Litecoin is often thought of as digital Silver and Bitcoin as digital Gold. Litecoin has many similar attributes to Bitcoin and is one of the oldest Cryptocurrencies in the upper echelon of market capitalization.

After Bitcoin took the Crypto world by storm, several altcoins came afterward that tried to prove the efficacy of digital currency and improve on what Bitcoin had set out to do. Some Cryptocurrencies complement Bitcoin, existing alongside the leading digital assets, much like silver sits next to gold. As an industry experts, we will provide insights in this article to help you determine if investing in Litecoin is a wise decision for your portfolio.

This guide will explain why Litecoin investment is wise and why any investment in Litecoin is worth it when you consider the long-term growth potential for not only Litecoin but digital payments in general. We will explain how to invest in Litecoin, the pros and cons of Litecoin investing, and much more.

Litecoin investing: what is it?

Litecoin is a Cryptocurrency token trading under the ticker symbol LTC. It has been a top-performing altcoin since its inception, created by Charlie “Satoshi Lite” Lee. Charlie Lee is a former Google employee and was an engineer at Coinbase. Litecoin launched in 2011. At one point, Litecoin Cryptocurrency was in the top ten coins by market cap. Today it has a market capitalization of $5 billion.

The Litecoin Foundation works with developing and adopting Litecoin, forming partnerships, funding opportunities, and the like. One example is in agreement with the Ultimate Fighting Championship to become the official Cryptocurrency of the UFC.

Litecoin is often a leading indicator of the rest of the Crypto market. As the community claims, “Litecoin lights the path that leads the way to alt season.” Traders will watch the price of LTC, even if they choose not to trade it. When Litecoin starts to take off, risk appetite spreads, and many smaller markets are about to have explosive gains.

The computer code behind Litecoin is almost identical to the code for Bitcoin. Litecoin has a fixed supply and a halving like Bitcoin does. This means that as time goes on, the reward for mining blocks will be smaller. Litecoin is proof of work, much like Bitcoin.

Litecoin has four times the supply of Bitcoin, with a maximum supply of 84 million LTC. Litecoin also lowered the block generation time to just 2 ½ minutes versus 10 minutes on the Bitcoin network, making it a faster solution for sending and receiving. Litecoin also offers cheap transactions compared to other coins.

While Crypto has struggled in 2023, the Litecoin market has shown that it can weather the storm multiple times. Because of this, as soon as this low is put in, Litecoin is once again a good investment for those willing to take the plunge.

Litecoin price history

Litecoin price today is trading at $72. Much like any Cryptocurrency, it performs in accordance with the rest of the Crypto market sentiment. Litecoin’s price has fluctuated dramatically over the years. Let’s take a look back at the Litecoin price chart and learn about the long-term price history.

Litecoin opening price was around 30 cents. It reached nearly $30 at its first peak, before falling an alarming 96% back to $1.10. Litecoin prices spent a couple years forming a base at an average price of around $4.

After this, Litecoin performed wildly beyond expectations, climbing more than 12,000% to over $360 at the coin’s all-time high in 2017. Litecoin’s price then fell another 94% to $20 in 2018. Since then, it has failed to make a significant new high.

Is Litecoin a good investment? How LTC price performed in 2023

Litecoin fails to perform the way Bitcoin does after its halving event, typically seeing Bitcoin rise in demand due to reduced supply. In fact, Litecoin has struggled over the last several years, seeing an average trading price between $60 and $70 in 2023. Although the Litecoin network usage and Litecoin payments continue to grow, price surges are minimal and LTC seems to still be in a bear market. It even failed to set a new significant all-time high during the 2021 bull market.

Fundamentally, Litecoin users are growing as can be seen in the growth of new wallets. The Litecoin community is stronger than ever, recently launching smart contracts. Litecoin’s potential as a token creation platform with low fees increases the chances of a positive outlook.

Investing in Litecoin in 2024? Is it a good idea?

Litecoin has plummeted over 80% over the last 12 months along with many other coins. Interestingly, we have seen this happen multiple times, but it is worth noting that Litecoin has always recovered. This does not mean that you should jump in right away, but this also does not mean that Litecoin investing is bad. Litecoin may have a substantial risk-to-reward ratio compared to other financial assets.

The Crypto markets are extraordinarily volatile. To begin with, you need to be cautious about investing too much in one shot. Much of this will come down to your investing strategy as to how much you put into the market at a time. Luckily, PrimeXBT offers Crypto Futures for Litecoin. This means you can trade both long and short of the market and with leverage. In other words, you do not need to risk massive amounts of money to take advantage of volatility.

Litecoin fundamental analysis

Developer activity continues to hold steady with Litecoin. Litecoin is often used as a testbed for Bitcoin development, so this is another reason to believe that people will still flock to the ecosystem. The close relation to Bitcoin and its limited supply makes Litecoin valuable.

Litecoin news hasn’t been as bullish, but the Litecoin project itself continues to see considerable milestones. For example, new address is hitting all-time highs, as is LTC hashrate. Although LTC’s price reacted very little to the Litecoin halving event, long term investors remain bullish and are adding to their Litecoin holdings.

Because Litecoin can process transactions very fast, Crypto investors regularly rely on Litecoin to make global payments. Litecoin also boasts lower transaction fees compared to other Cryptocurrencies. Due to this attribute, many vendors accept Litecoin payments as well.

Learn more about Fundamental Analysis

Litecoin technical analysis

Litecoin technical analysis looks like the rest of Crypto as if it’s trying to build some type of base and break out into a bull market. However, more confirmation might be necessary before going all in.

Using Crypto Futures, you can “scale into the position” with tiny increments of money, taking advantage of leverage to benefit from the swing to the upside. The time for shorting Litecoin is probably in the rearview mirror, although the price certainly can continue to fall. (The “easy money” to the downside has already been made as Litecoin has dropped over 80%, along with other altcoins.) Be certain to do your own research or seek professional investment advice before investing in any Cryptocurrency.

Learn more about Technical Analysis

Litecoin sentiment analysis

Litecoin sentiment analysis is very poor in 2023, as is the rest of the Cryptocurrency markets. Quite frankly, when sentiment becomes very poor, that is typically when the most money can be made. After all, it is often “darkest before dawn,” and that is true in all financial assets.

You can also look for the amount of social interaction on Twitter and Instagram. However, you should note that the more you see social interaction, the more likely you are closer to the top than the bottom. The exact opposite can also be true as well, for when the average retail trader has no interest in a market, it’s likely that you are closer to the bottom.

Litecoin price prediction

A Litecoin forecast using a Fibonacci retracement projects a possible target of over $2,000 per LTC price.

Litecoin price forecasts from experts

The coin has several experts jumping in to make Litecoin predictions about its price, as the volatility in the coin’s utility makes it an attractive investment.

Dan Gambardello, Youtuber and Founder of Crypto Capital Venture, is looking for a “massive run to $1,000+” after the current Crypto winter ends. Originally slated to happen sometime in 2024, he now believes it may be closer to 2027 by the time Litecoin breaks $1000.

GalaxyTrading, a well-known trading desk and technical analysis team, believes Litecoin could hit $1000 by the end of 2023, making it one of the most bullish firms.

Penguin Capital, a Crypto fund, joined the conversation suggesting that they believe Litecoin could reach as high as $2200 by the end of the decade. Keep in mind the current price of the digital currency is around $72.

Ways to invest in Litecoin

Investing in Litecoin can be done by mining or buying LTC online in a few simple clicks on a platform or exchange that offers Cryptocurrency. Once you have Litecoin, you can decide on several different ways to invest in the market. Here are some of the most common Litecoin investment strategies.

Buy and hold

Buying and holding a Cryptocurrency like Litecoin and other altcoins involves purchasing the asset on a spot exchange and moving it to a web Crypto wallet or a hardware wallet for safekeeping. Buying and holding a Cryptocurrency takes the least effort and expertise and forgoes a lot of significant risks. Whatever you pay for the Crypto is what you will be risking overall.

This type of investing can be profitable over the longer term, but one must be willing to sit through extreme volatility.

Trading

Instead of buying and holding an asset, investors can trade and try to profit from price swings. There are two main trading methods: spot trading and derivatives trading.

Spot trading involves buying an asset at low prices and selling it when prices rise. The idea is to gain as much as possible for each swing. This is how most people think about the stock market when they say, “buy low and sell high.” However, one of the major issues is that you cannot profit from drops in price. When spot trading, the best thing you can do is run to cash when markets get negative.

If a trader were to buy Litecoin at $20 and sell it at $140, it would have $120 in profit. However, when Litecoin fell back to the $20 range, they could have bought it back and still had $100 to spare.

Derivatives trading involves an alternative to spot trading that lets traders get both long and short an asset, and often with leverage, allowing the gains to be amplified. This allows markets no matter which way the market turns but also increases risk, so money management is crucial.

Using a platform like the one offered at PrimeXBT, traders could have profited from both when Litecoin climbed from $20 to $140 and again from $140 down to $20. Using 100 × leverage, the two $120 price swings and volatility could have gained the trader as much as $24,000. Clearly, you can make much more using the Crypto Futures platform.

Pros and cons of Litecoin

Investing and trading in Litecoin has been highly profitable for those who were early in the market. Several signs point to a repeat in the power of a massive breakout for the entire Crypto market, and Litecoin has shown itself to be a survivor. That being said, you should know the pros and cons of Litecoin investing.

Pros

- Transactions are much faster than Bitcoin.

- Litecoin has lower transaction costs than Bitcoin

- Has proven itself to be reliable and a survivor.

- Litecoin has had explosive returns in the past.

Cons

- Charlie Lee once sold a massive amount, tarnishing some investors’ confidence.

- Recent Crypto sentiment has been horrible.

- Halving event doesn’t have the same impact as it does on the Bitcoin network.

How much to invest in Litecoin?

Litecoin makes for an extraordinarily volatile asset, just like every other Cryptocurrency. Litecoin is divisible by up to eight decimal places, so smaller portions of Litecoin are possible to invest in and can be purchased in any increment. The more money you invest, the more potential return on investment. However, it’s important to remember that you should never invest more than you can comfortably lose.

As volatile as Crypto markets tend to be, losses will be much more uncomfortable than you may be used to. Profits are also just as shocking, so it does end up being worth the risk in the long term for those who apply sound money management.

Where To Invest In Litecoin?

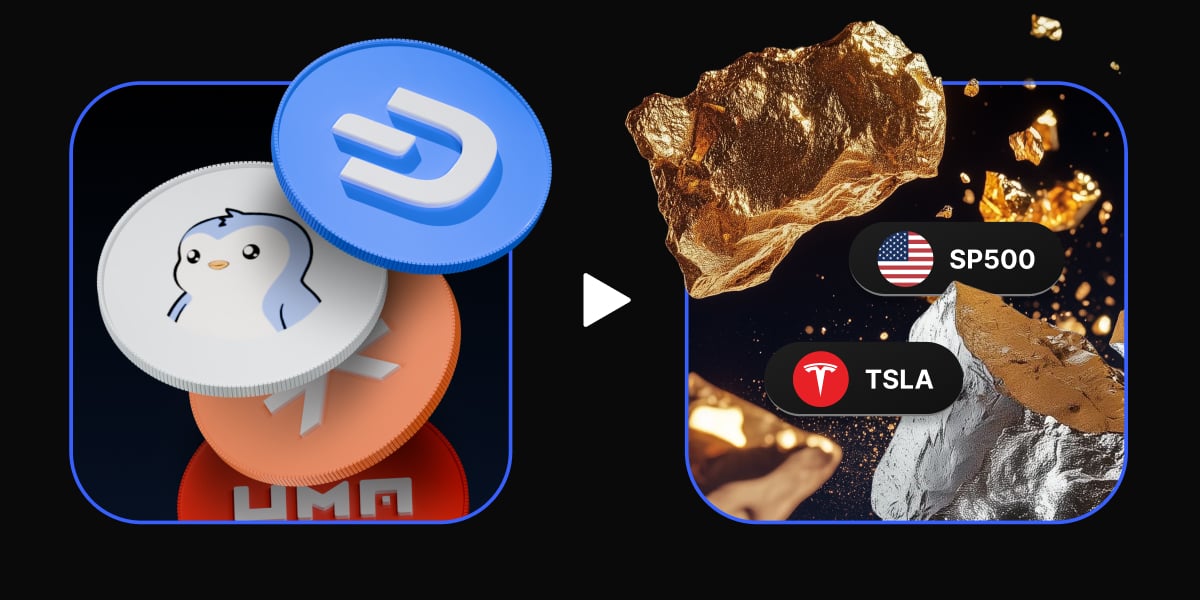

PrimeXBT is a great place to invest in Litecoin. The award-winning Bitcoin margin trading platform offers CFD markets for crypto, commodities, stock indices, and forex on one platform. Leverage and the ability to go both long and short allow traders to maximize their profit regardless of the price.

Registration is free and takes less than 60 seconds to get started. Users of the platform can either deposit a minimum of 0.001 BTC or buy Bitcoin directly from the platform offered by PrimeXBT to fund their trading account.

After the account is funded, traders can take positions in Litecoin and prepare for the next move. The platform is reliable and has a reputation for providing deep liquidity. Order execution is lightning fast, with little to no slippage. The platform also supplies technical analysis software, a full peer-to-peer copy trading module, and several other tools that make investing in Litecoin exciting and potentially wildly profitable.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.