Bitcoin is holding steady after rising to a three-month high in the previous session on speculation that Trump could win the presidential elections, bringing friendlier regulation to the crypto sector.

The latest Polymarket poll showed that Trump’s odds of winning are 60% over Harris’s 40% chance. However, recent media polls still see Harris with a slight lead. With three weeks to go, this is set to remain a tight race.

Crypto is also supported by Mt Gox postponing its timeline for returning coins to creditors and a broadly upbeat market mood, with US equities hovering around record highs.

However, dollar strength could limit further gains. A Trump win in the elections is also considered inflationary, given that Trump’s core policies, including tariffs, taxes, and immigration, could add to inflationary pressures, resulting in fewer interest rate cuts by the Federal Reserve in 2025.

Could Ether break out to $3000?

Ether is unchanged today but trades over 5% higher this week, in line with Bitcoin. On-chain analysis paints a mixed picture as to whether ETH could break out above 2.7k and reach 3k.

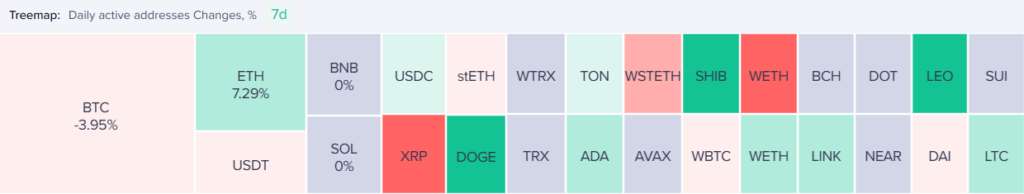

Daily active address rise

According to data on Santiment, Daily Active Addresses have risen this week by 7.3%, compared to an almost 4% decline in Bitcoin’s Daily Active Addresses. The rise is considered bullish as it can show rising demand for ETH or growing network activity.

Open Interest reaches record levels.

Ethereum futures Open Interest reached a record high this week. The surge in Open Interest points to the growing demand for leveraged ETH positions, which typically precede significant price corrections. The aggregate ether futures open interest surpassed 5 million ETH for the first time on October 15th, marking a 12% increase from 4 weeks prior. The last time Ether’s aggregate open interest peaked, the Ether price fell 30% over the following four days, falling to $2186 from $3205. Despite this happening previously, it doesn’t necessarily mean it is a bearish signal.

ETH ETFs are slow but positive

Ether ETFs are trending green, which is also a positive development. According to SoSo Value data, spot ETH ETFs saw $24.22 million in inflows yesterday after net outflows of $12 million yesterday. So far this week, spot ETH ETFs are on track to book gains, with $22.54 million in inflows this week after two straight weeks of outflows. These numbers are still a little underwhelming but are showing a slow trend of investors warming toward the spot ETH ETF.

Where next for Ether?

ETH/USD is extending its recovery from 2300 low, rising above 2500 and 2600. The next level bulls need to retake is 2700 to create a higher high. This level is crucial, as ETHUSD has risen above here for three months.