Forex trading strategies can vary greatly, and many traders give up on successful strategies far too soon. In this article, we are going to look at the building or borrowing of a Forex strategy to get started trading the currency markets.

What is a Forex Trading Strategy?

A Forex trading strategy is a systematic process in which traders will approach the currency markets. While each Forex trading strategy will vary, a handful of things are almost always found in each one. This would include the correct variables to enter a trade, a stop-loss methodology, the amount of the account to risk on each transaction – also known as money management, and an exit strategy for collecting profits. (Although some systems don’t have a defined profit target ahead of time but prefer other indications when it’s time to get out.)

The Forex trading strategy is typically a mix of indicators or perhaps price action via candlesticks and chart patterns. The process is usually back-tested ahead of time to determine its typical success rate and whether it makes money over the longer term.

How to Develop a Forex Trading Strategy

To be successful as a trader, you need to have some trading strategy. To be successful with that strategy, you need to understand how it works and what you can realistically expect. This is part of developing a forex strategy and understanding the statistical norms.

After all, there is no such thing as a strategy that wins every trade it takes, so you first need to understand what you can realistically expect and how it may or may not typically have several losses in a row at times. This can be done by doing what is known as backtesting, simply using the strategy on historical or even live data via a demo account and recording its performance. This would include the overall gains or losses, the percentage of successful trades, the longest winning streak, the longest losing streak, the Sharpe Ratio, and many other factors.

To be comfortable with the strategy, you should know precisely how it performs. You should also understand that only some system will be good for you, even if it is profitable. After all, if you’re not comfortable with that trading, you will almost certainly underperform what the strategy could do, as you may be prone to take profits too early, be hesitant to enter trades, etc.

Effective Forex Trading Strategies

While you may eventually want to build your Forex trading strategy, most traders use a handful of basic frameworks from which to start. Remember that the following strategies aren’t the only ones available, and there are limitless variations. However, it is an excellent place to understand how traders approach the markets.

Price Action Trading

Price action trading refers to trading mainly on candlesticks and overall price patterns. The price action trader will use such patterns as flags, triangles, and rectangles. They will also look for such candlesticks as hammers and shooting stars.

The world of technical analysis is vast, but the reality is that the bare bones of it come down to price action. The market will often see areas offer to buy or sell pressure at specific levels, and price action traders will look for the need to react to specific areas with particular candles or patterns. The price action trader will use these as signals to get in or out of the needs and can even use some ways to determine a profit target.

Remember that nothing is perfect, but there is a specific “self-fulfilling prophecy” aspect to this type of trading, as many traders will use the most common patterns. The market will all jump in concert; that’s the idea. However, some people rely far too much on price action alone, betting far too much on a particular form of action, ignoring that the market doesn’t always do what you think it will. It is simply a matter of putting the odds in your favor so that you will make more over the long term than you lose.

Range Trading Strategy

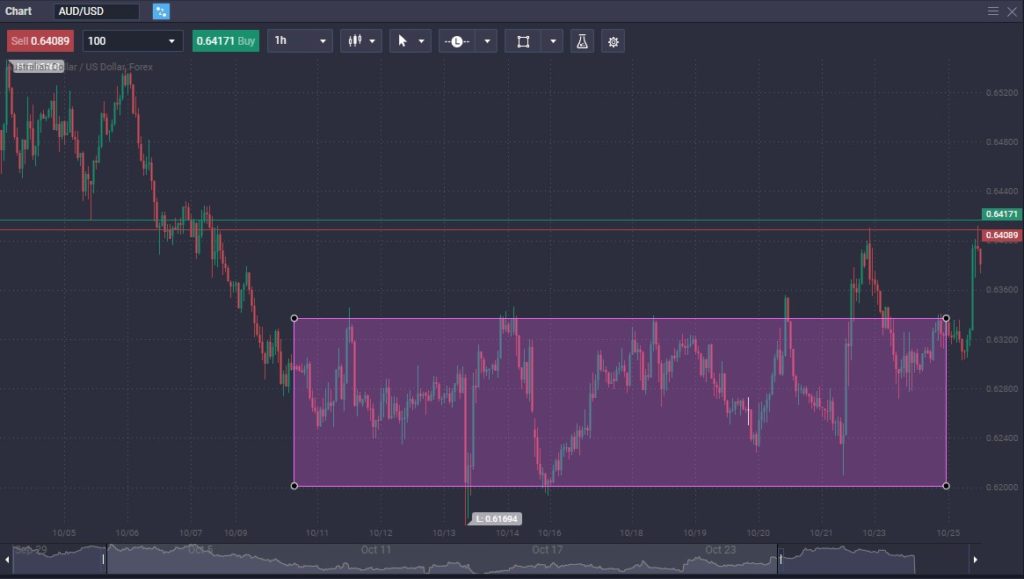

Range trading refers to trading back and forth in a predefined range. Overall, the markets consolidate over 70% of the time, so most traders have at least some rangebound trading system. These strategies often use a combination of price action and oscillators, indicators that measure potential overbought or oversold conditions. Some more common indicators include MACD, the Stochastic Oscillator, and others.

The idea is that you will trade back and forth until the market breaks out of the area. Once it does, you may lose, but if you have a handful of trades that have made money in this range along the way, you should make money over the longer term. Understanding that ranges are common, some traders use only this type of trading. However, many truly successful traders have multiple strategies for multiple market conditions.

Example of a ranging market (AUD/USD) on the PrimeXBT platform.

Trend Trading Strategy

A trend trading strategy is the best Forex trading strategy for beginners. After all, when you use a trend trading strategy, you want to correct the overall direction and hang onto the position. The variations of a trend trading strategy can differ quite a bit, but the fact is that the trader is looking to capture the more significant move.

Some of these systems can be as simple as buying when the market is above the 200-Day EMA and selling when it is below. There are also moving average crossover trend-following strategies, which can keep the trader in the market all the time, simply trying to follow the overall trend.

Position Trading

Position trading refers to the old “buy and hold” strategy most of you would be familiar with. Think of your retirement account, as it will often hold certain assets like IBM stock for years. Position trading means keeping an asset, in this case, currencies, for the long run. If a market has been trending in one direction for several months, it is common for more prominent traders to own it and add a pullback to build the most prominent position possible.

How the trader chooses to add to an already existing position, and how much to add, is the main difference between the average traders. Some will use Fibonacci retracement levels, some use moving averages, and others will occasionally add tiny positions, only adding when the market offers a “deal” because the currency has gotten cheaper.

This approach to trading takes immense patience, but it is also one of the easiest ways to trade, as it isn’t necessary to watch the markets all the time. Those practicing this kind of trading may look at the charts as little as once a week.

An astute trader could have had a long position trade for ages in GBP/JPY. (PrimeXBT charts, weekly.)

Day Trading Strategy

A day trading strategy focuses on short-term moves, getting the trader out of the market by the end of the day. The idea is to “go home flat” so that no overnight risks are involved. The catch with a day trading strategy is that traders must be comfortable with the short-term charts, which can be very noisy.

Usually, traders will use significant leverage to profit from the small moves during the day, but not necessarily as aggressively as scalping can do. This type of trading will often use 5, 15, or 30 mins charts. The main point is to be out of the market when the day is over.

Scalping Strategy

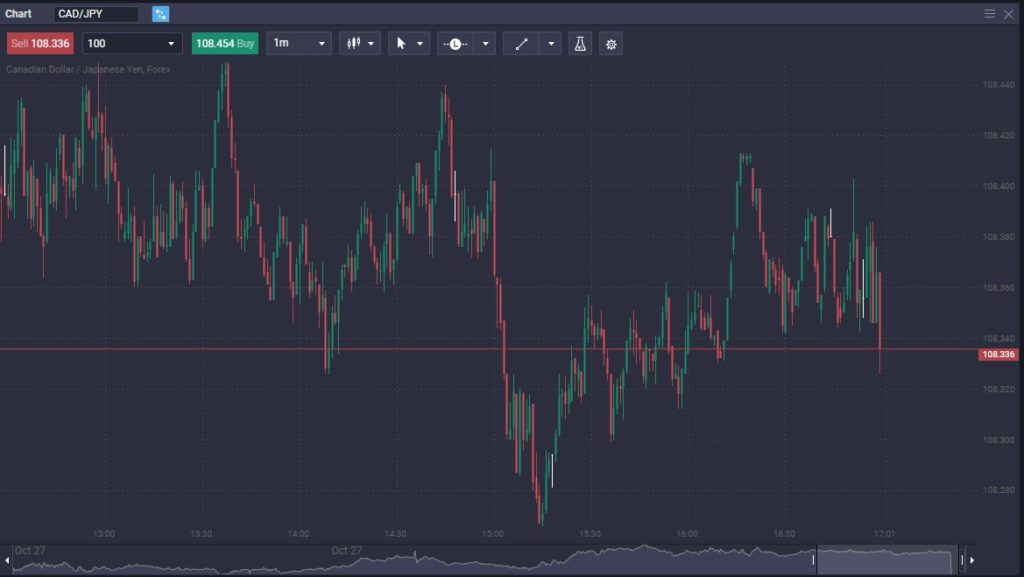

A scalping strategy is a strategy that involves ultra-short-term trading. This means you might talk for a few minutes or even a few seconds. The goal will be to take a few pips at a time, trading with momentum most of the time. Some scalpers will use indicators, but the most common approach to this type of trading is to follow the longer-term trend, trading in the same direction. The idea is to benefit from more prominent positions that don’t need to move as far. However, the losses can be devastating if you don’t get out of a trade as fast as possible.

The trick when trading like this is that the wins need to be frequent because the losses will overwhelm the victories if you are not careful. Remember, there is a spread that every trade will have to cover, so when you start a position, you are already negative a little bit. Scalping takes a lot of skill and nerves of steel.

Scalp the CAD/JPY 1-minute chart on the PrimeXBT platform.

Swing Trading

The form of trading known as “swing trading” is when the trader is trying to take advantage of the peaks and valleys in the market. The markets will swing back and forth, and the trader is looking to take advantage of the occasional change in direction.

There are also variations of swing trading that include trend following, buying in one direction only, but occasionally buying the dips or pullbacks of the longer-term trend. The swing trader, regardless of only choosing one path – which is essentially the same thing as retracement trading, something that we will touch on in a moment – or if they are trying to trade in both directions, the swing trader tends to hang onto trades for days, or even weeks to take advantage of the immediate directionality and momentum of the market.

Carry Trade Strategy

Carry trade strategies are based on the idea that interest is paid or received at the end of the trading day. This is because some interest rates in the world are higher than others, so the carry trader will buy those currencies that pay more interest while selling one with lower interest rates. At the end of the session, the “swap” occurs, with the interest rate differential being settled at 5 pm New York time. The idea is that over the longer term, money goes where it is treated the best. Hence the higher rates are so attractive. The bond market also has a part to play as the interest coupons become a reason to own the currency/bonds.

Breakout Strategy

A breakout strategy features one common characteristic, no matter what method you use: it is looking for the market to break away from a consolidation of some kind and taking advantage of the newfound momentum. For example, if a market has been consolidating in a rectangular shape for the last several weeks, a trader will take a trade once the shape has been broken above or below.

Some traders will take a trade as soon as the breakout happens, while others will wait for a close candlestick outside the previous range. Breakout strategies can occur on any timeframe and work the same regardless.

News Trading

News trading involves placing a trade based on an announcement. For example, you may wish to trade the EUR/USD pair, as there is an interest rate decision from the Federal Reserve. You believe the USD will strengthen if the Fed raises rates and trades accordingly. However, you will have to keep many factors in the back of your mind before you use this Forex trading strategy.

The first one is going to be speed. Most more prominent traders now have massive computer muscle trading in the markets. Because of this, you will be behind them. There is no way for the average retail trader to gain an edge in this situation unless the announcement goes contrary to what the market is expecting. Even then, most of the time, the trend will reassert itself soon enough. This short-term strategy takes a lot of information and experience to master, so it is certainly not a strategy newer traders should try to use.

Retracement Trading

Retracement trading, or “pullback trading,” is taking advantage of the overall trend but looking for value. For example, if you are trading USD/CAD in an uptrend, you are looking for the market to drop back to buy cheaper US dollars. Many traders use this strategy, paying attention to a few Fibonacci retracement levels, such as the 38.2%, 50%, or 68.1% levels. Many traders will look for price action to confirm the status and offer support, like a hammer on the pullback.

Grid Trading

Grid trading refers to placing orders above and below a specified price to take advantage of range bound conditions. This opens the possibility of many small trades in a choppy environment. The trader will set the buy and sell orders with the idea that the market will hang around the same general region.

Think of this type of trading as “reversion to the mean” trading. This means the market gets too far from the “anchor price” and returns. Some traders will also use something like this in trending markets, essentially the same as adding to existing positions, buying in one direction only.

Conclusion

There is no one way to trade. One of the biggest traps that new traders fall into is looking for the “Holy Grail” system, one that never loses. Unfortunately, there is so much noise and hype around trading that most people don’t understand that much work is put into being a successful trader. In this article, we have looked at 12 of the most common kinds of trading, and this should give you a start on what you are looking to do.

You should also understand that just because a strategy makes money doesn’t mean it is for you. You are best left alone if uncomfortable with a specific approach. This is because many traders will cut winners too short, fail to take trades, and generally fail to execute the system how it is meant to be.

This means that you will have to figure out what kind of trading is the most comfortable for you and then practice with it to see how it should perform over the longer term.

The process of learning the ins and outs of a system is called backtesting, which is running the system through historical or even live data to determine how it should perform and what you should expect as far as a win percentage, string of losses, and total return.

Most traders will pick a general framework like the ones listed in this article to start. At that point, they will often look to “tweak” the system with changes to see if they can improve it or maximize the system’s best parts and minimize the losses. Remember that none of these are plans that are “written in stone,” so if you find that adding or subtracting an indicator – that’s perfectly fine. It is the results you achieve that matter.

One part of the testing process for a system that you should remember is the difference between position sizing and results. While a system may have a 90 percent success rate, if the position sizes are big enough and the trades taken for profit aren’t, this can lead to a system like that losing money. Make sure you test the system for optimal trade size as well. This is where a lot of retail traders fail.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.