As the next Bitcoin halving event draws closer, cryptocurrency investors and traders must understand the protocol and know how to prepare best and navigate the event.

Here, we look at the strategies you could use in the 2024 Bitcoin halving event, including risk management and opportunity identification.

The Bitcoin halving event is expected to take place in mid-April and halves the rewards that Bitcoin miners receive to 3.125 BTC, regulating the supply of Bitcoin.

Historically, this event, which occurs every 210,000 blocks mined, has spurred a surge in BTC/USD as supply is reduced and demand remains constant or rises.

Strategies for the halving event:

Buy and hold strategy

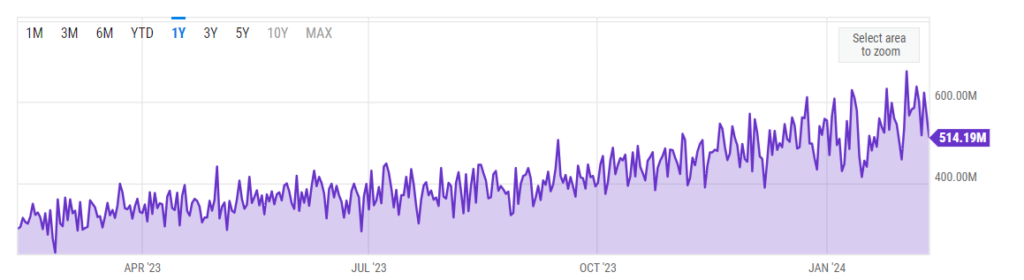

This is a long-term strategy where investors buy Bitcoin outright, expecting the price to increase over a long period. Market fluctuations are ignored to capitalize on long-term appreciation. Looking at the chart, investors who bought BTC/USD ahead of the last Bitcoin halving event in May 2020 would have seen the Bitcoin value rise from $8800 to $48,000 at the time of writing.

Dollar Cost Averaging (DCA)

DCA sees investors buying a fixed quantity of Bitcoin at regular intervals, regardless of the price at the point of purchase. By spreading out the investment over a period of time, short-term volatility is smoothed away. This strategy reduces the risk associated with timing the market. Again, the expectation here is that the price will increase over a long period.

Short-term trades

This strategy aims to capitalize on increased short-term volatility and sharp moves in the Bitcoin price surrounding the halving date. Bitcoin halving often sparks increased market volatility, which can provide more opportunities for short-term trades. For example, a trader could look for overbought or oversold opportunities using the Relative Strength Index. With short-term trading, it is essential to set out entry and exit levels before placing the trade in order to prevent emotions and impulsive decisions from disrupting the trading plan.

Risk management is crucial in times of heightened volatility to keep any losses in check. Meanwhile, profit-taking exit orders mean that sitting and monitoring the trade is unnecessary.

Indicators for identifying opportunities

In addition to looking at the BTC/USD price around halving, pairing the price action with bitcoin-specific indicators can help to understand the logic behind the price fluctuations and volatility, painting a more complete picture.

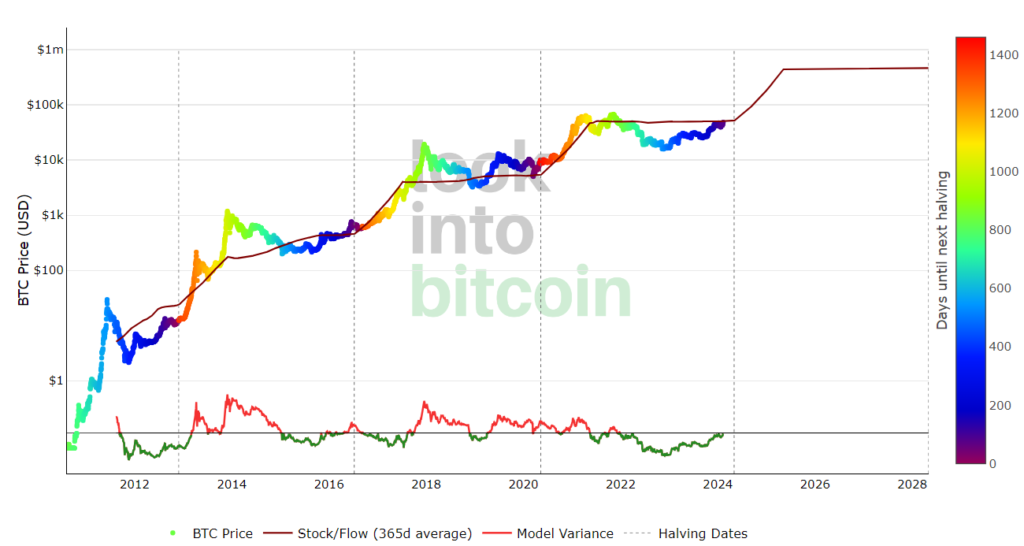

Given that BTC/USD halving directly impacts new Bitcoin supply, it can be useful to consider the Stock-to-Flow metric, which directly correlates to the price of BTC. By tracking this metric before and after halving, you may look to enter a trade when the model price line surges and its variance with the actual price declines.

The hash rate, which is a measure of the computational power of a blockchain network, could also be a helpful indicator. Miners could sell their setup or BTC post halving as the reward is slashed by 50%. This could lower the price, at least in the short term, which could be a good time to short. Meanwhile, buyers might wait for the hash rate to stabilize before taking a long position.

Conclusion

Investors can implement several different strategies to prepare for and navigate the 2024 halving event. Long-term investors may buy and hold or Dollar Cost Averaging. At the same time, traders may look to capitalize on the short-term volatility and use bitcoin indicators for a more holistic picture.

Resources

Investopedia: What Is Bitcoin Halving?

https://www.investopedia.com/bitcoin-halving-4843769

Bitpanda.com Bitcoin halving: What you need to know

https://blog.bitpanda.com/en/bitcoin-halving-what-you-need-know

Look into Bitcoin – Stock flow model

https://www.lookintobitcoin.com/charts/stock-to-flow-model/

BeinCrypto – Bitcoin Halving Cycle and Investment Strategies

https://beincrypto.com/learn/bitcoin-halving-investment-strategies/