Bitcoin is rising on Thursday, trading up almost 3% across the past 24 hours, boosted by in-line US inflation data, which raised bets for a December Fed rate cut.

The world’s largest cryptocurrency is attempting to break out of its recent range of 90K to 100K seen in recent weeks, rising to 101k, with altcoins booking stronger gains as risk appetite increases.

US CPI adds to December rate cut bets

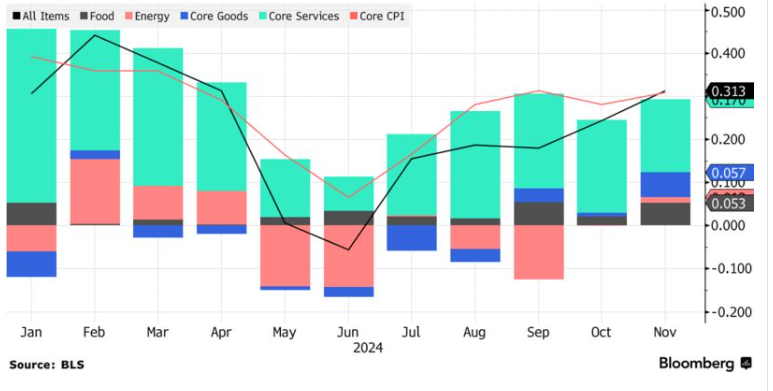

The market mood was upbeat after US inflation, as measured by the consumer price index (CPI), which rose to 2.7% YoY from 2.6%, and 0.3% MoM up from 0.2%, which aligns with forecasts. Meanwhile, core inflation, which removes more volatile assets such as food and fuel, remained unchanged at 3.3%.

The in-line reading boosted expectations that the Federal Reserve will cut interest rates by 25 basis points in the December meeting. According to the CME Fedwatch tool, the markets are pricing in a 95% probability of a rate cut in December, up from 85% before the data release.

A low interest rate environment bodes well for riskier assets such as stocks and crypto, helping the tech-heavy NASDAQ 100 reach an ATH above 20k.

Looking ahead, wholesale inflation, as measured by PPI, will be released today, and PPI is expected to rise from 3.2% YoY in November to 3.1%.

While the Fed looks set to cut rates in December, concerns over stalling disinflation, support a more gradual pace of rate cuts from the Fed next year.

Microsoft votes against Bitcoin investment

Microsoft shareholders voted against a proposal to add Bitcoin to the company’s balance sheet. The proposal argued that Bitcoin was a dependable inflation hedge, but shareholders rejected it due to the cryptocurrency’s volatility.

MicroStrategy CEO Michael Saylor’s comments that Microsoft should adopt Bitcoin did little to support the case. MicroStrategy has seen its share price rally over 450% year-to-date as investors see it as a proxy for Bitcoin.

MicroStrategy could join the Nasdaq 100 index on December 23 in the index’s annual rebalancing, a routine process that reflects the changing dynamics and valuation within the market. Including MicroStrategy would represent a significant milestone and further legitimacy to the crypto sector.

Why is AAVE surging?

AAVE is a standout performer in the cryptocurrency sector, posting gains of 30% over the past 24 hours. The token hit a yearly high following news that Donald Trump’s World Liberty has purchased $1 million worth of the token, 3357 AAVE, at $297.80.

AAVE rallied 50% across November and surpassed that with 66% gains in December.

Technically, AAVE has broken out of its recent range, rising above 300 as bulls look toward the 400 mark. The RSI is overbought so buyers should be cautious.