While trading deals with a lot of numbers, graphs, and other mathematical considerations, it is at its base level quite an emotional pursuit. The idea of trading is that the trader is looking to maximize their profits by making decisions on how the market is performing, and how it will perform, but making those decisions is not always black and white.

In order to make the right decisions about trading, a trader has to master their trading psychology. Trading psychology can be understood as the various aspects of an individual’s character and behaviors that influence their trading actions.

The reason trading psychology is so important is that it can make for better traders in the same way that market knowledge and experience do. Having the trading skill and knowledge is one thing, but being governed by emotions that are not in check can lead to a misuse of knowledge, experience, and skill.

The notion of trading psychology can be outlined on a scale between discipline and risk-taking, both important parts to being a successful trader, but having a robust trading psychology leads a trader to be disciplined at the right times, and take risks when they are viable.

The Importance of Trading Psychology?

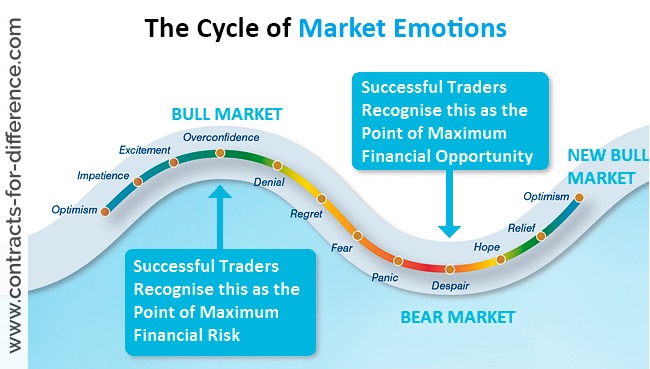

In trading there are two sides of a market — there is fear when markets are on a downward trend, and then there is greed, when the markets are rising. This ties back to discipline and risk taking in regards to the scale of trading psychology.

Trading psychology is having the ability to know when to take the risk in times of fear to maximize profits, and when to have discipline in times of greed so as to not get stuck or stung by a volatile market.

To master your trading psychology, and especially day trading psycology and to understand its importance, it is worth delving into four different types of thought effects we have when trading — emotions and moods, personality, behavioral bias, and social pressures.

Emotions and Moods

When trading, our moods and emotional state will play a big role in how we trade, and the decisions we make on a trade. It is important to note that an emotion is a chemical change in the brain and nervous system, and a mood is the state that chemical change initiates.

Different emotions can trigger different moods, and lead a trader to be fearful, greedy, hopeful, frustrated, or even bored. And, while in these different states, a trader can make entirely different calls and trades even when faced with the exact same market conditions.

Fear is one of the biggest emotions — tied with greed — that a trader has to control. To be fearful is good, as it curtails a traders desire to be too reckless in trading, but as Warren Buffet famously said: “bB fearful when others are greedy and greedy when others are fearful.”

One can see right away why it is difficult to master your trading psychology when one of the biggest rules is counter intuitive.

What Buffet means by this is that when there is a big loss in the market, most will be running for the hills and fearful, but this means there is a chance to be greedy and take a risk. At the same time, when there is greed in the market, it is often worth being risk-averse and fearful.

Other emotions, like hope, frustration and boredom also play their part and influence trades. To be hopeful can lead to chasing bad trades for longer than is necessary while boredom and frustration can lead a trader to make trades they would not normally make.

Emotional Trading

Emotional trading is one of the toughest things for traders to overcome as it is the heart leading the head, and the heart often wins. Part of successful trading involves the creation of a trading plan that forces a trader to react in a set manner regardless of the market sentiment and the fear and greed around the market.

For instance, your head and trading strategy may be telling you to sell now because the market will soon fall, emotional trading could make you hang in a little longer as the price is still rising and greed has taken over. Then, when the price does fall, and you are still in, the losses are a lot worse.

The battle between the head and the heart is something that can trip up the most experienced, and skillful trader, and something that is hard to master if you are not aware of how it plays a role in the psychology of trading.

Regret and FOMO

As the psychology of trading essentially revolves around what the influence of fear and greed have on a trader, it is also important to understand regret and FOMO. These two emotions often happen after emotional trading has occurred and leave the trader in a different mental state that causes them to trade poorly on the next attempt. If a trader is hit with emotional trading, and this leads to a bad trade that is counter to their trading strategy, they may be left with regret for being too greedy, or have FOMO — fear of missing out — for not being more risky in times of greed.

Having these lingering emotions after a trade can cause the trader to react differently the next time around. For example, if they are having regret for trading too recklessly, they may be overly cautious when they are faced with a chance to be greedy again. The same applies for a trader who has FOMO, as they can then be too greedy the next time around.

How To Improve Your Trading Psychology

As mentioned before, getting a handle on positive trading psychology means that a trader has to fight their heart on many occasions. This also makes a difference with the different types of trading because forex trading pyscology is different to cryptocurrency. This is easier said than done, but one way to improve your trading psychology is to put your head more in charge.

This means making sure that your trades are smart, rather than emotional, and that your trading plan is your go-to rather than your emotions and sentiment. To build a trading strategy is difficult, as it requires finding a method that works for the trader, as well as one that fits the market that they are operating in. It is also a multi-faceted thing as it requires the use of certain trading plans when the market is going one way, and then a change in-tact when the market reacts differently.

But, if you can reach a place where you have a strategy that works for you you will start to trust your plan more than trust your gut, or your heart. Having a trading strategy that is effective also comes with experience and skill, and the more you use your strategy, and leave your trading psychology indicators behind, the better trader you will become and the more control you will have over emotional trading.

Tips To Avoid Emotional Trading

Tip #1

Take Quality Trading Chances: There is always an opportunity to make a trade that looks like it will pay off, however, the quality of that trade, or pay off, can vary a lot. Choosing opportunities that are of quality will lead to quality results. This means that you should be looking for a trade that has a high chance of success, as well as a high pay off. You will probably find less of these, and trade more, but they will be more focused and valuable, and less ruled by mediocre emotions.

Tip #2

Don’t Watch the Scoreboard: each trade you face should be a separate entity to your entire trading game. If you are currently taking a lot of losses, and your confidence is down, this is a real chance for your emotions to dictate your trading. Treat each trade as if there is no running scoreboard or tab. Treat it as if it is your first trade and don’t let past emotions get in the way.

Tip #3

Plan the Trade; Trust the plan: As mentioned above, having a set plan on how you trade is vital to removing emotion from it. If you can follow your trading plan to a point, there will be no room for emotion. But, also plan every aspect of your trade, don’t just plan how you will get into a trade, plan what you will do if it starts taking off, but also what you will do if you start to lose so that you are ready for when this happens.

Conclusion

Emotional trading may sound like a curse, but it is still a vital part of the trading environment and rather needs the trader to master it than to hide it away. There are a number of factors to consider, and a number of issues to overcome, but emotional trading can be kept in check.

By having a plan, and being strong in your thinking and trading with your head, then your heart and your emotional side of things won’t have to affect your trading and success. In order to get your emotional trading under control, it is best to start building your plan and seeing how much you can stick to it.

PrimeXBT is a great platform to start mastering your emotional trading as there are a number of assets to trade, and different opportunities to take, which can help you perfect your trading strategy. Sign up here for a free account.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.