Bitcoin is holding steady on Wednesday at 93.5k after two straight days of losses as investors continue to lock in profits following Bitcoin’s recent rally and as the market waits for more clues on US monetary policy.

Bitcoin rallied 40% following Donald Trump’s victory in the US elections, taking it to within a breath of 100,000. The promise of deregulation in the sector and making the US the crypto capital of the world spurred strong gains across cryptocurrencies.

However, BTC failed at the 100k milestone and has fallen, reaching a low this week of 92.5k, as short-term investors book profits in a healthy pullback within a bull rally.

Short-term profit-taking

Data from Crypto shows the Spent Output Profit Ratio (SOPR), which measures whether investors are selling their BTC at a profit or loss, is at 1.028, down from 1.08 a week ago but still above the historical average. A reading above 1 indicates sellers are profiting, pressurizing Bitcoin’s price.

Whales accumulate, stablecoin inflows & active addresses soar

Despite this week’s correction, whales and sharks are showing no signs of easing. In November alone, wallets with at least 10 BTC have accumulated 63,922 more coins (worth $6.06B). While whales continue to accumulate, a bullish argument for BTC remains strong, and any fall could be short-lived.

Meanwhile, data also shows consistent inflows of stablecoins, particularly in recent weeks. As stablecoins are a primary gateway for crypto purchases, solid stablecoin inflows often point to investors preparing to buy Bitcoin – a bullish signal.

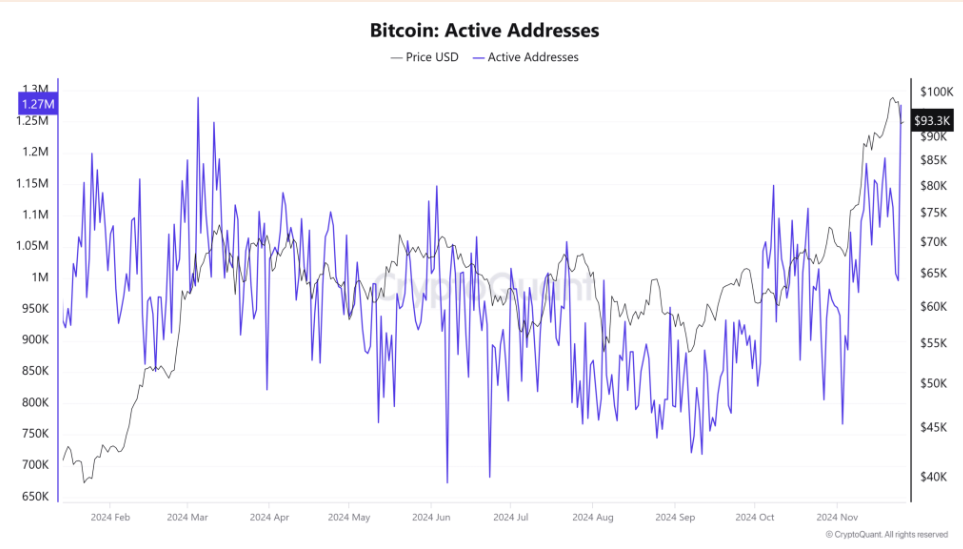

In addition to stablecoin inflows rising, active addresses—a measure of network usage and activity have jumped. Active addresses reached 1.27 million, marking the highest level since March amid increased participation in the network. This typically aligns with periods of price increases.

Risk appetite & core PCE data

Risk appetite has also been dented this week after US president-elect Donald Trump threatened to impose more trade tariffs on several countries, including Canada and Mexico. His comments fueled fears of a renewed trade war, hurting demand for riskier assets.

Looking ahead, the focus is on key economic data, including the core PCE index, which is the Federal Reserve’s preferred gauge for inflation. The data is expected to show that inflation rose to 2.8% in October up from 2.7% YoY. Hot inflation could limit any upside in Bitcoin, given the cryptocurrency performs better in low interest rate environments, where liquidity is higher.

The data comes after the minutes of the Federal Reserve meeting showed that policymakers were divided over the pace of future rate cuts, with officials supporting a gradual approach to reducing rates. Still, the market raised expectations for a December rate cut to 66% from 59% prior to the meeting.