Bitcoin eased lower on Friday after two days of gains. The cryptocurrency market was in a risk-off mood, with speculation over President Trump’s trade tariffs and as investors look ahead to US inflation figures.

Bitcoin has experienced choppy trade this week. It slumped to below 100k on Monday amid concerns of a disruptive Chinese AI model fueling a tech rout. Bitcoin then rebounded sharply, pushing above 105k yesterday.

Trump trade tariffs this weekend?

Yesterday evening, President Trump warned that 25% tariffs on Canada and Mexico are likely to go ahead as of February 1st. Trump also reiterated a threat to impose 10% tariffs on China from this weekend. He added threats of 100% tariffs on BRIC countries, warning them against any pivot away from the US dollar.

Trump’s comments hit risk sentiment, dampening the market mood. Tariffs will likely negatively impact global trade and economic growth. Trump’s moves also raise the risk of retaliatory tariffs from these countries, which could spark a global trade war. Safe-haven Gold has risen to a record high.

These developments overshadow optimism surrounding a more crypto-friendly stance in Washington under the new Trump administration.

How could core PCE impact Bitcoin?

Attention now turns to US core PCE, the Federal Reserve’s preferred gauge for inflation. It is expected that core PCE was 0.2% MoM in December, up from 0.1% in November, and was 2.8% annually, which is in line with November. December’s underlying CPI inflation was cooler than expected, and the market will be watching to see if this trend also shows up in core PCE data. Cooler-than-expected core PCE could bring Fed rate cut expectations forward, which could boost BTC.

Earlier in the week, the Fed left rates unchanged, and Fed Chair Powell signaled that the central bank was in no rush to cut rates again until the data showed it necessary.

ETH recovers but can it extend gains towards $3.8k?

Ethereum has recovered above 3200, trading 1% higher and outperforming Bitcoin – a rare occurrence in recent times. While Bitcoin trades just below its ATH of 109.5k, Ethereum is still some 33% below its record level.

ETH/USD managed to rise above 3200 even after the Federal Reserve adopted a more hawkish stance, and on-chain activity surged.

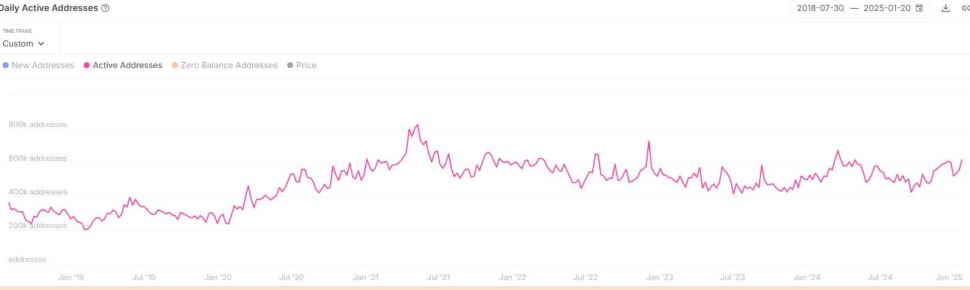

According to IntoTheBlock data, active Ethereum addresses have risen 37% over the last few months, reaching 670,000, significantly above the 400k level in early 2024. Rising network activity could be seen as rising demand and a bullish signal.

Technically, Ethereum would need to break above its descending trendline to extend the rebound towards 3730. However, should sellers break below 3000 support, a selloff towards 2750 could be on the cards.