Bitcoin steadies after a tariff-fueled sell-off earlier this week but remains below the key 100K level. On Thursday, BTC traded in the region of 99K, as risk sentiment across the broader financial market improved.

Fears of an all-out trade war sent Bitcoin lower at the start of the week as Trump applied 10% trade tariffs on Chinese imports. However, Beijing’s retaliatory levies on selected products were modest, suggesting that China would accept higher tariffs for now. Fears of escalating trade tensions have faded, lifting Bitcoin and other cryptocurrencies from weekly lows.

The SEC crypto unit is downsized – good news for XRP?

The crypto market is also finding support from developments towards a more crypto-friendly environment. The Securities and Exchange Commission is cutting back its crypto enforcement unit, marking a significant shift in regulatory policy under the new Trump administration and possibly marks first tangible pro-crypto move by the President.

The SEC crypto unit is being downsized following Trump’s recent executive order to reduce regulatory overreach in the digital asset sector. The move could be considered particularly good news for XRP after the chief litigation counsel, Jorge Tenreiro, who played a key role in both the Ripple and Coinbase lawsuits, was reassigned to a different business area.

News of this reassignment has fueled speculation that the SEC could withdraw its appeal in the SEC vs Ripple case, which was opened on January 15, just days before Gary Gensler stepped down as chair. XRP trades +2% as it recovers to 2.45.

Blackrock to bring Bitcoin ETPs in Europe

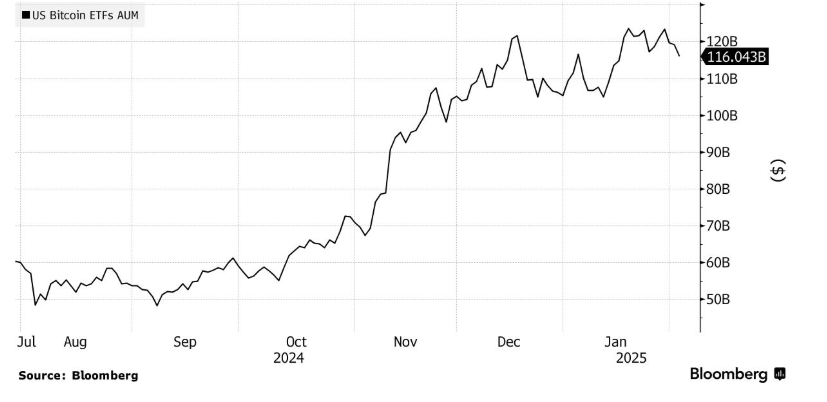

Meanwhile, BlackRock, the world’s largest asset manager, is preparing to list exchange-traded products directly linked to Bitcoin in Europe, following the clear success of its US ETF, which tracks Bitcoin.

US Bitcoin ETFs have surged in popularity over the past year since their launch, bringing in $116 billion in assets under management across the 12 providers.

Head of Digital Aset Research at Standard Chartered Geoffrey Kendrick highlighted the impact of the spot Bitcoin ETF and its potential to continue expanding as a reason that Bitcoin could reach 500k before the end of Trump’s Presidency. He emphasized increased access ability for investors and lower market volatility as playing essential roles in this potential rally.

US non-farm payroll data in focus

With Bitcoin trading under 100k, we are still some way off a rally to 500k and the mood remains cautious as investors look ahead to tomorrow’s nonfarm payroll report. The closely monitored report will provide further clues about the health of the US economy and the jobs market. Economists expect 154,000 new jobs created in January, significantly lower than December’s 256,000.

Signs of weakness seeping into the labour market could revive Fed rate cut bets. The US central bank left rates on hold in the meeting last week and signaled that it was in no rush to cut rates further until the data showed it was necessary.

Ahead of tomorrow’s non-farm payroll report, US jobless claims will be released today and are expected to show a rise to 213k from 207k.