Bitcoin is extending declines on Wednesday amid a cautious market mood after hotter-than-expected US inflation data Federal Reserve rate cut expectations.

US CPI rises to 3%

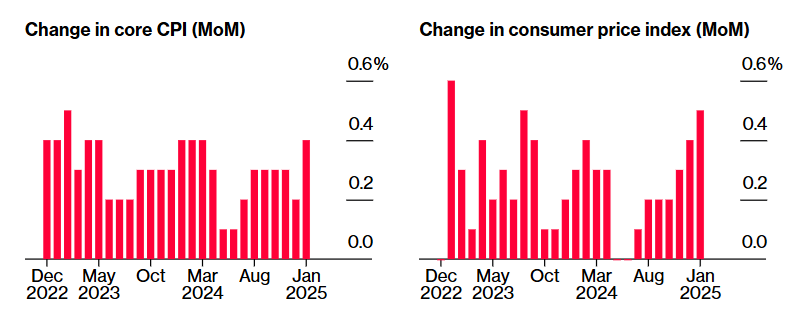

As measured by the consumer price index, US inflation rose 3% annually in January, ahead of the 2.9% level seen in December and forecast by economists. On a monthly basis, inflation rose 0.5%, up from 0.4% and defying expectations of a decline to 0.3%. Meanwhile, core inflation, which strips out more volatile items such as food and fuel, also unexpectedly raised 3.3%, up from 3.2% in December and well above the 3.1% forecast. The data supports the view that the Fed will not cut rates in the first half of this year.

The data comes after Federal Reserve chair Jerome Powell testified before the Senate Banking Committee yesterday and reiterated that the central bank was in no rush to cut interest rates again. Powell highlighted the strength of the US economy’s low unemployment rates and inflation levels still above the Fed’s 2% target as reasons to keep the benchmark rate unchanged.

High rates for longer can hurt risk appetite, putting pressure on assets such as cryptocurrencies and stocks. Owing to the increased liquidity, these tend to perform better in low-interest-rate environments.

Trade tariffs raise inflation worries.

Meanwhile, Trump’s latest trade tariffs have also hurt the broader market mood. Trump announced 25% tariffs on all steel and aluminium imports into the US. This is important because trade tariffs can create inflationary pressure within the US economy, meaning the Fed could struggle to cut interest rates this year.

Already sticky inflation combined with the inflationary impact of trade tariffs linger could mean the Fed won’t cut rates at all this year. This could limit the upside in Bitcoin and other risk assets for now. The market sees just one 25 basis point cut this year and that is not fully priced in.

Corporate buyers limit losses.

Despite the weakness in BTC price, corporate demand remains strong. Strategy’s Bitcoin buying spree kicked off again in February following a halt in late January. The company formerly known as MicroStrategy acquired an additional 7633 BTC for $724 million, making the average price $97,255.

Meanwhile, banking giant Goldman Sachs has unveiled a $2.3 billion Bitcoin ETF exposure in its latest 13F filing. This represents a $710 million increase compared to the final quarter of last year. Goldman Sachs initially revealed holding $418 million worth of Bitcoin ETFs last August in its regulatory filing for the second quarter.

Corporate interest adds to the legitimacy narrative, increasing demand and offering support to the price.