Bitcoin is hovering just below 96k as the world’s largest cryptocurrency keeps the 100k key milestone in focus. While the cryptocurrency failed at this key level last week and fell to 92.5k, buyers have not given up and have pushed the price back above 95k.

Crypto-friendly SEC & CFTC agencies

News that the Trump administration is looking to shift crypto regulatory control to the Commodity Futures Trading Commission (CFTC) and away from the Securities and Exchange Commission (SEC) is helping to boost the market mood. The CFTC oversees the US derivatives market and is considered to have less strict regulatory standards than the SEC.

Over the past few years, crypto firms have been under intense scrutiny in the US under the watchful eye of the SEC, with judicial actions taken against companies, including Coinbase and Kraken.

Bitcoin is also getting a boost on signs that crypto-friendly candidates could help to shape the fight against U.S. financial rules under Donald Trump. Crypto supporters are emerging as the favorite candidates to run both the SEC and the CFTC.

This comes as President-elect Donald Trump has vowed to undo the crackdown imposed under the Biden administration and favor a more crypto-friendly environment.

Paul Atkins has been floated as a top candidate to replace Gerry Gensler as SEC chair. Atkins supports digital assets and is expected to impose a friendlier approach to regulation than his predecessor, who has said he will step down on January 20th.

Meanwhile, potential candidates to head up the CFTC are also expected to be friendly towards the crypto market.

Strong data clouds Fed outlook for rate cuts

However, gains could be limited amid questions over the extent to which the Fed will be able to cut rates over the coming year. Data yesterday showed that US Q3 GDP was stronger than expected, and core PCE inflation also rose to 2.8%. While the Fed is expected to cut rates in December, fewer rate cuts are expected next year.

ETH reaches a 7-month high- Is altcoin season coming?

Meanwhile, Ethereum has surged almost 15% this week, moving above the 3600 level for the first time in seven months. The surge was fueled by massive trading volume exceeding $43 billion over the past 24 hours. When trading volume and price rise in tandem, it shows the rise is backed by significant activity, making it more sustainable.

ETH ETF flows also turned positive, which could be attributed to spot buying pressure. Ether ETF inflows booked a fourth straight positive day with over $90 million on November 27.

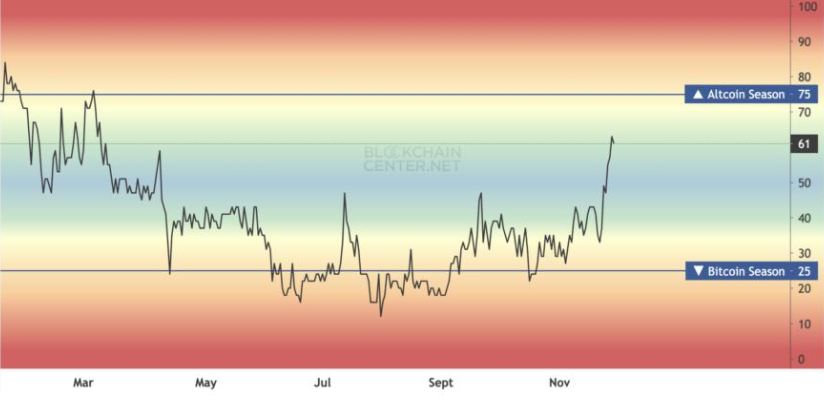

Ethereum’s recent rise points to a shift towards the altcoin season. According to Blockchain Centre’s Altcoin Season Index, the score has reached 61 out of 100, closing in on the 75 level needed to signal the start of Altcoin Season.