In the dynamic world of cryptocurrencies, understanding the distinct features and applications of various digital assets is essential for investors and enthusiasts alike. This article aims to provide a comprehensive comparison between two prominent cryptocurrencies, Cardano (ADA) and Ripple (XRP). By delving into their histories, technological foundations, roadmaps, community ecosystems, market performances, risk analysis, and investment perspectives, readers will gain valuable insights into these cryptocurrencies’ unique attributes and potential roles in the crypto landscape.

Introduction to Cardano (ADA)

Cardano network, founded by Charles Hoskinson, one of the co-founders of Ethereum, entered the blockchain scene in 2015 with a visionary mission. The platform was designed with a focus on scientific research, aiming to address some of the key challenges faced by earlier blockchain networks. the Cardano network’s fundamental purpose is to provide a secure, scalable, and sustainable blockchain infrastructure that can support the development of decentralized applications (dApps) and smart contracts.

At its core, Cardano is based on a unique layered architecture, separating the blockchain’s transaction settlement layer (SL) that handles the transfer of native cryptocurrency ADA from the computation layer (CL), responsible for executing smart contracts. This layered approach allows for more flexibility in upgrading the protocol and enhances security through isolation.

Introduction to Ripple (XRP)

Ripple, or XRP, emerged in 2012 with a distinct vision to revolutionize international financial transactions. Unlike many other cryptocurrencies, Ripple primarily targets institutions, aiming to facilitate cross-border payments and remittances. Ripple operates on a decentralized network known as the XRP Ledger, which aims to provide fast and low-cost bitcoin transactions.

The primary use case of XRP lies in enabling quick and efficient cross-border transactions, often referred to as “on-demand liquidity.” Ripple’s technology aims to replace traditional payment systems that are often slow and costly, providing banks and institutions with an alternative system for international remittances.

Technology Behind Cardano and Ripple

Both Cardano and Ripple leverage advanced blockchain technologies to achieve their respective objectives.

Cardano’s technology is driven by a peer-reviewed research approach, ensuring that each protocol upgrade is thoroughly examined and validated. Its layered architecture enhances scalability and enables independent updates of each layer. Additionally, the Cardano blockchain employs a Proof of Stake (PoS) consensus mechanism, promoting energy efficiency and sustainability.

Ripple, on the other hand, utilizes a unique consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA). This approach does not rely on traditional mining and is designed to confirm transactions quickly and efficiently. The XRP Ledger is seen as a more centralized blockchain, with a limited number of validators verifying transactions, compared to fully decentralized networks.

Roadmaps: Future Plans and Ambitions

Looking ahead, both Cardano and Ripple have ambitious roadmaps to enhance their ecosystems and functionalities.

Cardano has been implementing a series of upgrades through its phases, named after prominent figures in history. Byron, Shelley, Goguen, and Basho represent different milestones in Cardano’s development, each introducing new features and capabilities.

The upcoming Voltaire phase aims to bring decentralized governance to the platform, allowing ADA holders to actively participate in decision-making processes.

Ripple’s roadmap, meanwhile, is primarily focused and centered around its goal of becoming the standard for cross-border payments. The company seeks to expand its partnerships with financial institutions worldwide and continue improving the speed and cost-efficiency of transactions.

Community and Ecosystem

Community engagement plays a crucial role in the success and development of any cryptocurrency.

Cardano has garnered a large and active community due to its research-driven approach and transparent development process. The Cardano community actively participates in various discussions, technical feedback, and voting on proposals makes cardano, contributing to the platform’s growth and decentralization.

Targeting Financial Institutions:

Ripple, as a cryptocurrency mainly targeting financial institutions, has a more niche-oriented community. Nonetheless, it boasts an extensive network of private banking, partners and institutions, which contributes to its influence in the financial world.

Market Performance: Cardano vs XRP

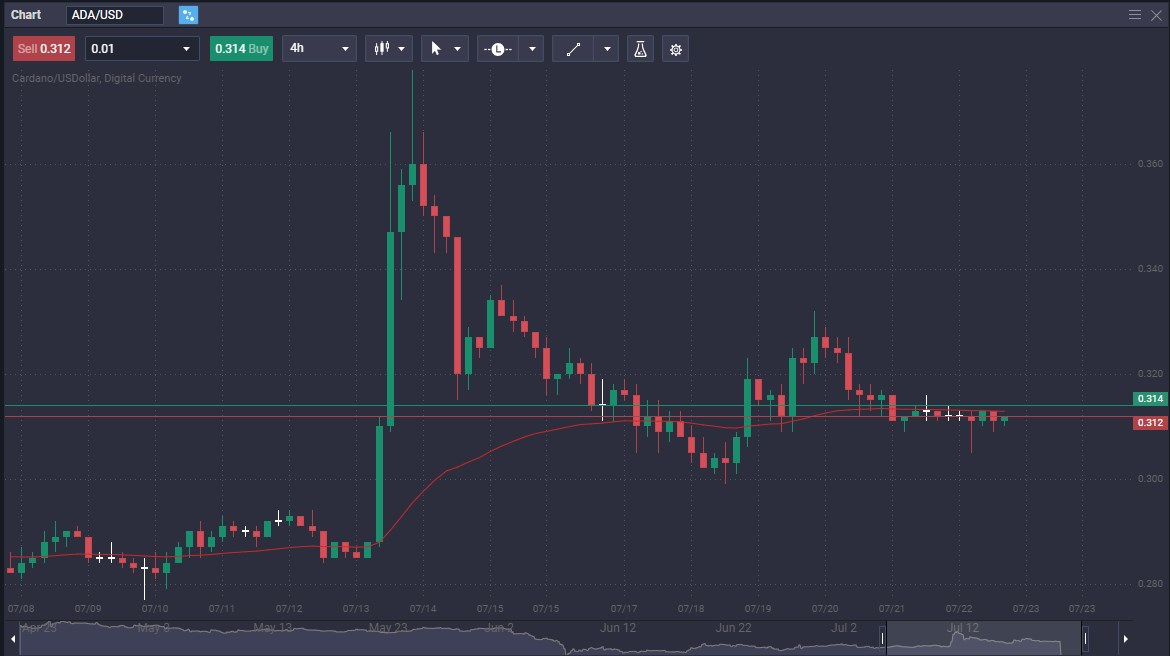

Analyzing the market performance of cryptocurrencies involves considering factors such as price history, market capitalization, and trading volume.

Price History and Analysis

Both Cardano and XRP have experienced significant price fluctuations in the cryptocurrency market. Cardano, which initially gained traction in 2017-2018 during the crypto bull market cap up run, saw its price surge to an all-time high. However, it also experienced price corrections during bear markets.

XRP, likewise, witnessed remarkable price surges in past bull cycles, mainly driven by its utility for international transactions and payment settlements. However, XRP faced regulatory challenges in some jurisdictions, impacting its price performance.

XRP vs ADA Risk Analysis

Investing in cryptocurrencies inherently comes with certain risks, and both Cardano and XRP are no exceptions.

Market risk:

The crypto market is known for its high volatility, with prices subject to rapid fluctuations influenced by various factors, including market sentiment and global events.

Regulatory risk:

The regulatory landscape for cryptocurrencies varies worldwide, and changes in regulations can impact the usage and value of both Cardano and XRP.

Technological risk:

As blockchain technologies are still relatively new, there is always a risk of technical vulnerabilities legal issues or challenges that could affect the functionality and security of the cryptocurrencies.

Cardano or XRP: Investment Perspective

When considering an investment perspective, it is crucial to weigh the pros and cons of higher price of both Cardano and XRP.

Cardano’s research-driven approach and layered architecture make it an attractive option for projects seeking enhanced security and scalability. Its community-driven governance model also offers ADA holders a say in protocol upgrades.

On the other hand, XRP’s use case in facilitating cross-border payments and remittances makes it appealing to institutions. Ripple’s extensive network of partnerships with banks crypto exchanges and payment providers further bolsters its position in the financial world.

However, it is essential to remember that the crypto market is highly speculative and subject to rapid changes. Investors should exercise caution and conduct thorough research before making any investment decisions.

Notable Partnerships and Collaborations

Both Cardano and XRP have secured notable partnerships and collaborations that could impact their respective developments and market positions.

Cardano has forged partnerships with various governments and academic institutions, working on projects that aim to improve public services and infrastructure through blockchain technology. Additionally, cardano foundation and collaborations with enterprises seeking blockchain solutions are expanding Cardano’s real-world use cases.

Ripple, being focused on financial solutions, has collaborated with numerous institutions worldwide, including major banks and payment providers. These partnerships demonstrate Ripple’s potential to revolutionize the traditional banking decentralized finance industry.

Conclusion

In conclusion, Cardano and Ripple are two prominent cryptocurrencies with distinct purposes and technological foundations. Cardano’s research-driven approach and layered architecture aim to provide a secure and scalable blockchain infrastructure for decentralized applications. Ripple, on the other hand, targets the financial industry with its cross-border payment solutions and decentralized apps.

Both cryptocurrencies have ambitious roadmaps and engaged communities that contribute to their development and adoption. Understanding the unique features and use cases of Cardano and XRP can empower investors to make informed decisions in the dynamic crypto landscape.

As always, caution should be exercised in the highly volatile crypto market, and readers are encouraged to conduct further research before making any investment decisions.

Is XRP or Cardano better?

Determining which cryptocurrency is better, XRP or Cardano, depends on the specific use case and individual investment goals. Cardano's focus on scientific research and layered architecture appeals to projects seeking enhanced security and scalability.

On the other hand, XRP's utility in facilitating cross-border payments and its extensive network of financial partnerships make it attractive to the financial industry. It is essential to assess the specific requirements and potential of each cryptocurrency before making a decision.

Is Cardano similar to XRP?

While both Cardano and XRP are prominent cryptocurrencies, they differ significantly in their primary objectives and use cases. Cardano aims to provide a robust and scalable blockchain infrastructure for decentralized applications, emphasizing scientific research and community governance. On the other hand, XRP targets the financial industry, particularly for cross-border payments, and focuses on partnerships with banks and institutions.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.