management eliminating emotions from the equation.

Effective stop loss placement flows from sound technical analysis. Logical levels include previous swing lows or breakout areas that would invalidate the pattern’s signaling power upon a breach. This contains potential losses to a fixed, acceptable threshold giving the trade time to play out.

Scale out to lock in some gains

Assuming the trade progresses favorably, traders may opt to scale out portions of the position on the way up (or down) to bank partial profits while retaining exposure for an extended move. This allows balancing both risk management and maximizing profitable outcomes.

For example, if buying a breakout from a bullish 3-bar pattern, a trader may sell 1/3rd of their position after prices hit the height of the first candle’s range. The second tranche exits after tagging the second candle’s height, locking in further gains. Be sure to establish your take profit target before entering a position.

Combining the 3-Bar Play with other indicators

While the 3-Bar Play is powerful on its own, traders can amplify its effectiveness by confirming the pattern’s signals using other technical analysis indicators. Used in tandem in a trading strategy, these complementary indicators act as verifying mechanisms, giving greater confidence about the high probability of breakouts or breakdowns. Learn more about the 3 Bar Play indicator combo below.

Oscillators

Oscillators and other momentum indicators like the RSI, Stochastics, or MACD prove extremely useful in assessing stretched market conditions. For example, the market hitting overbought readings on the RSI after a 3-Bar Play breakout reinforces the sustainability and impetus behind the existing trend higher. Conversely, oversold oscillators lend credence to an imminent reversal off a bearish pattern.

Divergences can also flag that a move may be nearing exhaustion while confirming the new direction. If prices break down in a bearish pattern while oscillators are putting in higher lows, that demonstrates waning momentum that aligns with the pattern’s thesis.

Moving Averages

Beyond oscillators and volume, traders can also use Moving Averages (MAs) to confirm high probability 3-Bar signals. MAs create dynamic support and resistance zones. Analysing how prices interact with key MAs provides supplementary trade clues.

For bullish 3-Bar Plays, traders want to see the pattern breakout supported by prices crossing above key short-term MAs like the 20 or 50-day lines. Riding above these levels indicates upside momentum aligned with the pattern’s projection.

Conversely, for bearish sets ups, traders want confirmation of closes below the MAs which flip to resistance on pullbacks. This crossover selling action reinforces the downward momentum in sync with the pattern’s bearish bias.

Additionally, the slope direction of the MAs hints at overall trend bias. Uptrending lines support continuation plays while downtrending MAs align with reversal setups. Price also tends to respect MAs as support/resistance during corrections offering secondary buy/sell trigger points.

Finally, bullish or bearish crosses where shorter term MAs cross above or below their longer term counterparts signal shifts in momentum where the 3-Bar Play may emerge.

Volume

Volume indicators also provide important supplementary evidence for 3-Bar Plays. High volume surges on the breakout and follow through stages reinforce conviction in the pattern’s projected direction. Heavy trading activity signals increased institutional participation likely to push prices further.

Meanwhile, lighter volume shows a lack of commitment hinting that the pattern may fail. Analysing volume levels across key stages paints a fuller picture. Using volume alongside the signals sets up optimal trading conditions.

Price patterns

Chart patterns can add context to the 3 Bar Play. For example, if the Three Bar Pattern forms during the right shoulder of a head and shoulders formation, the probability continued downward trend increases. Keep an open eye out for such a chart pattern or price action pattern to form.

Fibonacci retracements

In conjunction with trading the 3-Bar Play, traders can further refine entry and take profit levels using Fibonacci retracement technical analysis. After spotting a validated 3-Bar breakout, Fibonacci tools can forecast the next likely upside profit target.

Fibonacci retracements identify key levels where an uptrend or downtrend may pause before continuing. These are calculated by dividing the overall trading range using special ratios like 23.6%, 38.2%, 50%, 61.8% that reflect intrinsic market symmetry.

This analysis can then highlight the next Fibonacci retracement level where prices may consolidate offering opportunities to enter trades in the direction of the prevailing trend.

Likewise, Fib levels indicate probable take profit targets where counters may stall again within the expansion leg. Using confluence around the closest profit target level on the Fib reading with the 3-Bar signal optimises trade management. This presents a rational area to lock in gains as the move exhausts itself.

In this manner, Fibonacci retracements used judiciously with patterns like the reliable 3-Bar Play create a strategic toolkit allowing traders to fine-tune high probability trading opportunities with clarity. Use Fibonacci retracement levels with other trading strategies to increase effectiveness.

Case studies: successful trades using the 3 Bar Play

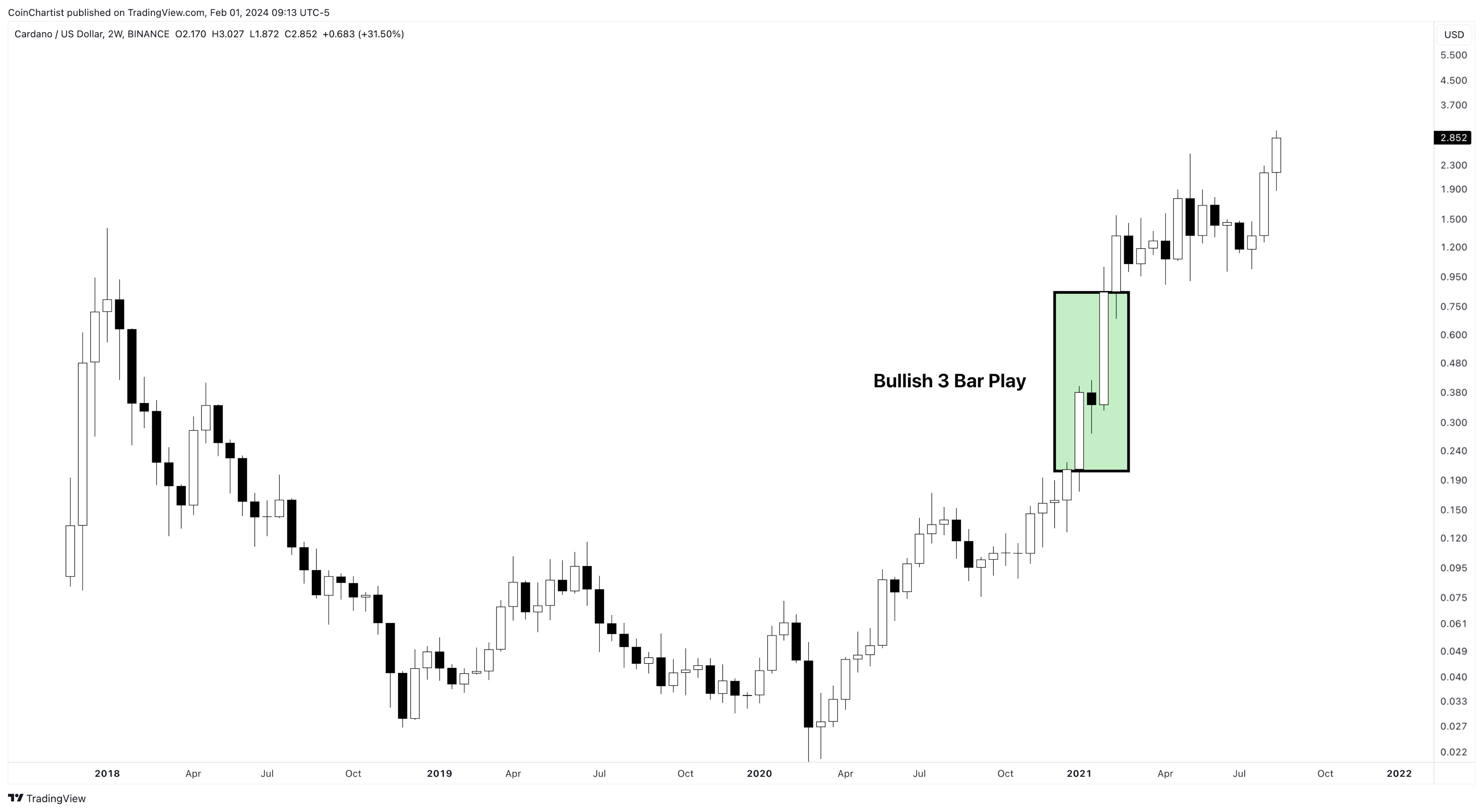

While the Three Bar Play Pattern is predominantly used for short-term trading strategies, in this winning example for the Cryptocurrency market, Cardano has formed the pattern on the monthly timeframe, leading to strong continuation.

After a large upward expansion candle during the first bar, the second candlestick is a small bearish candle, telling retail traders to watch for the three bar play pattern to form on the third candle. The final bar should be an above average sized bar, nearly the same size as the first candle. Note the pattern confirmed and several consecutive bars on the trading chart continued the bullish trend.

Potential risks and drawbacks

While the 3-Bar Play formation delivers a potent early signal for traders, overdependence on any one pattern often proves perilous for several reasons:

No guaranteed success

Firstly, traders must remember that no chart pattern or indicator provides guaranteed predictions of future price action. Even the most reliable setups fail periodically. The market’s inherent uncertainty means things can always happen unexpectedly.

Therefore, prudent risk management techniques like stop losses, position sizing, portfolio allocation and risk/reward assessment remains mandatory. Without contingency plans for when trades go awry, account balances suffer. Respect the power but accept the potential flaws in the pattern.

Fading effectiveness

Additionally, financial markets evolve dynamically so a pattern that proves lucrative now may see its edge fade in different conditions later. This holds true for the 3-Bar Play as well. As more traders adopt the strategy, its profit potential may diminish.

For example, increased algorithmic trading has shortened time horizons and boosted efficiencies reducing the chance to capitalise manually on short-term signals. Traders should monitor the pattern’s ongoing accuracy and be ready to adjust strategies accordingly if market landscapes shift.

Limited scope

Finally, while potent at signaling potential turning points, the 3-Bar Play itself provides very limited guidance on other critical trading facets – namely trade location, initial risk points, timing and tactics.

Mastering the pure pattern provides just one piece of the puzzle. Traders must still cultivate specialised knowledge and skills through rigorous practice, testing and screen time in order to determine optimal entry levels, risk management protocols and trade timeframes to profit consistently from high probability signals. No pattern trades itself automatically without applying such trading acumen.

Conclusion and further resources

The simplicity yet potency of the 3-Bar Play formation provides traders an efficient mechanism to identify potential turning points in short-term market momentum. However, fully capitalising on the pattern requires dedicating efforts into practice and skill refinement.

At the end of the day, the 3-Bar Play constitutes just one piece of the trading puzzle – albeit an important one. Employing proper risk controls and developing specialised knowledge around integrating it into a structured approach can help flip the odds favourably over time. But ultimate success lies with the trader’s discretion, execution, and risk management in trading around high probability pattern signals.

For newcomers fascinated by the pattern, further in-depth resources exist to study various nuances in even greater detail:

- Thomas Bulkowski’s respected Encyclopedia of Candlestick Charts – This mammoth reference profiles popular patterns providing crucial stats on average performance and historical outcomes during various market conditions.

- Steve Nison’s Candlestick Charting Techniques – Nison’s seminal work introduced candlestick charting to western traders outlining formulations and applications for day trading, swing trading and investing across asset classes.

- Gregory L. Morris’ Candlestick Charting Explained – Morris’ detailing of candlestick analysis focuses heavily on reversal patterns with practical insights into trading psychology and crowd behavior.

Additionally, many quality online resources from reputable trading educators exist breaking down specifics on confirming signals, chart examples and real trades using the 3-Bar and other candlestick patterns.

By combining the simplicity of patterns like the 3-Bar Play with rigorous skills development through testing, screen time, and the study materials above, traders can craft their own consistent approaches to trading markets fluidly.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.