There are many aspects of trading that aspiring investors and traders will need to learn before taking a dive into volatile, shark-filled markets. These critical tools include fundamental analysis, technical analysis, and perhaps the most important factor of all, proper trading risk management strategies.

Charting the most accurate trend lines or peering through financial figures can only get you so far, the rest involves properly planning which assets to trade, when and at what price to enter, how large of a position to take, and where to place stop loss orders to keep losses to a minimum.

The best and most successful traders apply risk management to even their short term trading strategies, ensuring profitability and preventing losses that can lead to significant setbacks.

Those who are able to regularly implement trading risk prevention tactics will watch their capital levels grow at a steady, stable pace.

Risk Management By Through Emotional Control

Most day trading risk management strategies primarily involve careful planning across the board, in-depth research and analysis, and a strong mind, free of emotional reaction.

The first step in ensuring that emotions never get the best of any trader is to never invest more than you can comfortably afford to lose. The key word here is comfortable.

Many investors and traders only think that they’ve invested a comfortable amount, but when prices begin falling, they panic and end up selling their assets at a loss just as the price action reverses.

A strong hand and even stronger mind is necessary to hold through underwater positions, and or not get overly discouraged when experiencing losses, leading to revenge trading.

After a series of losses, oftentimes a break and reset of trading style or technique is helpful. Angrily going back to trade – called revenge trading – can lead to substantial losses, due to letting emotions get the best of you.

On the flip side, having a well-planned exit strategy and take profit level in mind when placing an order can prevent traders from holding onto a winning position too long. Taking regular profit is a risk management strategy in and of itself, ensuring profits are regularly booked.

Irrational exuberance can run rampant when traders take off in profit. It’s a good idea to practice regular profit-taking, even if it is just a portion of the size.

Risk Management By Position Planning

Before any position is even taken, traders should complete extensive fundamental analysis of the underlying asset, then review price charts and perform technical analysis to attempt to predict short term price movements and plan the ideal setup.

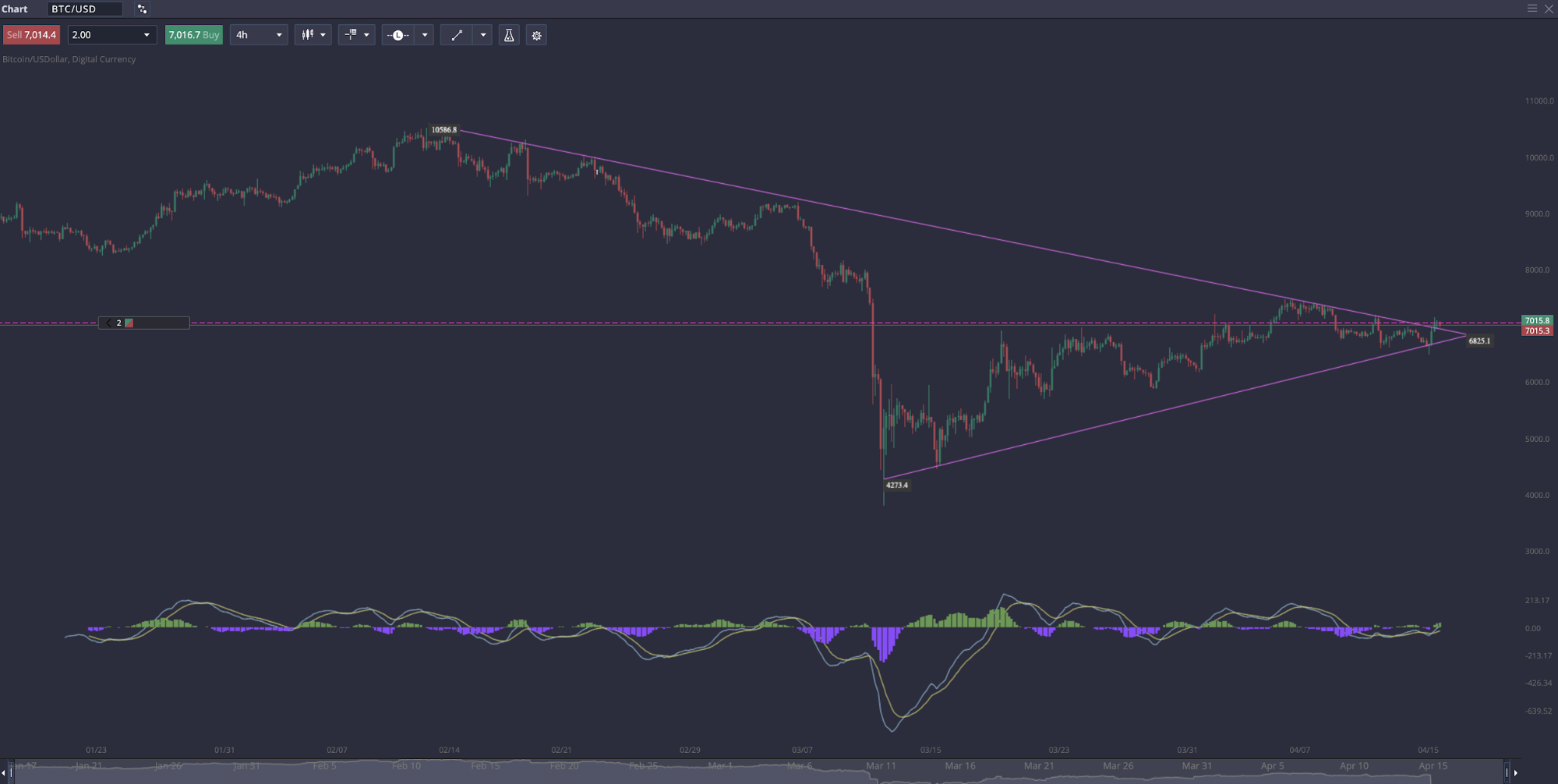

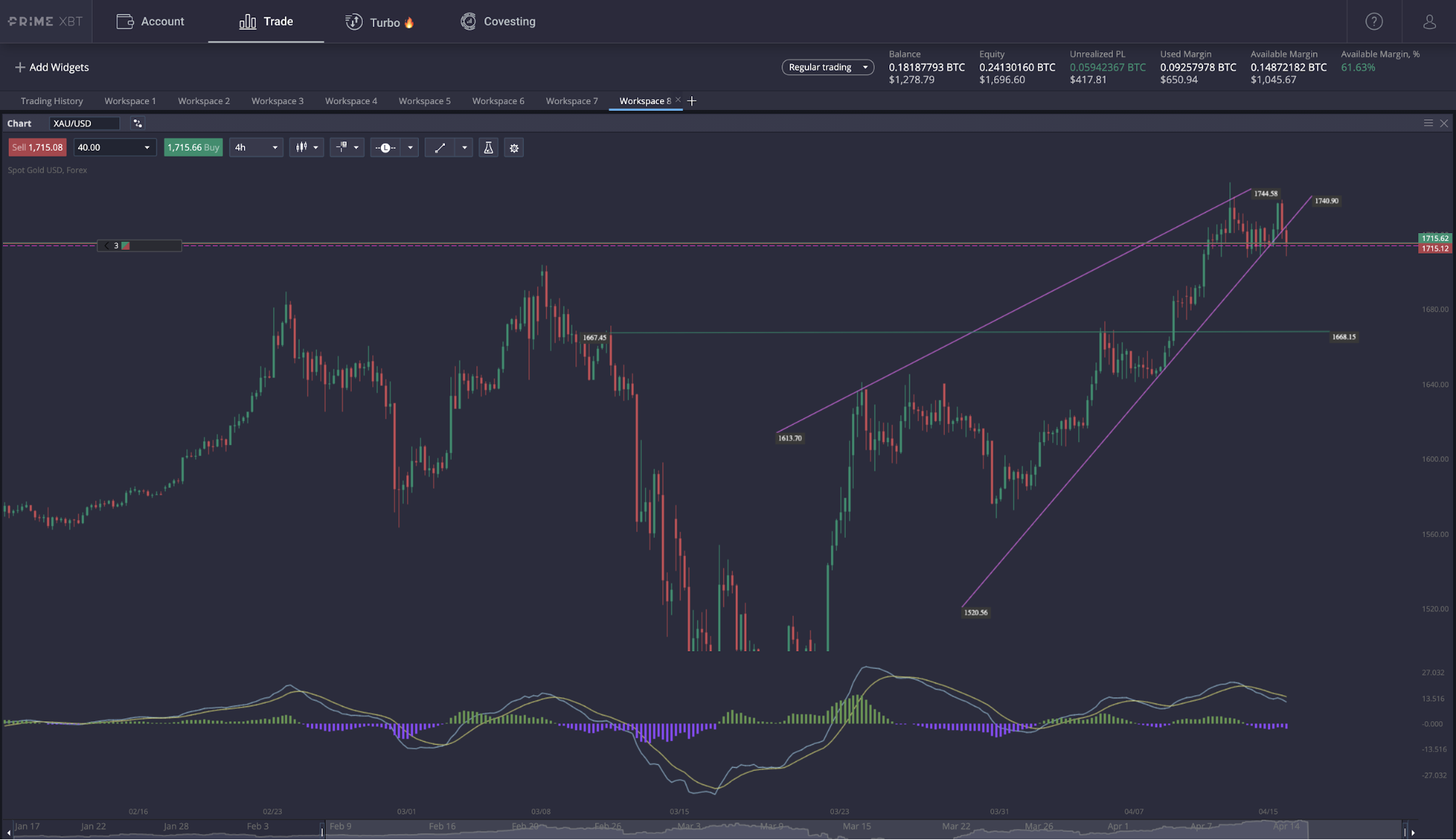

Using charting software, such as the built-in charting tools on PrimeXBT to draw trend lines and chart patterns can give traders a competitive edge, and make planning positions much easier and more effective and efficient.

PrimeXBT allows traders to place orders directly by clicking on the chart itself, for an unmatched level of accuracy when entering positions and planning stop loss orders or take profit levels.

Long orders should be placed near or at support, with a take profit level set for resistance. Short order should be taken at resistance, and profit taking done as the price approaches support.

Doing this in sequence back and forth can turn any trading range into profits while keeping any risk at bay.

Risk Management By Using 1 Percent Strategy

By following this strategy, even novices should be able to make 1 percent a day trading, by only ever risking 1 percent of an account in any given trade.

This means if the trader’s account is valued at $50,000, the maximum trade size is just $500. By comparison, this may appear to be a tiny trade, but smaller trades mean less capital is ever put at risk.

If the account is denominated in 1 whole Bitcoin, only 0.01 BTC should ever be put at risk.

This is where using leverage is especially helpful, because just 1 percent of an account can be risked, but is multiplied by a factor of up to 1000x, making the profits generated comparable to a much more sizable trade.

Leverage also vastly increases the reward part of the risk to reward ratio of the capital put at stake.

Risk Management Through Portfolio Diversification

It may sound counterproductive, but spreading capital across many different assets for a well-diversified trading portfolio has been statistically shown to reduce risk and increase return on investment.

The way it works is that by having assets that are anti-correlated or uncorrelated, no opportunities are left behind, and leaves traders less susceptible to fluctuations due to one specific asset or asset class.

Traders should look to find a trading platform that offers a wide variety of trading instruments, both offering a variety of opportunities but also to provide the best possible portfolio diversification.

PrimeXBT offers forex, stock indices, commodities and cryptocurrencies at up to 1000x leverage.

Oftentimes one of the assets listed on the platform outperforms the rest of the listings, adding credence to the theory that diversification is the best strategy for risk averse traders.

Risk Management By Using Stop Loss Orders

After assets are chosen by the trader, and they have familiarized themselves with the platform’s trading tools, along with the basics of technical analysis, it’s time to begin planning out trading strategies, and applying more advanced risk management tactics.

The first and most important is the stop loss order. Stop loss orders are designed to do just that: stop loss.

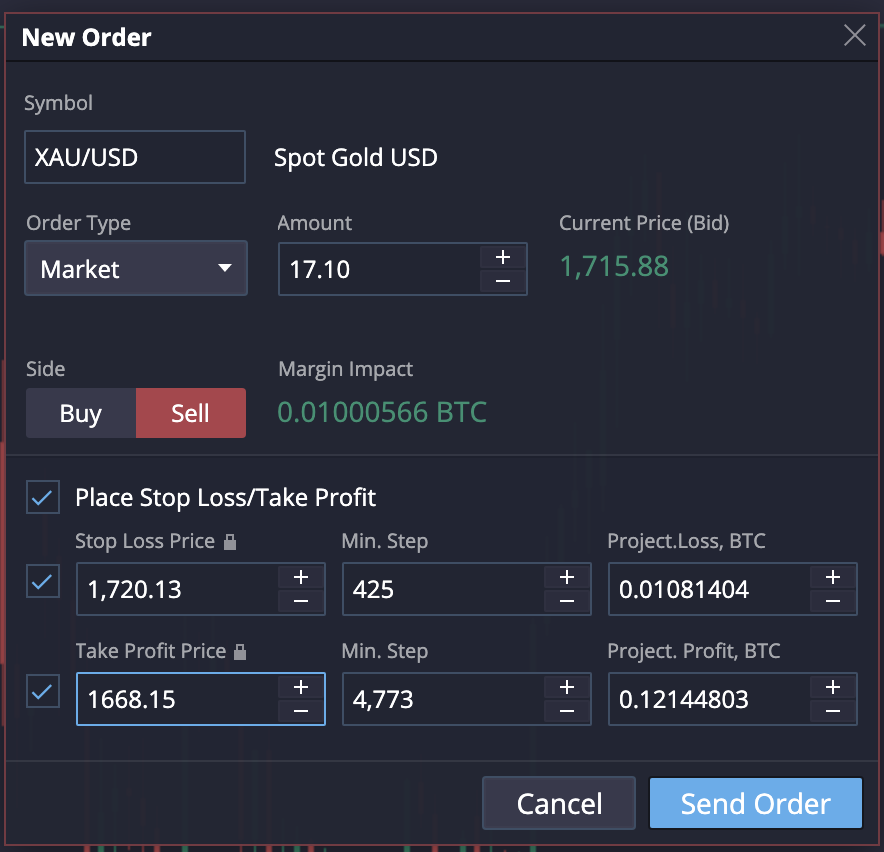

These orders are placed at certain levels, at which the traders do not want the price of an asset to fall below. Once this level is reached, the stop loss order is triggered, and an opposite order of the currently open position is made to close it out.

Traders can place these stop loss orders below support or above resistance, or beyond trend lines, to limit losses if price moves beyond the target reversal zones.

Stop loss orders can be placed on long or short orders, and some platforms, like PrimeXBT, allow traders to place stop loss orders both at the time the initial order is placed or by editing orders after the fact.

Stop loss levels can also be adjusted, and used as part of a profit taking strategy.

If a trade has performed better than anticipated, traders can move a stop loss order lower to be used as a profit-taking tactic, so if the price returns to the set level, the stop loss is triggered in profit.

Carefully placing these stop loss levels is critical to win, and is crucial to proper trade management and risk mitigation. No trade should ever be placed without one.

Risk Management Strategy Example

In this area of the guide, we are going to take you through planning a trade from start to finish in a detailed, step-by-step risk management strategy example.

Using the built-in charting tools at PrimeXBT, trend lines have been drawn to outline an ascending wedge – a bearish structure that suggests a price drop is imminent.

The trader would conservatively wait for the structure’s bottom trend line to break down to take an entry, placing a stop loss order above the price action at a desired range, depending on risk appetite.

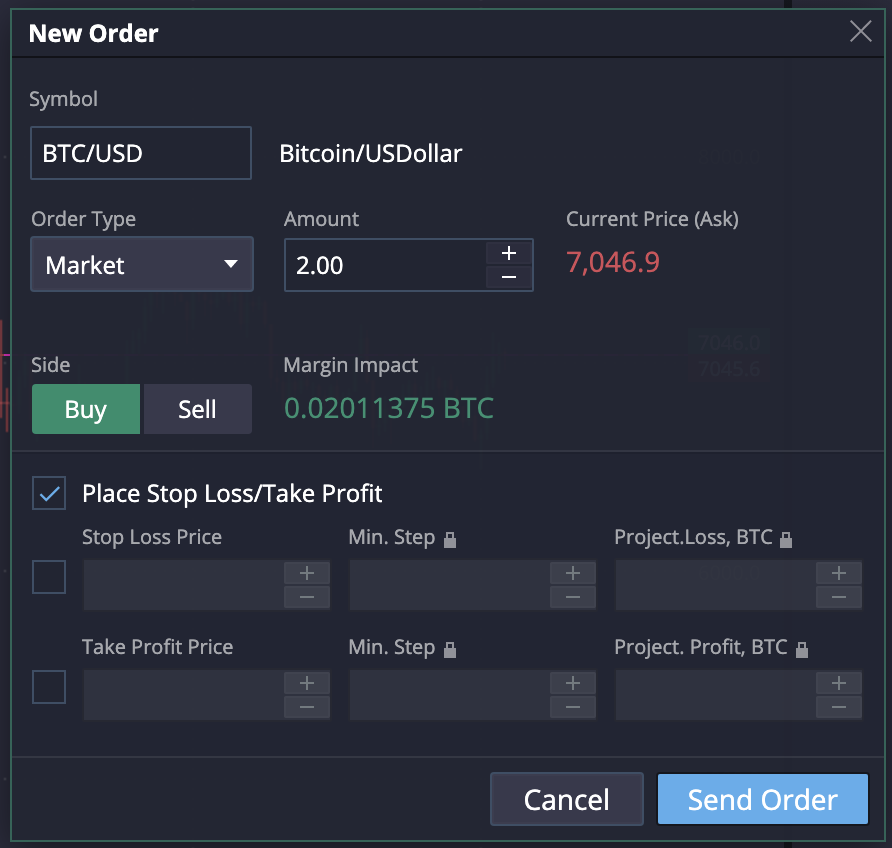

By clicking the chart itself, orders can be placed with unmatched precision. Adding a stop loss order at this time is the next step.

In this case, the trader has a balance of 1 BTC. Using the 1% method, only 1% of the account or 0.01 BTC is put at stake.

A stop loss order is placed at a level where if reached, only 0.01 BTC is lost. The ideal profit level is at least 0.01 BTC, doubling your position size with each trade. Traders can experiment with how much upside reward they want to aim for.

But remember, less is more when it comes to trading. Whether you are trading crypto, gold, forex, or stocks, securing profits is most important.

Leverage makes the size of this position much more powerful than what the capital would normally allow for, letting traders grow their profit margins quickly while preventing any substantial losses and minimizing risk.

At this point, the trader may either set a take profit order, in this case, an order residing at a previous support level, as indicated by the chart or can manually market close the order when a suitable profit level is reached.

If this is your first trade, remember to stick to your plan, and don’t let nerves get the best of you if it looks like the trade is going the wrong way. If your stop loss level was carefully selected, you should still end up in profits.

Summary: Putting These Risk Management Strategies to the Test on PrimeXBT

Risk management is just another tool that every trader needs to continue to hone, just like technical and fundamental analysis, and is critical to establishing a successful strategy and win rate.

Combining risk management strategies with a strong mind and a powerful trading platform can be a recipe for incredible wealth. But only if you are consistent, continue to learn, and use the right trading tools.

PrimeXBT features all the tools necessary to put together a thorough and sound risk management strategy that consistently churns out profits and keeps money flowing.

The award-winning Bitcoin-based margin trading platform offers up to 1000x leverage on forex, stock indices, commodities, and cryptocurrencies.

The power of leverage combined with low minimum positions sizes and deposits means very little capital is ever put at risk.

Advanced order types such as stop loss, take profit, or one cancels the other orders provide the most precision and control over entries and exits.

Built in charting tools make creating, executing, and sticking to a trading plan possible right from the platform itself.

Further lowering overall risk associated with day trading online, PrimeXBT features bank grade security, two-factor authentication, and additional security features like encryption and address whitelisting.

Registration is free, fast, and requires no personal information, so there is never any risk of private information being leaked or stolen.

Sign up for PrimeXBT today and put your risk management plan into action!

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.