There are as many ways to trade the Crypto market as there are stars in the sky. From the classic Hodl strategy, where investors buy Crypto assets and hold them as long-term investment to the dollar cost average strategy that invests a certain amount at . Others use swing trading strategy which involves holding Crypto assets for more than a day or even a few weeks in anticipation of an increase in value, with the goal of committing profitable trades.

Day trading Crypto is similar to the swing trading strategy, with the main difference being that all trades are opened and closed within a single day (or potentially two days, depending on the market’s and asset’s movement). When talking about “traditional” assets, which are listed or offered on markets that have opening and closing hours, all trades are opened and closed within those hours or what is called a single trading day.

This type of trading strategy seeks to take advantage of smaller, frequent price increases or drops (if you are “shorting” the Crypto assets you are trading) instead of longer-term and more significant price movements.

In fact, day trading Crypto is an extremely popular strategy that seems to be tailor-made for the Crypto market which experiences multiple rapid price movements throughout a single day. Just keep in mind, being flexible is just as important as being disciplined when trading.

Markets can be unpredictable, and you should be able to adjust your strategy on the fly within your risk tolerance using technical analysis you may have performed previously.

Key takeaways

- There are many Crypto trading strategies you can choose from.

- Day trading Crypto is similar to swing trading but assets are held for only one or two days.

- The strategy can be used for both when buying and selling an asset, allowing you to take advantage of both price increases and drops.

- Being flexible as market conditions change can increase the possibility of successful day trading.

What is Crypto day trading?

Day trading Crypto is a trading strategy that involves opening and closing all your trades within a period of one or two days. The goal of this method of trading is to take advantage of short-term price fluctuations.

There are a few reasons why this strategy is so popular. First, it is generally considered less risky than taking a larger position and waiting for a larger price movement or using leverage, which can amplify both positive and negative movements. Here you buy low and sell high, or short an asset’s price hoping it will drop. Second, it seems perfect for the Crypto market, which sees high volatility and high liquidity, allowing for rapidly executed transactions.

Additionally, it’s easier to create short-term technical analyses. Price forecasts on a more extended time frame can be affected by unanticipated events or microeconomics being “priced in” after they happen. But when you are day trading Crypto, although you can put together a decent technical analysis, you also need to closely watch market movements, the market sentiment and be ready to act almost immediately when market trends change.

And they change rapidly when talking about Cryptocurrency market which is characterised by its high volatility. Of course, when day trading Cryptocurrencies, highly volatility means more opportunities, as you are depending on changing market trends to open and close your trades in profit.

Navigating Crypto markets: essential tools for success

First, knowledge is one of the most powerful tools Crypto traders have at their disposal. From simply knowing where to look for Crypto market updates, news and discussions, to knowing what potential policies are being discussed and covered in the news that might affect the Crypto market.

The ability to put together a short-term technical analysis can also be useful when day trading Crypto, as it will give you specific prices to enter and exit trades, in addition to your maximum market exposure.

To achieve all this though you’ll need a few tools:

- Technical analysis tools: platforms like PrimeXBT‘s offer a wealth of technical indicators, order books (which can reveal market sentiment), the ability to draw chart patterns and see graphic displays of stop loss and take profit orders.

- Trading software: this can either be integrated with your broker so you can trade from it, or used independently to create and maybe even share your technical analysis.

- A news aggregator, live feed, or news apps specific to the Crypto market: being informed of any breaking news can help you both avoid risk and take advantage of the potential moves the news might cause.

- Cryptocurrency market communities: numerous apps allow Cryptocurrency traders and investors to talk with each other, share strategies, ideas, price charts, and price predictions.

Which Crypto coin is best for day trading?

Any Cryptocurrency that moves frequently throughout the span of single day is a great choice. The problem though with smaller alt-coins, is liquidity or the amount of traders buying and selling at any given time. Although less liquid Cryptos may see bigger price moves, finding someone to buy what you are selling when the time comes might be challenging. Additionally, unlike Cryptos with more liquidity, low liquidity Cryptos may be easier to price manipulate.

Going with the “Big 3” (or the Cryptos with the three highest market caps) i.e. Bitcoin, Ethereum and Solana (or Tether on occasion), should make this less of a risk, since they have very high liquidity, large market caps and significant coverage even in the mainstream media.

Crypto exchanges vs. brokerages: making the right choice

When day trading Crypto, fees are your biggest enemy. This is because your strategy is based on opening and closing multiple trades throughout the span of a single day. Depending on who you are trading with each of these transactions may carry a significant fee.

For example, on the higher end of fees, certain exchanges can charge you as much as 0.6% for takers when buying, selling or even converting Cryptocurrencies.

PrimeXBT offers fees that start around 0.01% for makers and 0.02% for takers on many popular Crypto Futures, or 1/30th the amount you’d pay on an exchange. When you make dozens of transactions in a day that can add up quickly.

Crafting your Crypto trading strategy

There is no such thing as quick profits. That being said, a trading strategy can help you when you are day trading Crypto so your overall session is profitable. Although day trading does describe a way to trade, this strategy can be broken down into other types of trading; scalping, high frequency and range trading.

What is scalping?

Scalping is a strategy used when day trading Crypto. You essentially target multiple small gains, that by the end of your day add up to significant profits.

The idea is to seize small incremental price movements as buyers and sellers battle it out throughout the trading day. This method of trading requires you to hawk the markets, watching closely every little jump and drop.

But at the same time it is arguably one of the most exciting and action-packed way to day trade.

Range trading strategy

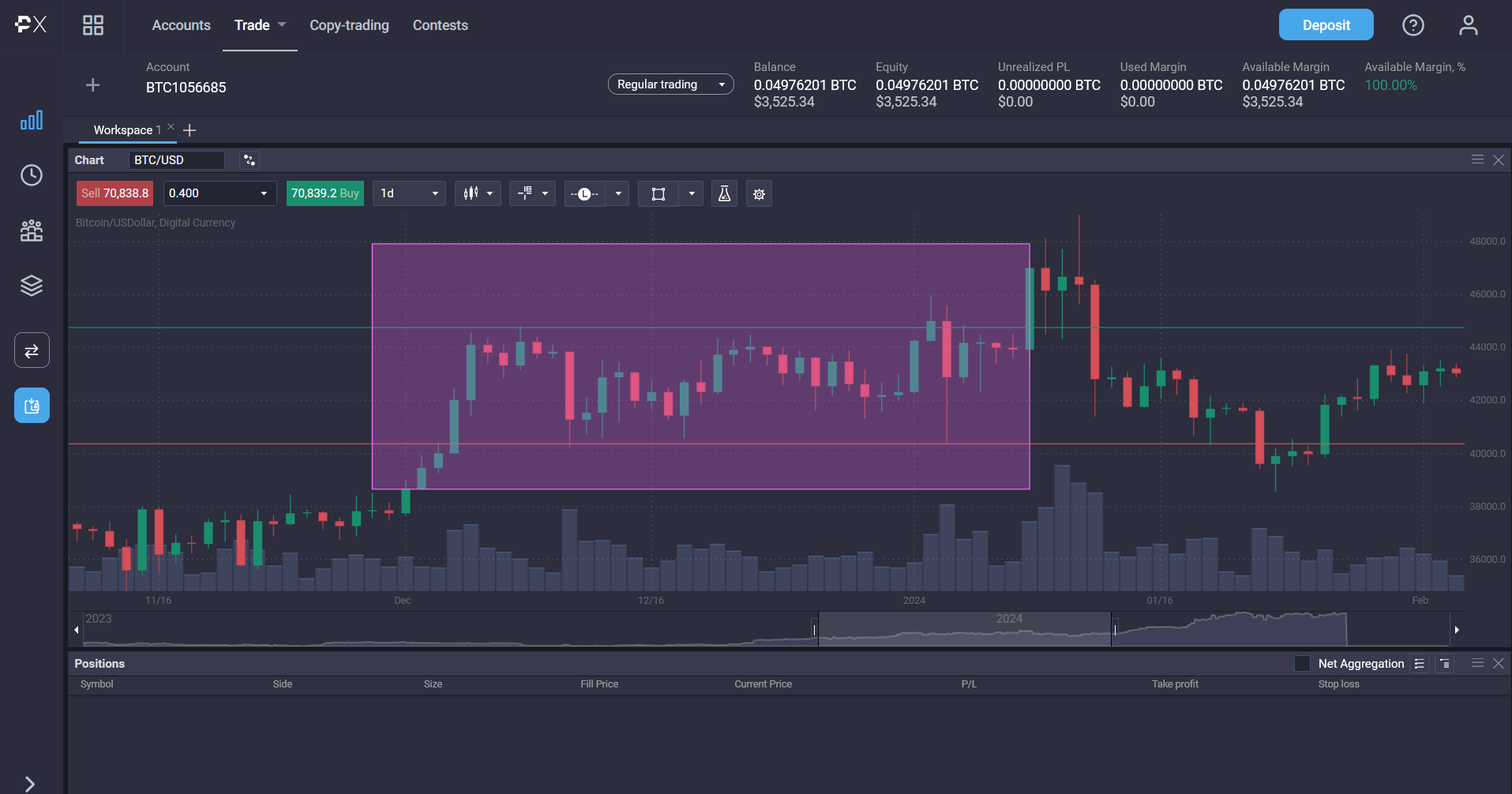

The range trading strategy is based on finding points to enter and exit a trade when markets are in their consolidation phase. A consolidated market is when the price movement is bounded within a range of prices and is more or less bouncing off of support and resistance but not breaking out.

To use this strategy you would enter a trade at the bottom of the range and exit when it approaches the top of said range. Or inversely you would short the asset at the top of the range and close your trade as it approaches support or the bottom of the range.

The hope is that throughout the trading day the asset will remain bounded but test both resistance and support multiple times with breaking through either level.

High-frequency trading

High frequency trading or HFT is a method that is used by institutional traders, banks and hedge funds. This is usually done using purpose built software which performs a huge volume of transactions throughout the day, while also scanning markets for other potential opportunities.

How to create a personalised strategy for day trading Crypto

One of the first things you need to know before creating a day trading Crypto strategy is the amount you are willing to stake for how much potential profit. Since you are day trading, the timeframe won’t be that much of a consideration, although you can define the time frame in which you will commit your trades within a single day.

Although some strategies would define the profit horizon for each trade they intend to open, usually, when day trading, you’ll want to set the profit goal for the entire day. This will help you better manage small loses that will be counterbalanced by the smaller incremental gains.

Finally, you have to decide when to enter and exit trades. Create your technical analysis, see what the average daily movement of the asset that you want to trade, and decide when you want to enter and exit the trade, either when you hit your profit target or when you reach your risk limit.

Risk management in Crypto trading

PrimeXBT offers a robust platform for Crypto trading, but the Crypto market itself is known for volatility. To succeed in day trading Crypto, risk management is crucial.

Position sizing and stop-loss orders: PrimeXBT allows for precise order placement directly on charts. This is vital for setting stop-loss orders, which automatically exit your position if the price goes against you and take profit which closes the trade when it reaches your desired profit – to avoid potential price reversals wiping out your profits. A common strategy is the 1-2% rule, where you only risk 1-2% of your capital per trade. PrimeXBT helps you stick to this by limiting your position size.

Portfolio diversification: PrimeXBT offers a variety of assets beyond Crypto, including Forex and Commodities. This allows you to spread your risk across different markets. By having assets with low correlation (meaning their prices don’t move in tandem), you can lessen the impact of a downturn in a single Crypto.

By using these strategies and PrimeXBT’s platform features, you can trade Cryptocurrencies with a more measured approach avoiding unnecessary risk.

Avoiding common Crypto trading mistakes

The most common pitfall when day trading Crypto is over leveraging your trades. It can be very tempting to use leverage to open bigger trades than you are able to, but remember that leverage works both ways.

The psychological game of Crypto trading

Negative emotional trading can also have undesired repercussions on your trading session. For example, if while day trading Crypto, you lose consecutive trades, this may be a sign to take a break instead of trying to rapidly recover your losses. Funny enough, overconfidence can have an equally undesirable result, causing you to increase your risk tolerance and ignore your strategy.

Focus is really important when day trading Crypto, so taking occasional breaks can give you time to gather yourself and refresh your mind. Although this may seem a bit absurd no matter how exciting the trading day is, remember to both eat and hydrate as these things are also important to keep your mind sharp, so you can respond quickly.

Securing your digital assets: essential measures

Since you’ll be trading Crypto, you’ll need a way to store them. The easiest is, unfortunately, the least secure – keeping your assets on an exchange. Luckily PrimeXBT offers its traders secure wallets they can use to store their assets in and easily access them when they want to trade.

Other methods are using cold wallets, paper wallets, or hardware Cryptocurrency wallets that use two-factor authentication or bio-metric authentication. If you are using an online wallet, it might be a good idea to use a VPN to avoid being tracked or compromised.

Finally you need to be careful of potential scams – including phishing or spoofing attacks.

Keeping up-to-date: a trader’s guide to Crypto news

Especially when day trading Crypto, you need to be aware of any events, changes, or updates that may affect the Cryptos you are trading. There are various forums and news outlets that focus specifically on the Crypto market trends and news.

Additionally you can find market analysis and updates on PrimeXBT’s website, that can help you make informed and safer decisions.

Downtime can also be used effectively to learn new strategies, test the ones you are currently using and expand your knowledge about technical analysis and indicators.

Most-followed Crypto education and news sources

Here are some of the most followed Crypto market news channels:

- Coindesk

- Cointelegraph

- Bitcoin Magazine

- The Block

- CryptoSlate

- Blockworks

- CoinMarketCap

- BelnCrypto

- DailyCoin

Keep in mind that there are various online communities and forums which are also dedicated to Crypto news, discussions and trading strategies. You can find these on Discord, Reddit and Telegram.

Conclusion

In the dynamic world of Cryptocurrency trading, where opportunities can arise at any moment, day trading is both a challenge and an opportunity. With strategies ranging from scalping to range trading, and with a plethora of tools and platforms at their disposal, traders can make informed and knowledgeable trades to achieve their goals.

However, success in Crypto day trading is not just about seizing opportunities; it’s about managing risks, staying informed, and maintaining discipline. From setting stop-loss orders to diversifying portfolios and avoiding common pitfalls like overleveraging, traders must navigate a complex psychological landscape while remaining focused and resilient.

Platforms like PrimeXBT offer traders the tools they need to succeed, from advanced technical analysis features to secure wallets for storing digital assets. Coupled with a commitment to staying informed through reputable news sources and communities, traders can navigate the volatile world of cryptocurrency with confidence.

Ultimately, whether you’re a seasoned trader or just starting out, the journey of Crypto day trading is as much about continuous learning and adaptation as it is about profit. By staying informed, managing risks, and honing your skills, you can navigate the highs and lows of the Crypto market with confidence and resilience.

Can you day trade Crypto?

Of course, anyone with a PrimeXBT account and a computer or mobile device can day trade Crypto.

How much does it cost to start day trading Crypto?

PrimeXBT allows traders to start with just $10.

Is Crypto good for day trading?

The Cryptocurrency market is probably one of the best markets for day trading, since prices move frequently in a small amount of time.

Can I buy and sell Crypto multiple times a day?

Yes you definitely can. Just be careful before trading to choose a broker that has low fees like PrimeXBT.

Which Crypto is good for day trading?

Any Crypto is great for day trading, but the problem is liquidity i.e. the amount of traders buying and selling the Crypto assets at any given moment. If you go with one of the more popular Cryptos like Bitcoin or Ethereum, there is a higher chance you will find someone wanting to buy your assets when you are selling, and vice versa.

Which Crypto is best for scalping?

The same holds true for scalping as well. You need to be sure that there are people interested and ready to buy when you want to sell. Bitcoin and Ethereum have large volumes of traders at any given moment so if you have a lower risk appetite these should work great for you!

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.