Ethereum is showing signs of steadying after falling over 30% since the start of the year. The price of the world’s second-largest cryptocurrency tumbled from a peak of 3740 in early January to find support at the 2500 level. Today, ETH/USD trades higher at 2650.

Ethereum is finding support from news of the CBoE filing for SEC approval to introduce staking for the 21Shares core Ethereum ETF. If approved, this could mark a milestone in the US ETF landscape, allowing investors to earn staking rewards.

What is staking? Staking is a process that involves locking up Ethereum to help secure the blockchain while generating passive income. Unlike just holding it, staking ETFs enable investors to earn additional returns. The lack of ability to stake has often been highlighted as one of the reasons that ETH ETFs have underperformed BTC ETFs.

The application comes amid a recent shift in leadership at the SEC, which has renewed optimism that the regulator may consider a favourable stance on staking ETF products.

Why does this matter? The integration of seeking into Ethereum ETFs could help drive institutional interest and investment into Ethereum. If approved, this could change the long-term investment case for Ethereum, potentially helping the token push past the 4000 top seen in this bull cycle.

The final decision is expected around the 30th of October and will be closely monitored as it could set a precedent for other ETF issuers looking to integrate staking into their ETF offering.

ETH whales buy the dip & gas limits rise

Ethereum whale activity has recently jumped, with the number of addresses holding over 10,000 ETH rising by 2.3% since the start of this month. The rise in whale accumulation could point to growing bullish sentiment, as large holders buy the dip.

Recently, Ethereum raised its gas limit from 30 million to 36 million, enabling it to process transactions more efficiently and reduce network congestion. This adjustment leads to transaction speeds that are 20% faster and gas fees that decrease by 10 to 30%. Consequently, this increase in the gas limit is likely to attract more users and investors to the Ethereum network.

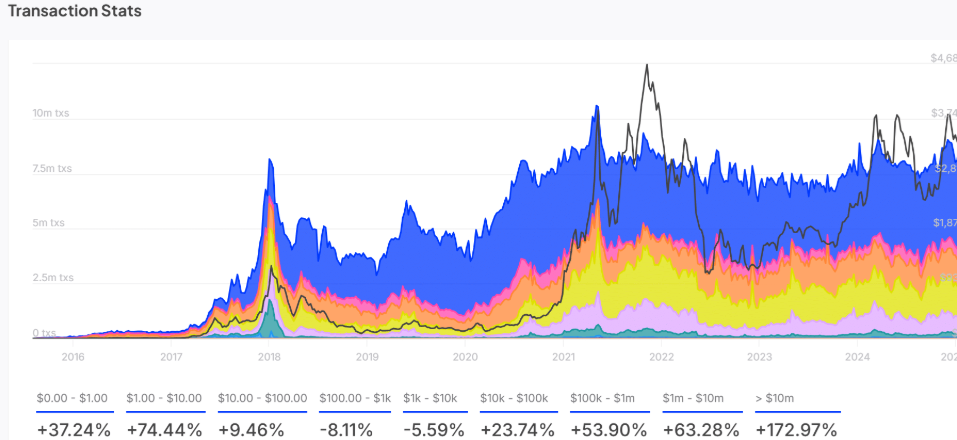

Interestingly, Ethereum has seen an increase in the number of transactions exceeding $10 million, indicating that large-scale institutional investors are becoming more active. Transactions over $10 million surged by 172%, suggesting that Ethereum’s role as a preferred network for larger investors is also on the rise, which could help support the price.

Conclusion

- After a steep decline year-to-date, Ethereum could be bottoming out and a recovery could be coming.

- News the CBoE applied to the SEC to introduce staking for 21Shares core ETH ETF could pave the way to a milestone moment for ETH ETFs, opening the door to increased institutional demand.

- Meanwhile, whale activity in Ethereum has jumped and gas limits increased, attracting more users and investors.