- Bitcoin is in correction territory after falling over 10%

- Jitters show ahead of the Federal Reserve rate decision

- Choppy liquidity led to a flash crash yesterday on one exchange

Bitcoin has fallen 18% from its all-time high last week to a low today of $60,800. While BTC/USD has picked up from the 2-week low of just above $60,000, the rebound has only been modest, and the price remains firmly in correction territory.

Correction territory is when a market falls 10% from its recent high. A bear market is when a market trades 20% off its recent high, which is not that far away!

Bitcoin could be vulnerable to further declines with the Federal Reserve interest rate decision due later today and amid choppy liquidity in crypto markets, making it susceptible to flash crash dynamics, even as the medium-term outlook remains upbeat.

Flash crash dynamics

Yesterday, Bitcoin fell 6%, breaking through support to a low of $62,350. While profit-taking, pre-Fed jitters, and some slowing to ETF inflows are likely driving the price southwards, low liquidity could also be playing a role. An anonymous whale sold 997 BTC on the open market, causing a flash crash in the Bitcoin price on one exchange. The price crashed to $8,900 on the BitMEX exchange, which is rather alarming for an asset class worth $1 trillion; a $55 million sell order shouldn’t cause a crash unless liquidity is very low.

While the flash crash was limited to the spot market on BitMEX, there are rising concerns that it could ripple out into other crypto markets.

Fed rate decision

Today, attention is firmly on the Federal Reserve interest rate decision, which will be announced at 18:00 GMT after two days of deliberations. The outcome could decide whether the BTC/USD correction is over.

The correction lower in Bitcoin and other cryptocurrencies followed hotter-than-expected wholesale and consumer price inflation last week. Sticky inflation could mean the Fed keeps rates high longer to tame inflation back to its 2% target. Delaying interest rate cuts would be bad news for riskier assets, such as equities or cryptocurrencies, as higher treasury yields make riskier assets less attractive.

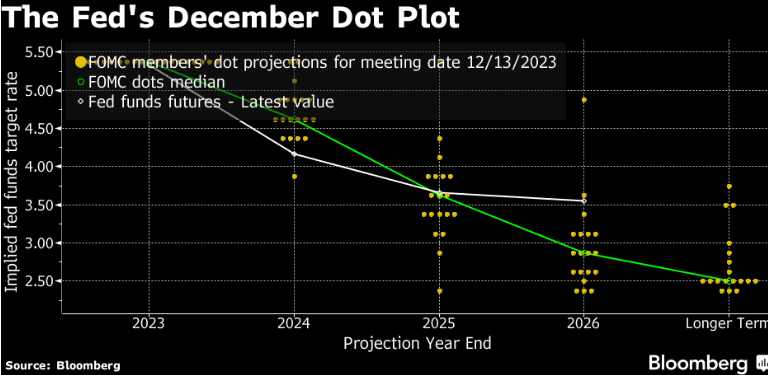

The market is fully pricing in the Fed, leaving interest rates unchanged at a 22-year high of 5.25%—5.5%. However, attention will be on any adjustments to the dot plot, a graph that shows Fed policymakers’ outlook for interest rates over the coming year. In December 2023, the Fed’s dot plot pointed to 3 rate cuts this year.

Given the persistently sticky inflation and resilience of the US economy, there is a chance that the Fed may adjust the dot plot to just two cuts this year. A more hawkish-sounding Federal Reserve could weigh on investors’ appetite for risk and extend the selloff in Bitcoin and other cryptocurrencies.

The correlation between cryptocurrencies and macro fundamentals has been low since the start of the year following the spot BTC ETF approval. However, a less friendly investor policy from the Fed and the subsequent risk-off mood could easily spill over into the crypto space.

Sources

https://www.coindesk.com/markets/2024/03/19/bitcoin-flash-crashed-to-89k-on-bitmex/

https://www.barrons.com/articles/bitcoin-ethereum-price-crypto-market-today-178bec6b

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.